The US Federal Reserve announced an interest rate hike of 0.75% after the interest rate meeting, which was the second consecutive increase of 0.75%, in line with market expectations.

The HKMA also raised the discount window base rate by 0.75% today (28th).

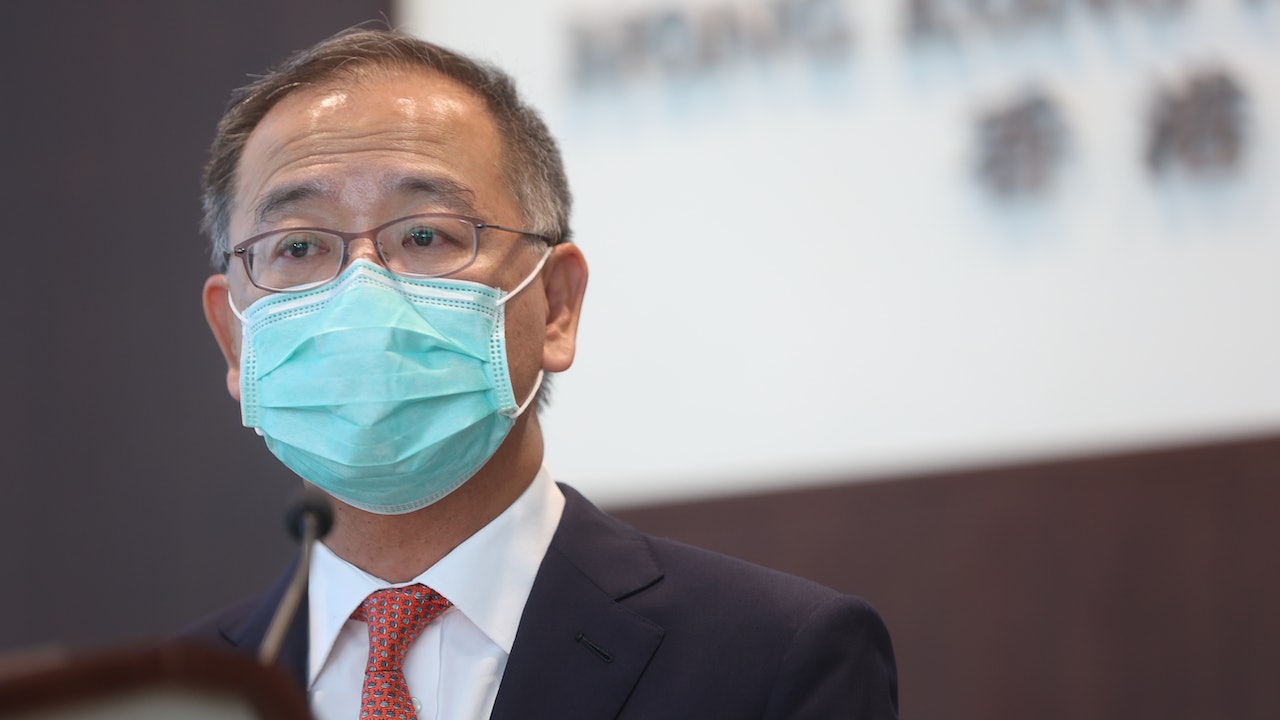

Yu Weiwen, President of the Financial Services Bureau, said today (28th) that the rate hike this time is in line with market expectations. As the pace of interest rate hikes in the United States continues, the rising trend of Hong Kong's interest rates will continue or even accelerate. Banks will raise interest rates based on capital needs or other factors. , I noticed that some banks have raised the upper limit of the lock-up interest rate. I believe that other banks will also increase the maximum interest rate (P) in the future. Therefore, the public should be careful about interest rate risk when making mortgage and home purchase decisions.

Yu Weiwen added that the public should consider the increase in interbank interest rates, and local banks may also adjust deposit and loan interest rates.

(Photo by Zheng Zifeng)

Yu Weiwen said that since March, the Fed has raised interest rates four times, with a cumulative increase of 2.25%. The Fed has indicated that the pace of future interest rate hikes will depend on economic data, that is, there is uncertainty in the pace and magnitude of future interest rate hikes.

He emphasized that citizens need to maintain confidence in the linked exchange mechanism. Due to the outflow of funds from the Hong Kong dollar system, the Hong Kong dollar interest rate has risen and gradually approached the US dollar interest rate, which will gradually offset the incentives for carry trades and stabilize the Hong Kong dollar in the range of 7.75 to 7.85.

He pointed out that Hong Kong dollar short-term interest rates include overnight and one-month interest rates, and the short-term interest rate gap with the United States is larger than that of medium and long-term interest rates.

However, in the past few months, the short-term interest rate in Hong Kong has been raised again in response to the increase in interest rates in the United States. He expects that the upward trend may continue or even accelerate, but it also depends on the market's demand for Hong Kong dollars. Therefore, the market should be prepared for the rise in interest rates. Interest rates may be raised based on funding needs or other factors.

Since some banks have raised the lock-up limit, the prime rate may also rise in the future.

Yu Weiwen reminded the public to be careful about interest rate risk when making mortgage and home purchase decisions, because mortgage is a decision that lasts for decades.

(Photo by Zheng Zifeng)

In terms of the property market, Yu Weiwen pointed out that in addition to interest rates, there are other factors such as land and housing supply and demand, the overall economic environment, and the epidemic that affect the trend of the property market. In addition, local banks may also adjust interest rates, including the best interest rate. Therefore, citizens should be careful when making mortgage and home purchase decisions. Interest rate risk because a mortgage is a decades-long decision.

As for whether there will be negative equity, he responded that banks have borrowing ratios and repayment ability requirements for mortgage applicants, and they are able to make repayments if interest rates rise.

In addition, he pointed out that mainland housing is facing financial difficulties and banks in Hong Kong have risk exposure, reminding that the proportion of loans of specific categories has an opportunity to increase.

US interest rate hike|Wang Meifeng: It is expected that the interest rate will remain at 3% by the end of the year, and the actual impact on the property market will be slight. Risks must be managed well before the US interest rate hike | The Fed's rate hike is "dove" in line with expectations, and the US dollar loses 107 levels