When the 20th National Congress of the Communist Party of China was held, the outside world paid attention to two major points in the economic dimension: one was the new economic team, and the other was whether there will be new formulations of economic policies after the 20th National Congress to help the Chinese economy get out of the trough Expect.

Prospects of the 20th National Congress of the Communist Party of China | One Core, Two Revolutions, and Three Key Words How to change the prospect of the 20th National Congress of the Communist Party of China | Xi Jinping frequently mentions "historical confidence" and "five self-confidence" or will be released

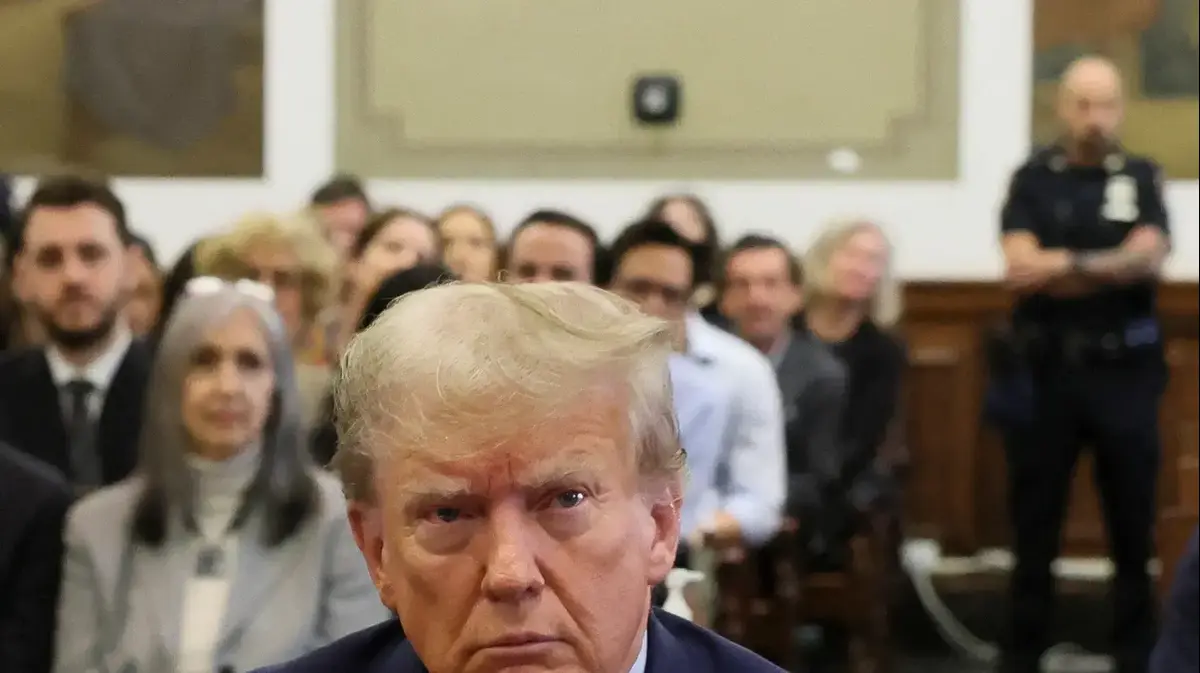

Premier Li Keqiang will end his term of office next year. Although there are still a few months to go, he will be able to know who will be the successor if he enters the permanent list of the 20th National Congress of the Communist Party of China.

In addition, Li Keqiang, vice premier Liu He, 70, and Guo Shuqing, 66, party secretary of the People's Bank of China and chairman of the China Banking and Insurance Regulatory Commission, are likely to end their terms early next year, multiple policy sources said.

The 20th National Congress of the Communist Party of China has enough room to choose a new economic team.

Liu He serves as the Office Director of the Central Financial and Economic Leading Group, and is fully responsible for China's economic policies and implementation.

(Reuters)

There is no doubt that the new economic team will face unprecedented challenges.

