Over the years, central banks around the world have "released water", flooding the market, causing asset prices to rise, and even the prices of famous watches have risen sharply, turning a "status symbol" into an investment tool.

Individual popular big brand styles, such as Rolex's "Daytona", once more than doubled from the public price of more than 100,000 yuan to 40,000 to 500,000 yuan.

Although the "speculation price" of trendy watches has recently softened by about 30% from its high level, its resilience is higher than that of other assets. During the same period, buying famous watches still earns 20%, while buying Bitcoin loses nearly half!

A senior watch industry person dismantled the mystery of the four major appreciation of famous watches to reporters, and believed that even if the price turned down recently, they would not worry about "collapse".

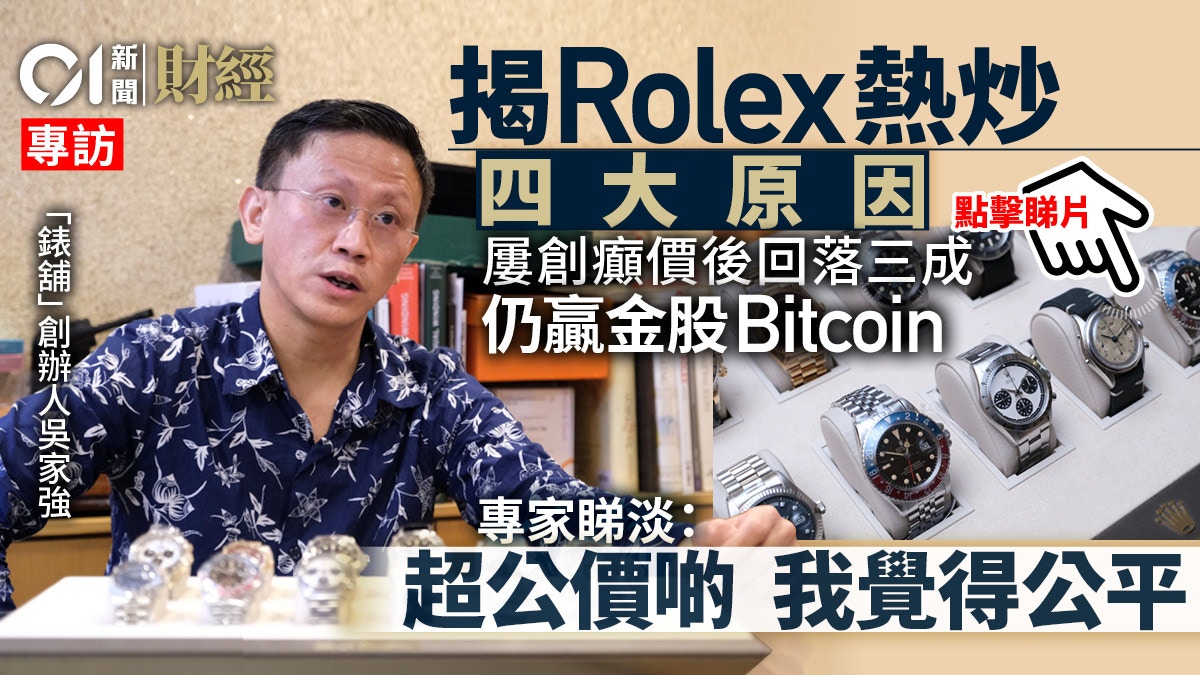

Wu Jiaqiang has many years of experience in repairing and collecting famous watches. He clearly stated that there are four reasons why Rolex has been "hyped up" in recent years. (Photo by Lu Yiming)

Owning a brand-name watch is the dream of many men.

Indeed, a watch is often sold with six figures, and not every "worker" can easily afford it.

But in recent years, the famous watch is not just a collectible, it is more like an investment tool.

For example, Rolex Daytona (Ref. 116508), commonly known as "Golden Green", has a public price of more than 280,000 yuan. According to data from Subdial, a British second-hand luxury watch trading platform, although the "speculation price" has dropped from a high of more than 610,000 yuan in March to nearly The monthly value is about 460,000 yuan, but it still appreciates by more than 23% year-on-year, and it has doubled in terms of public price.

As for the Rolex Daytona Ref.116506 (commonly known as Ice Blue Rolex) worn by Kimura Takuya, it was priced at about 500,000 yuan when it was launched in 2013, and the transaction price once rose to more than 1 million yuan.

Rolex has successfully stimulated the second-hand market by extending its warranty to 5 years.

(Photo by Lu Yiming)

Watches far outperform gold stocks Bitcoin

Under today's high inflation, tense geopolitical situation, and complex and changeable investment environment, how to avoid risk can be said to be an "art". Gold has always been a traditional hedging tool, and Bitcoin was once hailed as an anti-account under the new crown epidemic. "Digital Gold".

As for the reason why the watch has become the new favorite of the investment community, it is all because of its resilience.

For example, if you buy watches, gold, Hang Seng Index and Bitcoin from the beginning of August to the end of August last year at the same time, the changes after one year will be an appreciation of 18.2%, a decrease of 4.3%, a decrease of 22% and a decrease of 22%. 56.4%!

(01 Drawing)

Wu Jiaqiang, the founder of "Watch Shop", has been in the business for more than 30 years, and has studied under "Godfather-level" independent watchmakers Phillips Dufour and kari Voutilainen.

In an exclusive interview with "Hong Kong 01", he bluntly stated that the "crazy price" of famous watches did not appear in recent years.

