Enlarge image

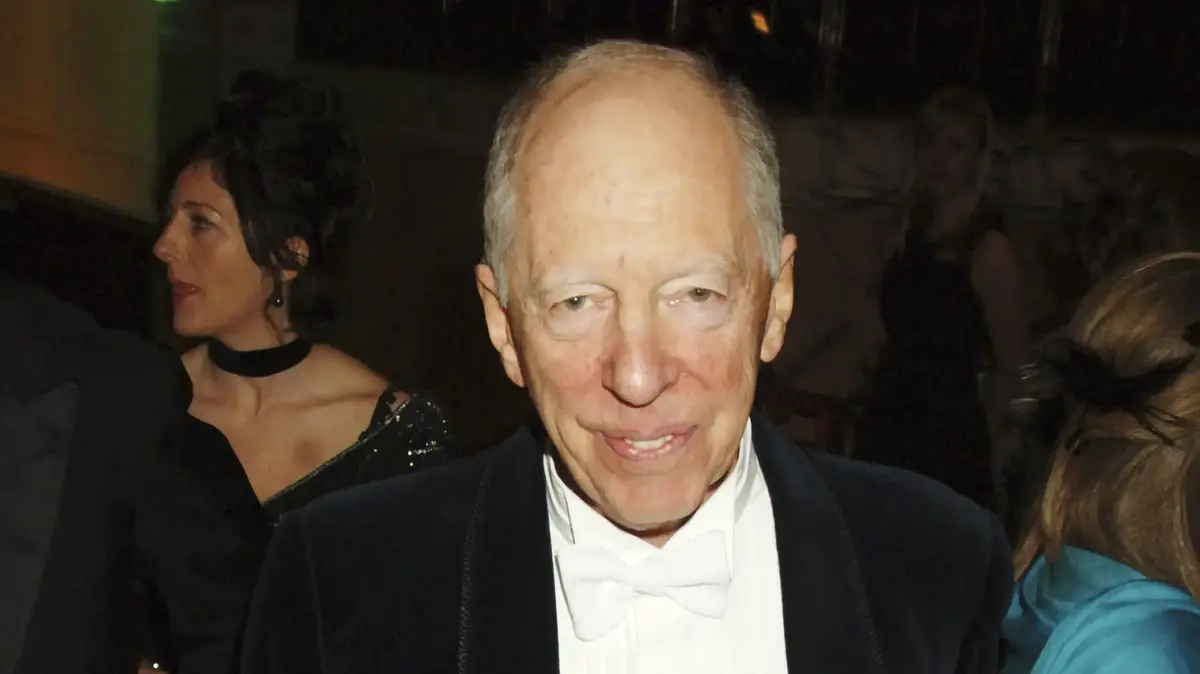

Party in Singapore:

For the time being, the music is no longer playing for Three Arrows Capital

Photo: TIM CHONG/ REUTERS

Three Arrows Capital was once one of the major players in the cryptocurrency market, a multi-billion dollar hedge fund.

But now the company is bankrupt, hit from two directions at once: On the one hand, the US Federal Reserve triggered a veritable sell-off in risky assets such as stocks and cryptocurrencies with its interest rate hikes in the fight against inflation.

As a result, the entire crypto market has lost around a trillion dollars in market volume since April of this year alone.

On the other hand, two much-noticed tokens, terraUSD and Luna, collapsed completely in May, which further accelerated the market sell-off.

Three Arrows Capital (3AC for short) also lost a lot of money.

Consequence: The "Wall Street Journal" reported at the end of June that a court in the British Virgin Islands had ordered the liquidation of Three Arrows.

Shortly thereafter, the hedge fund filed for Chapter 15 bankruptcy protection.

According to the "Financial Times", the fund is also threatened with regulatory problems in Singapore, where investigations have been underway for a year, according to the newspaper.

The lights go out for one of the once largest players in the crypto market.

Three Arrows was founded in 2012 by former school friends and later Wall Street currency

traders Su Zhu

(35) and

Kyle Davies

.

The hedge fund, which started with just $1.2 million in assets, initially focused on emerging market currencies.

Later, Zhu and Davies switched to cryptocurrencies and multiplied the fund's value during the crypto boom of the past few years.

According to Davies, 3AC was worth about $3 billion as of April this year, just before the industry sell-off.

The US broadcaster CNBC even speaks of a volume of ten billion dollars in March this year.

speculation on credit

The crux of the matter: 3AC is by no means rushing into the abyss alone.

Until recently, the company not only invested its own money.

Rather, Zhu and Davies acted on credit in a big way, borrowing large amounts of Bitcoins and other cryptocurrencies to invest in other cyber money projects.

The victims of the bankruptcy are therefore also those who entrusted their money to the hedge fund.

According to media reports, these also include private investors who released their crypto holdings for loan via specialized platforms in order to achieve a supposedly secure return.

One company that was also active in this business is the Berlin start-up Nuri.

Nuri recruited retail investors whose funds ended up with crypto firm Celsius Network.

However, Celsius also got into trouble in the market crash and stopped paying out to customers in mid-June.

At 3AC, the list of affected crypto companies is long: According to CNBC, the crypto platform Blockchain.com has $270 million on fire.

Digital broker Voyager Digital has already filed for bankruptcy over $670 million in debt it loaned to 3AC.

Other victims include US firms Genesis and BlockFi, derivatives platform BitMEX and crypto exchange FTX, according to CNBC.

The Wall Street Journal also names DRB Panama, the operator of the crypto exchange Deribit, who has already sued 3AC.

It is questionable whether the victims will see some of their money back.

3AC founder Zhu spoke up on Twitter on Tuesday.

In his statement, he asserted that he wanted to cooperate with the lawyers handling the bankruptcy and complained of alleged hate speech against his company.

According to media reports, however, there can hardly be any talk of cooperation so far.

Rather, it is said that the 3AC founders have left Singapore, the long-standing headquarters of their company before it was last relocated to the British Virgin Islands, and cannot be found.

During a Zoom meeting, they are said to have switched off the picture and sound without further ado.

Zhu and Davies actually still had a lot planned for their company.

Media are reporting plans to move the company's headquarters to Dubai, the place that has recently become a crypto hot spot.

At the beginning of 2021, Zhu predicted a "super cycle" for the Bitcoin market, with prices rising permanently.

A thesis that he regretted via Twitter after the price slide in May.

In February of this year, however, Zhu expressed confidence in Bitcoin.

In an extensive Bloomberg interview, he emphasized that the most important cryptocurrency has what it takes to become the world's reserve currency.

He probably had no idea then what turbulence the market, his company and ultimately himself would face.

cr

/cloudfront-eu-central-1.images.arcpublishing.com/prisa/V6PAJ7OIKO4NO7NV7GCNE3UIMA.jpg)