The year-on-year GDP growth in the second quarter was only 0.4%. This year, it is possible that the government’s set economic growth target will not be achieved for the first time. China’s economy is in a trough period, and it needs to find a way out in the real estate crisis that threatens financial stability and the “zero policy” of the new crown virus. .

Against such a background, we look forward to giving new guidance on the 20th CCP.

However, compared with the comprehensive observation and judgment of the reports of the Party Congress over the years, there may be no new suggestions for economic policies in the report of the 20th National Congress of the Communist Party of China.

A common saying in the Western world is that "the zero policy may end China's reform and opening up" and that "the best way for China to realize its economic potential is to return to the path of reform and opening up." In fact, this statement is inaccurate .

In Western public opinion, the "zero policy" and "reform and opening up" are completely binary opposition, but in fact, anyone who understands Chinese politics knows that this is a matter of different levels and different political meanings.

"Seeking Truth" recently published Xi Jinping's article "The Whole Party Must Completely, Accurately, and Fully Implement the New Development Concept" The article continues to point out that it is necessary to continue to deepen reform and opening up.

In addition, the central government's focus on economic regulation and control is "stability", which will continue for a considerable period of time.

At the last (2021) Central Economic Work Conference, he stated that "China's economic development is facing triple pressures of shrinking demand, supply shocks, and weakening expectations, and put forward the general tone of "steadfastness and making progress while maintaining stability".

This is the clearest and most accurate judgment on the current Chinese economy, and subsequent policies are also planned accordingly.

Most likely will continue.

From December 8 to 10, 2021, the Central Economic Work Conference will be held in Beijing.

It is proposed that "China's economic development is facing triple pressures of demand contraction, supply shock, and weakening expectations."

(Xinhua News Agency)

It's not about the policy itself

Looking back at history, in the 30 years after China's reform and opening up in 1978, the average annual growth rate was around 10%.

In 2012, it began to drop to the range of 7%-8%, and the "7 era" lasted for four years.

2016 further decelerated and entered the "6 era".

A new crown epidemic has recalibrated the target.

Affected by the epidemic, the trend of lower growth rate has come faster than expected, and China will start the "5" (5%) era in 2022 (affected by the epidemic, GDP will increase by 2.3% year-on-year in 2020 and 6.8% in 2021).

Today, Chinese society and the outside world are more concerned about whether the "5" era can be sustained.

Ensuring that the Chinese economy does not slow down further is not only an economic issue, but also a core political issue.

What is the problem with China's economy today?

Although it has been greatly affected by the epidemic, why has it been impossible to restore normal economic vitality for a long time after the resumption of work and production?

—— Investors dare not invest, and consumers dare not consume. This is such a "simple and rude" reason.

It should be realistically said that the direction of fiscal policy and monetary policy is correct, but if the deep-seated problems are not solved, it will be very difficult for the economy to recover.

We must think about how to solve deep-seated problems, otherwise investors will not dare to invest and consumers will not dare to consume, and the role of macro policies will be greatly constrained and limited.

What is the deep-seated problem, in the judgment of this year: the triple pressure facing the Chinese economy.

In particular, "the first pressure: weakening expectations" is a concept in non-traditional economic ethics that underestimates its impact.

Why does China suddenly have weaker expectations?

The signs of this start from the enterprise and then spread to the whole society.

This has to start with last year's proposal to "prevent the disorderly expansion of capital".

"Preventing the disorderly expansion of capital" has sparked fears of hitting capital.

The meeting of the Politburo of the Central Committee of the Communist Party of China emphasized that "strengthening anti-monopoly and preventing the disorderly expansion of capital".

Alibaba is the first "early bird".

(file picture)

At the Central Economic Work Conference held at the end of 2020, "strengthening anti-monopoly and preventing disorderly expansion of capital" was listed as one of the eight key tasks in economic work in 2021.

And then successively took a series of actions in some areas of capital expansion.

The business community has more or less made the judgment that "the country will crack down on capital", causing many enterprises to be nervous and afraid to increase investment and consumption.

In fact, "preventing the disorderly expansion of capital" is not about hitting capital.