Recalling that in 1997, when I bought my first Rolex Submariner in a chain watch store, I already had to "eat the bones" (forcibly buy additional products), "If you buy a watch for 15,000 yuan, you have to spend an extra 3,000 mosquitoes to buy a buried and isolated electronic watch. .” Buying luxury watches at a premium is nothing new.

1. Rolex changed its warranty terms to stimulate the second-hand market

However, the reason for the "insane price" can not be fully summarized by simply being "more money" in the market.

Wu Jiaqiang pointed out that Rolex took the lead in changing the warranty terms in 2015, and began to create conditions for speculation.

He pointed out that the warranty and maintenance costs of watches and clocks have always been high. In the past, most brands were mainly based on two-year warranty, but after Rolex changed it to five years, it officially broke the "rules of the industry", and many peers also followed.

Because the watch is spent, damaged or even damaged, Rolex provides after-sales service. In disguise, the second-hand market has begun to form. "I bought it after wearing it for two years. It has a Rolex (original) warranty. Are you surprised?"

Second, the brand is enough to insist that the tool table become a collectible

You may ask, the function of the watch only depends on the time, what is the value of speculation?

Wu Jiaqiang also "identified" and joked that Rolex was founded in 1905. Over the years, "it has come and gone with several series", and its selling point is also a tool watch, "Three laps are timekeeping, Submariner is for diving, GMT pilot timekeeping. , I have never told you to listen to it, only to show that it can be fried.”

But it is also the brand's persistence in surface, bezel and movement technology for a hundred years, coupled with the unique brand story, so that Rolex, Patek Philippe (Bard Philippe), Audemars Piguet (Audemars Piguet) and Richard Mille and other products, Attracting the favor of many collectors, "I have a customer who buys a dozen of them, not to wear them, but to collect them, not to wind the chain, not to compare the needles."

3. The central bank "releases water" and citizens have rich wallets

The value of famous brands has been recognized, coupled with the popularity of social media, the public's awareness of famous watches has improved, and the "rich" stuff in the past has gradually become the mainstream.

More importantly, after the 2008 financial tsunami, global central banks "released water" and asset values rose sharply. "Everyone buys more money, and many (assets) start to kill, so both new and second-hand watches are booming.. ...., there are also some people who are willing to pay high prices, there are a few people who pay a lot of money, or there are big families with the same fund, there is a way to buy a watch and fry, and one makes a lot of money... Borrowing 1% of money from the bank, you will win if you go to speculate (table) points, so you are chasing the price together.”

The investment market always has its "dark" places. Wu Jiaqiang revealed that some "concerned people" will raise prices. Since there is no trading mechanism in the second-hand watch market, "concerned people" can use loopholes to raise prices. Finally, they successfully found Buyers, "raise the price" to become the market price.

Fourth, the new crown epidemic affects production

But the real disruption between supply and demand is the new crown epidemic.

Wu Jiaqiang pointed out that the new crown epidemic is first of all to change the way of life of the public. More people do sports, less banquets and parties, and tool-type watches have become mainstream.

Secondly, the epidemic has brought production to a halt. Many "watchmakers" in Switzerland are from France. Under the epidemic, countries have "closed customs", and factories have simply stopped production, which has greatly reduced production.

According to the 2021 Swiss Watch Industry Research Report jointly released by Morgan Stanley and Lux Consult in March, Rolex became the watch brand with the highest total sales last year, although the output increased from 810,000 in 2020 to 1.05 million last year. The previous level, an increase of 30% year-on-year, but the output cannot keep up with the purchase speed, plus the second-hand has a five-year warranty period, and its collection value makes people more willing to buy watches at high prices.

However, it has recently been reported that Rolex is expanding its fifth workshop in Bell, Switzerland, which is expected to be opened early next year. It is said that the output of movement can be increased by 25% every year, and the annual output of watches will also increase by 30%. The problem of supply and demand may be eased.

+1

Falling with the stock market is normal: don't worry about a "crash"

Of course, there are more innate advantages, such as the zero-tariff feature of Hong Kong, and it is estimated that more transactions will take place in Hong Kong.

When it comes to some models, the transaction prices rose to new highs in February and March, and some fell by 30% to 40%.

Wu Jiaqiang believes that it is normal for "speculation" to fall with the stock market. "The interest rate hike and the speculation are very high. (After the interest rate increase) the business is not done. If it goes to 3% or 6%, who will do business?"

He estimates that it may continue to fall in the future, but he clearly stated that he is not worried about the "collapse" of watch prices. "It fell to the price of a year ago, not three or four years ago. After that, I saw a group of users enter the market immediately... .If you have no chance to fall again, Yijia will only fall into the first wave, the fall point will fall for one day, and your rise will rise for three years...Learn from the stock market, just watch it and use it The Great Wall of flesh and blood at home can stand up.” However, due to the demand for supply and collectibles, it is estimated that it will eventually rebound with the economy and the stock market. The price is good, I think it's fair."

Rolex│Takuya Kimura once again wears the Rolex Daytona 116500LN panda face, which is the easiest to match with Rolex | An alternative tribute to Rolex?

Hong Kong brand and artist super cute Daytona Rolex Rolex and Patek Philippe and other popular watches began to fall or be affected by it?

Rolex pushes new regulations to ban "matching watches" in specialized stores. Will the price of popular watches in the future be more exaggerated?

Italian steel door GiGi Rolex Datejust skeleton modified watch is very eye-catching Name: lonely time