Enlarge image

Gold has two prices: the buying price and the selling price

Photo: UNKNOWN/ AP

The Krugerrand is the most traded gold coin in the world - and is particularly popular in Germany.

Over 700,000 troy ounces were exported last year.

The South African marketing company Prestige Bullion recently reported that 80 percent of the demand came from Germany.

The coin from South Africa is popular as an alternative investment.

It was minted for the first time in 1967. In the meantime, especially in times of crisis, small investors also fall back on the coin.

Because precious metals are considered crisis-proof - they are always indestructible.

But is it really like that?

Read what you should know about gold.

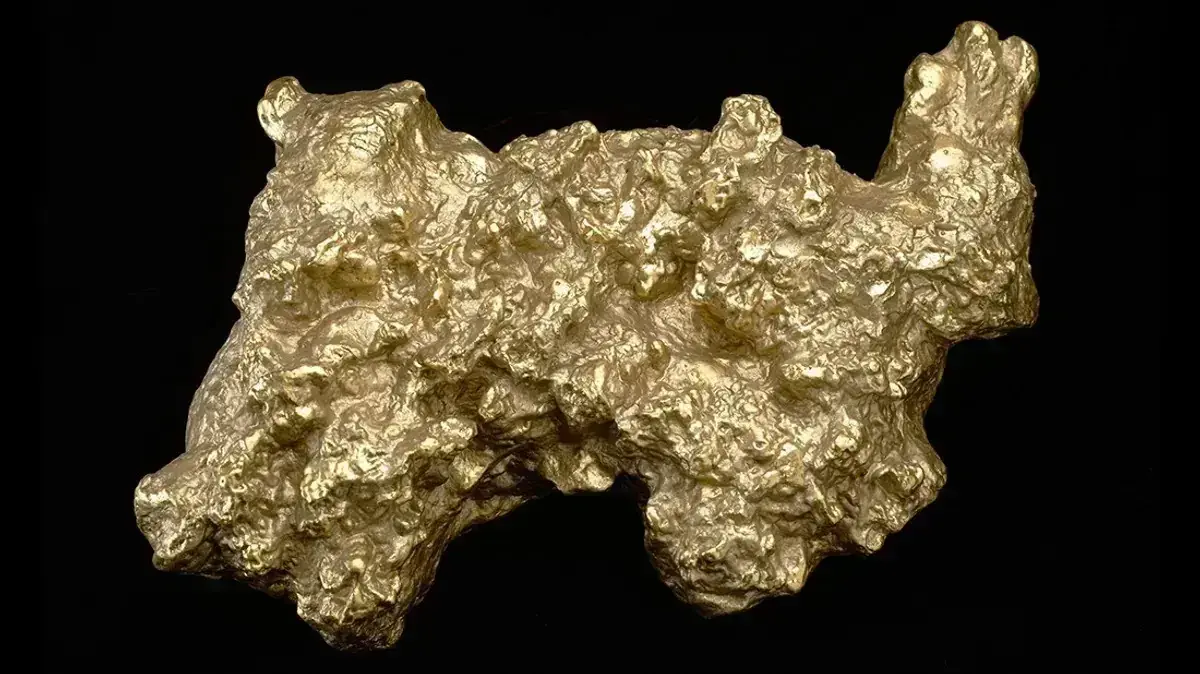

How is gold formed?

Unfortunately, it's not as easy as in the fairy tale "Tischlein Deck dich", in which the donkey spits gold on command.

People have been trying to create gold for centuries, but so far they have always failed.

Annika Dziggel, professor at the Institute for Geology, Mineralogy and Geophysics at the University of Bochum, explains to manager magazin: "Gold as an element is created during the so-called nucleosynthesis, for example during a supernova or a neutron star collision."

So the gold elements on earth formed several million years ago.

The deposits then formed, for example, under tectonic conditions, for example during mountain building.

"In the process, gold is dissolved out of the rock in hot aqueous solutions, transported and then precipitated again in fissures together with quartz and sulfides," says Dziggel.

But there are also deposits that were formed in the course of volcanism, often as copper-gold deposits.

Eventually, through weathering of the mountain rocks, gold can enter rivers and be washed above ground as nuggets or other small particles.

Subsurface deposits are mined from open pits or underground, depending on the depth of the deposits.

Where is most of the gold in the world?

The discovery of gold caused large waves of immigration to the USA in the 19th century, but also to other countries such as Australia.

At that time, tens of thousands of adventurers set out.

Today the times of the big gold rush are over, but new veins of gold or larger chunks of gold are still being discovered by private individuals from time to time and cause a sensation.

However, large-scale prospecting for gold has long been in professional hands.

Gold is found in many countries around the world.

"But the largest gold deposits are in South Africa," explains Dziggel.

About a third of the gold ever mined comes from the Witwatersrand gold field near Johannesburg.

"The majority of these deposits have already been exhausted," reports the scientist.

Currently, the largest producing countries are China, Australia and Russia.

The world's largest gold mine is located in South Africa in the Witwatersrand Basin.

When will all the gold be mined or how long will the reserves last?

"The reserves are currently estimated at around 50,000 tons of gold, with an annual production of around 3,000 tons," reports the professor from Bochum.

The reserves could therefore be exhausted in about 16 years.

"But," the expert qualifies, "the amount of reserves and resources also depends on the price and thus on demand."

