A million French people would be concerned!

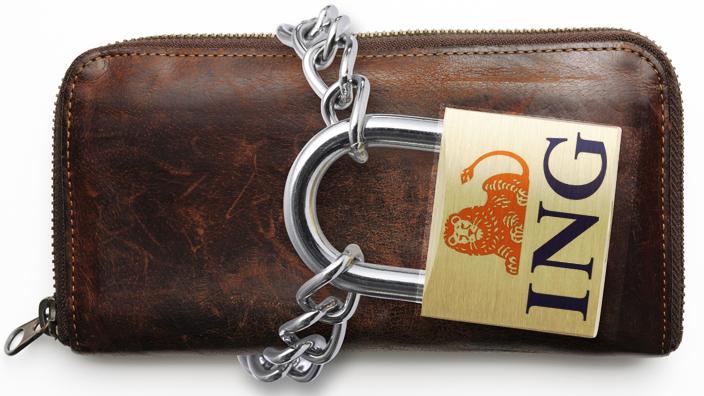

Accounts opened with ING will have to be transferred quickly to another establishment, if they have not already been closed or automatically transferred, to the amazement of customers.

ING, a Dutch group established in France since the beginning of the 2000s, in the online banking sector, is stopping its activity in France.

To discover

The main measures of the purchasing power law and the timetable for their entry into force

The Recall, to recover the money transferred by bank transfer

For ING customers, it's chaos.

Most of them have learned or will discover that they have to choose a new establishment to accommodate their assets, in the middle of the summer period.

Finding a solution in August is a challenge… And everything has been orchestrated to transfer as many customers as possible to Boursorama Banque, the customer buyer.

ING has effectively sold its client portfolio to Boursorama Banque and therefore proposes, more or less peremptorily, to transfer the accounts currently open in its books to this subsidiary of the Société Générale group.

Boursorama bank thus hopes to collect half of the clients of ING's portfolio.

"The target of recovering 50% of ING's 500,000 active customers (including customers who have taken out life insurance) seems both ambitious but realistic given the commercial offer and the simplified process offered", announced the Company. general to its shareholders from May 2022. Everything is said there: if the ING client turns to Boursorama, everything will be simpler for him, if he is less docile, his career will be more difficult.

“We have the impression of being oriented with bayonets”,

a customer pours out.

Some 200,000 people have already taken the path of Boursorama Banque, a figure at the beginning of July 2022.

However, there is no obligation and the customer is free to choose his new establishment online or at a physical branch of the traditional network.

At least, in most cases.

And whether the new bank is Boursorama or another, the setbacks associated with account transfers are the same.

Spread the word !

ING current accounts blocked "hussardically"

"At the end of July 2022, my bank account was closed, 2 or 3 days after I received a simple letter announcing the imminent closure of my account", says an ING customer who did not even have time to turn around.

Bad luck, the client in question is Michel Guillaud, president of France Conso Banque, who managed, thanks to the association's mediation structure, to have his account reopened in a few days, the time to be able to take the necessary steps. at another establishment.

For the Lambda client, such a

modus operandi

sign of disaster.

From one day to the next, he loses his bank account and therefore his means of payment.

"Accounts are closed in a hurry, while ING should have sent registered letters to warn of the closure", explains Michel Guillaud.

“The Dutch bank did, in some cases, send a registered letter to warn that ING was considering closing current accounts, but for the closing itself, it went by simple letter 'Écopli'”, he continues.

Overnight, customers found themselves naked as worms, without their cash, without a payment card, without bank details...

“It is estimated that between 400,000 and 500,000 people hold a current account with ING.

For many of them, this is their main account and that puts them in complicated situations,” explains France Conso Banque.

Account statements remain available online until the account is closed.

For those whose account is still open, it is therefore wise to download them, otherwise they will be permanently lost shortly.

For others, it's too late.

The good news is that the closure of accounts will not be charged, “except for the costs of maintaining an inactive account, in accordance with the current tariff”, tempers ING.

Payment cards and checks must be destroyed and ING must be released from them by sending it a certificate of destruction of the payment instruments.

Once the account is closed, "using these means of payment will be considered fraud with a report to the Banque de France", warns the bank.

Attention, in case of payment in several times subscribed with a merchant, the deadline will be refused after the closure of the account.

“The merchant will contact you to set up a new bank card to finalize this payment,” ING lapidarily announces.

Let the customer manage...

Loss of interest on ING savings accounts

The Livret A, LDDS (Sustainable and Solidarity Development Account) and Orange Savings Account accounts have been or will be closed.

The available money is then credited to the new account opened for competition by the customer.

The problem is that ING is "overwhelmed" by the number of files to be processed.

However, a bank can only open a regulated savings account (Livret A, LDDS) if the customer does not already have one.

It is also required to question the Ficoba to find out if a savings account has already been opened in another establishment, before any opening of the placement.

Result: ING customers cannot open a new regulated savings account until the new establishment receives the green light.

“We are struggling to meet the deadlines imposed by ING,” observes Clément Vernhes, director of the BNP Paribas Foch Maillot agency in Paris, which is beginning to see an influx of former ING clients.