First, capital is a profit-seeking economic category, and capital is not capital if it does not pursue profit; thirdly, in the process of capital chasing profit, it may be consistent with the country's macro-policy.

When it is consistent with the national macro policy, it is called the orderly operation of capital.

Of course, it is also possible that it is opposed and inconsistent with the country's macro-policy. To a certain extent, it is called the disorderly expansion of capital.

Therefore, the main indicator for judging whether capital is operating in an orderly manner or expanding disorderly is to see whether it is coordinated with the country's macroeconomic policies.

Any enterprise should pay attention to the coordination of national macro policies in the process of profit-seeking.

In fact, looking back, there are traces of “preventing the disorderly expansion of capital” over the past year. It is not the whole network to hunt down, but mainly focus on three areas.

The first area is real estate.

The disorderly expansion of real estate capital has continuously used high leverage to drive high land prices, and used high land prices to drive high housing prices.

Especially after 2015, a large number of real estate developers have sunk to the fourth, fifth and sixth tier cities.

In real estate and land speculation, capital has greatly expanded the attributes of capital and changed the consumption attributes of real estate.

In order to solve the sequelae caused by the disorderly expansion of real estate, and because "houses are for living in, not for speculation", not only Evergrande has a problem, but suppliers, investors, and buyers of the entire industry are suffering from labor pains. .

I am afraid that this wave has triggered the largest thunderstorm of real estate companies in history. Who would have thought that real estate companies such as Sunac, R&F, Kaisa, and Agile could be on the list... And once the real estate industry is shaken, it will involve the emergence of upstream and downstream industry chains chain reaction.

The largest real estate company in history has a thunderstorm, and real estate companies such as Evergrande, Sunac, R&F, Kaisa, and Agile are all on the list.

(Photo by Zheng Zifeng)

The second area is education.

There are two types of education in China, one is called compulsory education and the other is called non-compulsory education.

Compulsory education is paid by the state, but there are various training classes that accompany it. Compulsory education has caused a heavy burden on the family.

According to statistics, junior high school students pay about 100,000 educational expenses per family each year.

The turmoil of capital in this field has caused anxiety and complaints in the entire society, and it has to be cleaned up.

The actual purpose is to reduce as much as possible the phenomenon of “involution” in education to the general public, especially the middle class, due to the fairness of education.

With the decree, the education and training industry is full of grief.

The stock prices of education giants such as New Oriental and TAL have plummeted, and many education and training institutions that went public in a frenzy in the past few years are directly facing delisting warnings.

The third area is the Internet.

The disorderly expansion of the Internet field is very obvious.

Some capitals use the Internet platform to continuously promote monopoly, making small and medium-sized enterprises unable to survive and constantly being exploited.

It has gradually developed from online to offline retail. If this continues, more small and medium-sized enterprises will not be able to survive.

What is even more exaggerated is Internet finance, and some capitals use technology in disguise.

Originally, technology is technology, and financial use of technology cannot be called technology.

Financial use of technology is not technological innovation, or finance, which should not be confused.

However, Internet finance took advantage of the loopholes and even packaged the so-called usury as inclusive finance, resulting in rising financing costs for companies and rising financing for consumers.

This is an important content of the disorderly expansion of the financial sector.

Alibaba, Tencent, Didi, ByteDance and a number of Internet giants have all been punished.

Of course, another area where the disorderly expansion of capital has been rectified is the entertainment industry.

Capital continues to expand in the entertainment industry, constantly packaging various so-called idols, fan circles, and fan circles, resulting in a series of problems.

Frankly speaking, there is no problem with remediation in these areas.

The capital "Frenzy Dance" really disrupted the normal order.

The rectification at the central level is to hope that more capital will enter the track that is consistent with the national macro policy, and that more capital can solve the current shortcomings of the Chinese economy.

These are fully understandable original intentions - to promote fairness, justice and sound development of China's "society".

But the problem lies in the fact that real estate, finance, Internet, education and training, culture and entertainment, etc., by coincidence, are all popular industries.

How popular in the past few years, how deserted this year.