If the gold price is high, the search for new gold deposits is worthwhile.

"Then more reserves will be identified that were previously classified as uneconomic."

After all, mining can be worthwhile when gold prices are high.

"The amount of reserves and resources is therefore a highly dynamic number that says little about when the raw material will actually be exhausted," says Dziggel.

In the case of gold in particular, little is lost because it is not consumed like, for example, oil and natural gas.

"Gold can and will be recycled," says the expert.

Who owns the most gold?

In the middle of last year, the report made the rounds that German private investors had considerably more gold in their safes and deposit boxes than the Deutsche Bundesbank.

In fact, many private individuals have reached for the shiny precious metal.

However, the individual countries are still considered to be the owners of the largest amounts of gold.

The USA has by far the largest gold reserves, followed by Germany and Italy.

What is the best gold in the world?

"As a precious metal, gold occurs in nature mostly as a mineral in its elemental form," says Dziggel.

These can be gold nuggets or other shapes.

"Depending on the type of deposit, gold can contain up to 20 percent silver," explains the scientist.

Gold has the lowest silver concentrations from deposits where gold occurs together with sulphide minerals, for example in quartz veins.

The purity of gold is indicated in karat or fineness.

The term karat is used for jewelry and indicates the percentage of gold in an alloy.

It is measured in 24th parts by weight.

Eight carats of gold then means that one third of the total weight consists of pure gold.

The fineness also describes the proportion of gold in an alloy.

However, it is given in parts per thousand of the total weight.

585 gold then means 585 per thousand of the total weight.

999 fineness is equated with pure gold.

Most gold coins are made of 999 gold.

Why does the price of gold fluctuate?

"In the last 20 years, the gold price has fluctuated between around 300 and 1880 euros," reports Thomas Hentschel, financial expert at the North Rhine-Westphalia consumer center, to manager magazin.

Times of crisis in particular drive up the price.

Unforeseen events such as terrorist attacks, for example, have an impact.

But geopolitical tensions also have an impact on the price of gold, as do fears of inflation, currency crises and recession.

In times of crisis, investors are looking for stable values and gold appears to be the safe haven.

If demand then falls again, the price of gold falls too.

This behavior could be observed in the recent past, for example during the corona pandemic, as well as at the beginning of the Ukraine war.

The gold price rose significantly when the dispute began, a few months later the price had already fallen again.

Other factors for the price development are a change in monetary and interest rate policy.

For example, if interest rates rise, the price of gold falls.

And last but not least, the amount of gold produced can also affect the price.

Gold as an investment

"Even if the price of gold is currently at its highest, gold is anything but a safe investment," emphasizes Hentschel.

Especially those who are looking for a high return will probably not be happy with gold in the long term.

Gold can mitigate risks in the portfolio.

But in the past, the price of gold has fluctuated significantly and brought in significantly less compared to broadly diversified stock portfolios.

In addition, gold does not pay interest or dividends.

more on the subject

The portfolio of investment professional Bert Flossbach also looks exemplary with 80 percent shares, 10 percent gold, 10 percent cash.

Read here how investors protect their investments in times of crashes.

Investment in a crash: How the warhorse investors are now securing their fundsBy Mark Böschen

Experts therefore agree: If at all, then only a small part of the assets should be invested in gold.

That's why Henschel advises not to invest significantly more than ten percent of your assets in gold.

How to buy gold and what is best?

If you want to invest in gold apart from jewelry, you first have to decide whether you want to buy coins or bars, alternatively securities are also an option.

The most popular coins in this country include Krugerrand, Eagle, Maple Leaf, Britannia, Vienna Philharmonic and Kangaroo.

The most popular gold coins in Germany

1. Krugerrand |

2. Maple Leaf Gold |

3. Kangaroo |

4. Gold Euro |

5. Vreneli |

6. Sovereigns |

7th Vienna Philharmonic |

8. Britannia |

9. German Empire |

10. American Eagle Gold |

In addition to coins, gold bars can also be purchased.

However, the purchase of minibars is considered expensive, and the same applies to individual coins.

"If you want to get as much gold for your money as possible, you should better buy a few larger coins than many small ones," advises the financial expert at the consumer advice center.

In addition, banks and gold dealers wanted to make money from the gold trade, explains Henschel.

"There are two prices: the buying price and the selling price."

For an ounce, the selling price is usually around six percent higher than the purchase price.

If the purchase of a tenth of an ounce is planned, there would be a gap of around 20 percent between the buying and selling price.

Gold is also traded in dollars, which also affects the price to be paid.

If you buy gold outside the dollar area when the dollar is strong, the buyer automatically pays more.

Basically, when buying gold, you should always rely on well-known providers.

Finanztip, for example, prefers the sites Gold.de or gold-preisvergleich.de.

You can find out more about gold as an investment here.

Where should you store gold?

Here, too, the consumer center knows advice.

Storage at home in a cupboard or small safe is rated as risky.

Whether or not the insurance covers the loss after a possible theft depends on the contents policy.

The safe deposit box in the bank is safer, but there are additional costs for the space in the safe.

What do you have to consider when selling?

Since gold pays no interest or dividends, the price must rise in order to make a profit.

But caution is advised:

"

The price gain must also exceed the costs incurred - such as for a safe deposit box, the fees for buying or selling and the difference between the buying and selling price," warns Henschel.

Otherwise, investing in gold is a losing proposition.