For savers, the closing of their savings account signifies the loss of interest which should have been generated between the closing of the account by ING and the opening of the new one.

“They can contact us to join the collective action that we are going to launch.

The objective is for each saver to be compensated,

at least

for the interest that he has not received”, explains Michel Guillaud.

Securities accounts and PEAs neutralized by ING for an indefinite period

"In the absence of a request for transfer or closure of the securities account or the PEA, ING" reserves the right to initiate the closure of your account(s) from August 2022 and to sell your securities in accordance with our general conditions”, warns ING (sic).

The sentence is harsh and difficult to accept, especially since ING has alerted its customers, in the middle of the summer period.

Some started receiving alert e-mails in mid-July 2022, others ended up receiving a registered letter in mid-August indicating that the closing will take place in October 2022. Two short months to look back... Between clients not informed to date and those for whom the ING e-mail has arrived in spam, disputes are looming.

Read alsoStock market: in a complicated context, here are 5 robust stocks to put in your PEA

For a securities account as for a PEA (share savings plan), an untimely closure on the part of ING could result in capital losses.

For equity savings plans, it must also be considered that the tax advantages linked to the investment will simply be lost.

Let's add that the picture darkens a little more if we consider that a transfer of titles takes time.

However, during this period of time, the saver can neither sell nor buy... Which is very unfortunate and will give rise to financial damage, even if the transfer of the securities is done free of charge, that the securities in the portfolios retain their unit purchase price and that the opening date and tax advantages of the PEA are maintained.

Read alsoIn the stock market, passive management pays more than active management

If the securities account or the PEA has been closed by ING, for lack of action within the allotted time, all that remains is to contact the online bank to recover the money, by sending it a RIB ( Bank account details) of an active account at

ING – Operations Department, 40 avenue des Terroirs de France, 75616 Paris cedex 12

.

“The invoice will be presented to ING, we will quantify the damages for each person who will join the collective against ING”, assures Michel Guillaud.

Life insurance automatically transferred to Boursorama

Whether someone who has opened life insurance with ING likes it or not, their contract is automatically found at Boursorama bank!

Some 5 billion euros in assets were thus transferred automatically.

For “ING Direct Vie” life insurance, ING was only a broker of contracts managed by Generali Vie.

In July 2022, the management of these contracts was thus transferred once again to Boursorama Banque.

Identifiers were sent to these “new customers” so that they could connect to the Boursorama Banque website, as that of ING was no longer accessible.

The surprise is significant for the return of the holidays of the savers who will have to be reassured on this basis: “the investments, the tax anteriority, the general conditions and the designated beneficiaries remain”.

For the dissatisfied, a solution could consist in contacting Generali in order to know the banks with which the insurer works, to choose his broker in this panel.

France Conso Banque has already made contact with Generali for this purpose, especially since some of its members complain about the extremely intrusive questionnaire on their income and their family life, which they had to answer before being able to "return in their personal space at Boursorama.

Real estate loans that last, outside France

Having failed to find a buyer for its “real estate loans” activity, ING kept them.

The monthly payments will be debited, on the usual dates, from the current account which must be indicated to the Dutch bank.

To do this, you must send, "in an unstamped envelope" (sic) to

ING – Crédit Immobilier / Gestion, Libre RESPONSE 70678, 75567 Paris Cedex 12

, the form received after having completed it, attaching the RIB of the account. from which the samples will be taken.

To keep track of the shipment, it is strongly advised to prefer sending by registered letter with acknowledgment of receipt.

Especially since in the event that ING does not receive these documents, the unpaid monthly payments will generate penalties and an entry in the file of incidents of repayment of loans to individuals is incurred.

For day-to-day credit management, “dedicated experts will continue to support you in managing your credit by email, telephone and post,” ING assures its latest customers.

Personal loans to repay, if possible

As with home loans, ING continues to manage personal loans, under the same conditions.

For the payment of future monthly installments, you must send the dedicated form to ING, attaching a SEPA direct debit mandate and the bank details of the new account from which the direct debits will be made.

These documents should be returned, still in an “unstamped envelope”, to

ING – Service Prêt personnel, Libre responded 70678, 75567 Paris cedex12.

Here again, it is preferable to send it by registered letter with acknowledgment of receipt in order to keep a trace of the process since once the current account has been closed by ING, monthly payments will be unpaid, penalties will be invoiced and registration on the personal credit repayment incident file is incurred.

The choice of early repayment may be the right opportunity to permanently sever its ties with ING, especially since it is possible to do so without penalties.

Insolvency proceedings against ING, at a lower cost

ING customers who feel wronged can join the collective action which will soon be launched by France conso Banque.

The cost of annual membership to the association of 90 € includes advice, procedures and mediation because often the problems are settled in a phone call from the association.

Those who only wish to join the class action against ING will only have to pay €45.

And while ING customers struggle with the formalities made necessary by the cessation of online banking activity in France, UBS recommends buying ING shares with a target price of €14.7, signing thus a potential growth of 56% of the share.

"ING benefits from an attractive valuation with a relatively low balance sheet risk", is it estimated.