They are all capital-intensive or capital-operated, and they are all strongly supported by policies.

In the short-term "policy support + capital support", a period of extremely prosperous Gilded Age emerged.

This Gilded Age has become a benchmark.

But suddenly, the policy took a sharp turn for the worse, and the standardized supervision system became more and more tightly woven. After a "wild bombardment", the "barbaric growth period" ended and immediately entered the "ice age", and the enterprise immediately put on the curse.

"Regulation is for better development", which is the main basis of supervision. The norm is positive, but in the market, after the normative measures meet the "anti-capital" sentiment that fills the public opinion field, different interpretations will always emerge: For example, supervision is regarded as a "hammer"; "tipping a sleeve is also a kind of love", but some people worry that they will tear their arms off; preventing the risk of "too big to fail" is also misinterpreted by some people as "big to fail". It’s time to fall”… Not to mention the market value of relevant listed companies, they are directly cut to the heels. Although the market value is not real money, it is an important component of competitiveness.

Gradually, concerns about the "disorderly contraction of capital" began to arise.

The power of corporate sentiment cannot be underestimated.

The flip side of emotion is anticipation and confidence.

In addition, basically these tuyere industries have contracted nearly 60% of the job-seeking intentions of fresh graduates in recent years.

Now, it is cut down with one knife, and the bubble is squeezed indiscriminately.

When the capital is no longer coerced, the employment absorption capacity also declines rapidly, and both upstream and downstream are lost.

Without employment, there will be no income, and without income, there will be no consumption.

This is also the main reason for the decline in the consumption tendency of residents and the ineffectiveness of various policies to stimulate consumption.

Over and over again, the expectations weaken, and the enterprise will multiply to the entire social level.

Li Keqiang said that the six major economic provinces accounted for more than 40% of the country's total economic output, the number of market players, and employment.

Economically large provinces must bravely take the lead, ensure that market players stabilize the economy, and stabilize the employment of local and migrant workers.

A stable economy is also a stable source of money.

(CCTV)

So, is this a matter of policy?

Not at all, it's all a matter of scale at the execution level.

That is, the "crooked monk sings the wrong scriptures" will cause a steady stream of far-reaching effects.

Crooked monk sings wrong scriptures

"Faced with the new stage, new situation and new requirements, we must comprehensively deepen reforms."

Xi Jinping said the same.

Yes, in order to have the ability to fight internal and external risks, we must seize deep-seated problems and continue to deepen reforms.

I believe that the CCP has already had a sense of crisis at the cognitive level, and it definitely has enough "tools".

However, "one hundred miles are half-nine." Although many policies have "prescribed the right medicine", the key to whether the medicine can cure the disease is how to "prescribe" it.

At this level, the CCP may need to reconsider.

Because from the results, the effect of many policies has been significantly discounted.

For example, the large-scale value-added tax credit and refund under the epidemic situation.

Tax and fee reduction is an achievement that the Chinese government can definitely boast about.

However, the immediate problem faced by many companies today is that they cannot pay the taxes at all. How can they be paid first and then refunded?

There are many shops in Changxiang Alley that cannot pay the tax at all, and they may close their doors before the government tax refund.

Now is not a "transition" issue, but a "survival" issue. This is seeking truth from facts.

Is it possible to break the inertia and directly exempt some enterprises from taxation in special periods?

For another example, the common problem of financing difficulties for small and medium-sized enterprises cannot be broken through.

The highly centralized financial system dominated by large banks is the main reason for the financing difficulties of SMEs, and there are institutional constraints on their financing.

The four major state-owned commercial banks own more than 70% of the country's credit funds and have a monopoly in the credit market.

In recent years, I have often heard state-owned banks preach that they want to "promote the building of financial service capabilities for small and micro enterprises", but they are very honest about where the money goes.

According to the China Statistical Yearbook, more than half of the credit of state-owned banks is currently lent to major customers who are less than 1% of the total loans. Most of these major customers are state-owned enterprises.

The policy has never been less, but it has become a chronic disease.

