By Kate Dore -

CNBC

The 80,000 million dollars that includes the environmental, health and tax bill promoted by the president, Joe Biden (already approved by Congress, and pending signature in the White House) destined for the Internal Revenue Service (IRS, in English) has caused uncertainty because it includes 45,000 million to strengthen tax audits of taxpayers.

IRS Commissioner Charles Rettig said in a letter to the Senate "that this is absolutely not about increasing scrutiny of small businesses or middle-income Americans."

However, the GOP claims it will affect the average American, based on official projections of what will be raised after the investment: $203.7 billion between 2022 and 2031, according to the Congressional Budget Office.

[Cheaper medicine and insurance: these are the health coverage benefits of the package approved by Congress]

"Our biggest concern is that the burden of these audits falls on the people who go to Walmart stores to do their shopping," said Rep. Kevin Brady, R-Texas, during an interview with CNBC news network.

Overall, IRS audits fell 44% between fiscal years 2015 and 2019, according to the Treasury Inspector General's 2021 Tax Administration Report.

The IRS will expand refunds for gas expenses to certain people due to high prices

June 16, 202200:55

Since many low-income taxpayers are salaried, their audits are generally less complex and many can be automated.

“Resources to modernize the IRS will be used to improve taxpayer services, from answering phones to upgrading computer systems, and cracking down on high-income and corporate tax evaders costing the American people hundreds of thousands. million dollars each year,” according to a Treasury official.

The Treasury estimated in a 2021 report that the funds could allow the IRS to hire about 87,000 employees, a figure that has been widely reported in the media.

But these hires can include a variety of positions, including auditors, customer service personnel and systems engineers, the Treasury Department told CNBC in a statement.

When Biden signs the law, the IRS is expected to share the exact number of new hires he will make in the coming months.

"Most of the new hires will replace staff leaving in the next few years," the Treasury official said.

How the IRS chooses whom to audit

Currently, the IRS uses software to classify each tax return with a numerical score.

The system can send an alert when tax deductions or credits are out of range compared to reported income.

For example, let's say you earn $150,000 a year and claim a $50,000 deduction for charitable contributions.

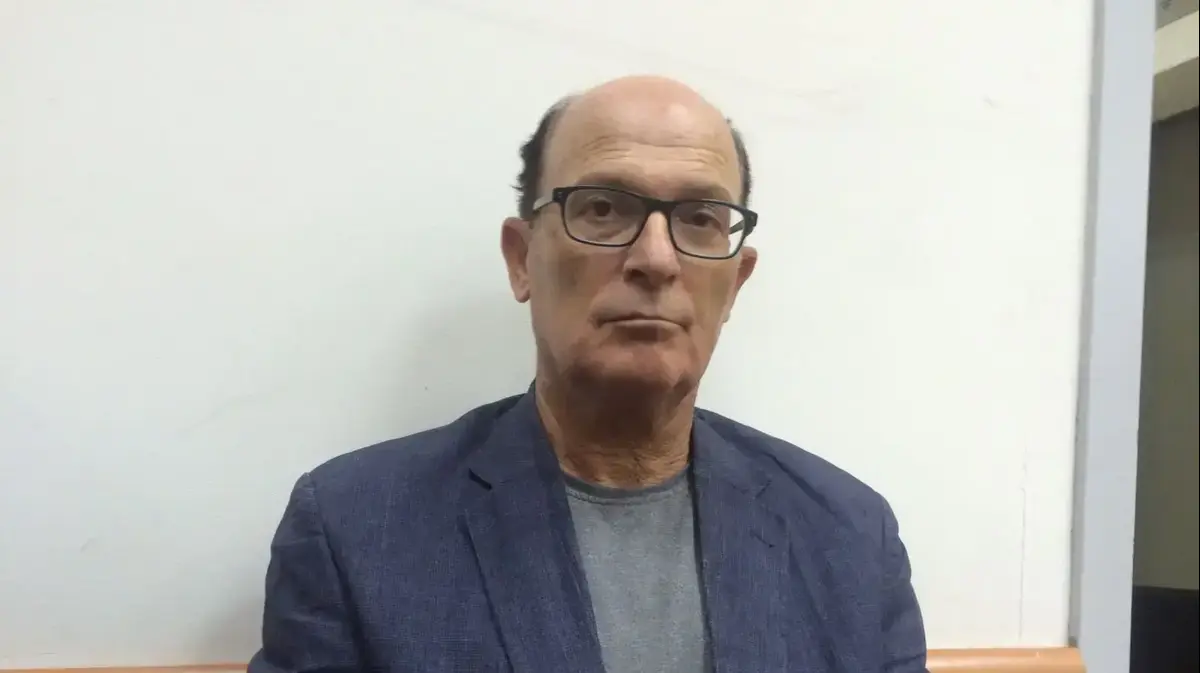

It will be more likely to be audited because it is "disproportionate" to what the system expects, said Lawrence Levy, president of the tax firm Levy and Associates.

[The right criticizes financing the IRS. But the workers denounce that they don't even have paper to print]

Other red flags for the IRS can be unreported income, refundable tax credits like the EITC, homework or car deductions, as well as rounding numbers on your return, according to experts.

How IRS audits can change

It will take time for the IRS to bring in the new resources, as well as recruit and train the new staff.

To become certified as auditors, IRS workers must complete a six-month training program and start with cases worth a few hundred thousand dollars rather than tens of millions, Levy explained.

“You are not going to give the General Motors portfolio to a trainee, for example.

That's just not going to happen,” he stated.

Republicans criticize the new law that the Democrats will approve, claiming that it "may worsen" inflation

Aug. 8, 202201:22

The chance of an audit may increase for self-employed taxpayers, Levy said, depending on their return.

The odds may not change for traditional wage earners with a flawless filing, he said.

“In my opinion, a W-2 employee is much less likely to be audited than a self-employed person,” Levy said.

Of course, one of the best ways to avoid future headaches is to keep accurate records with detailed accounting and keep all receipts, he added.