The US Federal Reserve announced an interest rate hike of 0.75% after the interest rate meeting, which was the second consecutive increase of 0.75%, in line with market expectations.

The HKMA also raised the discount window base rate by 0.75% today (28th).

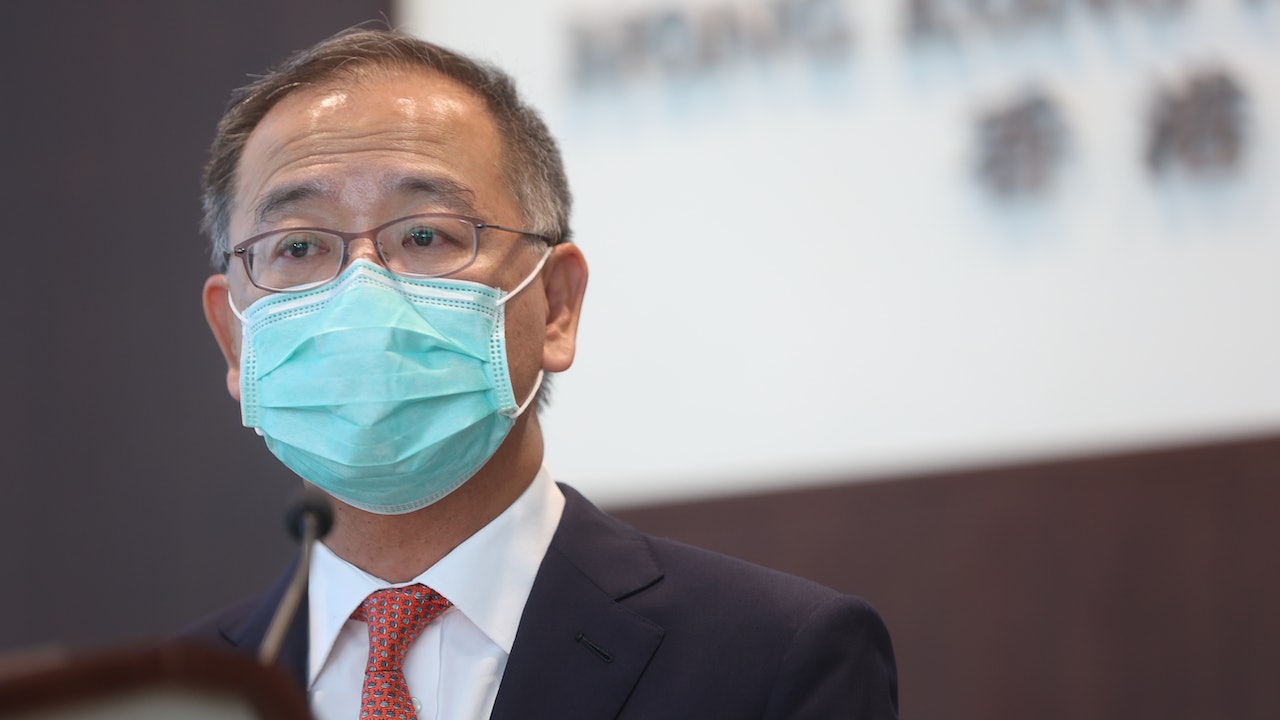

The President of the HKMA, Yu Weiwen, saw the US interest rate hike this morning. He said that the Federal Reserve has raised interest rates four times since March, with a cumulative increase of 2.25%. The market expects the Federal Reserve to maintain economic growth and suppress inflation. It is believed that the rate hike action is reasonable and will depend on the US economic data, so there is great uncertainty in the pace and magnitude of the rate hike.

Yu Weiwen emphasized that the US interest rate hike cycle will not have any impact on the stability of Hong Kong's financial and currency, and the system has been operating in an orderly manner.

Talking about the trend of interest rates in Hong Kong, he pointed out that the short-term interest rate of the Hong Kong dollar, including overnight and one-month interest rates, has a larger gap with the US short-term interest rate than the medium and long-term interest rate. The rate hike is expected to continue or even accelerate, but it also depends on the demand for Hong Kong dollars in the local market.

Yu Weiwen added that the public should consider the increase in interbank interest rates, and local banks may also adjust deposit and loan interest rates, including the prime rate (P﹚), urging the public to carefully manage interest rate risk when buying houses, mortgages and other loans.