What is the use of the central bank's continuous release of liquidity against internal and external pressures?

The main contradiction that needs to be broken through is that it will not be broken for many years, and it will be even more difficult under special circumstances.

On February 26, 2019, a national teleconference on clearing up arrears of accounts to private enterprises and SMEs was held in Beijing. The then State Councilor Wang Yong attended the meeting and delivered a speech.

(Xinhua News Agency)

What needs to be seen again is that in the face of an economic stall, the natural focus of fiscal efforts will be on infrastructure investment.

At the beginning of 2020, the sudden outbreak of the new crown epidemic had a severe impact on the Chinese economy.

But at the end of May of that year, Li Keqiang pointed out at the Prime Minister's press conference, "The large-scale policies we launched focus on stabilizing employment and protecting people's livelihood, not relying on infrastructure projects, because now China's economic structure has undergone great changes, and consumption is growing rapidly in the economy. play the main pulling role".

In fact, this is also true. The large-scale policy adopted at that time used about 70% of the funds to directly or relatively directly support residents' income, promote consumption and drive the market.

However, after the spread of the epidemic in the mainland this year, coordinating epidemic prevention and control and economic and social development has encountered new challenges. Although the economy cannot be called a cliff-like decline, it has been caught off guard.

In the face of stalling, big investment and big construction suddenly became the only way.

Judging from the list of projects released by various places, new infrastructure, major transportation, energy and water conservancy, park supporting facilities and major livelihood infrastructure are still the focus of investment in various places, and the number of new and old infrastructure major projects generally exceeds 50%.

There is no doubt that major projects, as an important starting point for economic development under the counter-cyclical policy, have indeed played a great role in stabilizing growth.

In this way, GDP growth is expected to be achieved in 2022.

But even if this year's GDP turns in a report card driven by strong fundamental investment, can it really reverse the "expected difference"?

GDP is "homework" at the national level, while "expectations" are more of a people's heart.

It is even more important to realize that the 4 trillion investment in response to the subprime mortgage crisis has caused many spillover effects - the blind construction of "big, dry, fast and advanced" in various places has caused overcapacity in many key industries and banks are burdened with huge credit pressures. The bubbles in the capital market and the property market are getting bigger and bigger... "Promoting transformation and adjusting the structure" is also on the agenda under such circumstances.

This path has already been traveled once.

The growth rate of China's infrastructure investment is still thriving.

(Xinhua News Agency)

...all of these are on the "last mile".

The political appeal of "stability over everything".

"Overreaction" by local governments is a relatively common phenomenon.

The generalization and expansion of the stability issue actually comes from a mindset of preferring left to right, rather tight than loose.

In the short term, we need to balance, compromise and accommodate, just like the current economic growth rate, but in the medium and long term, we must resolve deep-seated conflicts, or we must not compromise or accommodate.

If these are not handled properly, it will bring a lot of dilemmas and difficulties.

Reform and social issues are like two tigers running a race. The two tigers seem to have all elements of their own, and they seem to be unable to see each other clearly, but they are both running forward. Which tiger runs faster will determine Chinese society. fate.

It is necessary to prevent problems before they occur, and contradictions highlight the superposition of hidden dangers.

Without overcoming the hidden dangers, the road ahead may become narrower and narrower.

The direction determines the road, and the way of thinking determines the way out.

It must be recognized that the Chinese economy has fallen into a new predicament. To solve the deep-seated problems, the triple pressure faced by the Chinese economy must be eliminated before it can get back on track.

There has always been no problem with the direction of the central economic policy, and the 20th National Congress of the Communist Party of China does not need "innovation" in economic policy.

But obviously this challenge is a big test of economic governance, and the devil is in the details.

For the CCP, there must be a higher level of KPI setting - words and deeds must be fruitful, and results are the goal.

Prospects of the 20th National Congress of the Communist Party of China | One Core, Two Revolutions, and Three Key Words How to change the prospect of the 20th National Congress of the Communist Party of China | Xi Jinping frequently mentions "historical confidence" and "five self-confidence" or will be released