After months of litigation disputes and facing a trial on October 17, Tesla founder Elon Musk communicated to Twitter late at night on Monday (October 3), Eastern Time, and decided to follow the agreement in April. Acquired Twitter for $44 billion at $54.2 per share.

After the news came out on the 4th, Twitter's stock price surged 22% to $52 per share.

However, Musk's repertoire of Twitter acquisitions is far from over.

buyer's regret

Musk has begun to invest heavily in Twitter at the beginning of this year. In March, he expressed his intention to privatize Twitter or establish social media. In April, he proposed a 44 billion acquisition case and reached an acquisition agreement with Twitter on the 25th of the same month.

However, in May, Twitter and Tesla shares fell sharply with the market, the former from nearly $50 per share before the acquisition was confirmed to below $40 per share, the acquisition agreement reached a few weeks ago looks more and more more expensive.

By May 13, Musk abruptly said his plans to buy Twitter were on hold, claiming Twitter's fake accounts were far higher than his "under 5%" estimate.

The problem is that Twitter's inaccurate and understated estimates of fake accounts (or bot accounts) are public information, and the company has indicated in its SEC filings that its estimates may not accurately reflect the true proportion of fake accounts, The real number may be higher than estimated.

Regarding Musk's "hesitation", people have to suspect that he "regrets" because of Tesla's stock price drop and the sudden "net worth" loss, trying to backtrack and save tens of billions of dollars.

The two sides fought until July, when Musk decided to abandon the acquisition. Twitter then sued Musk, demanding that the latter perform the contract, saying that Musk's "sudden" concern about the number of robot accounts was just an excuse for its default; The estimation method misled him.

Since Twitter is based in Delaware, like most large corporations in the United States, the state's Chancery Court is the home of the lawsuit.

Buying Twitter is an accelerant to creating X, the everything app

— Elon Musk (@elonmusk) October 4, 2022

A first-to-lose lawsuit?

From the very beginning, analysts generally believed that Musk had no chance of winning, and the biggest possibility was to pay Twitter the $1 billion breakup fee agreed by the two parties, or even the difference between its acquisition price and Twitter’s stock price as compensation; the most serious is more likely to require Musk fulfills the acquisition agreement.

Even worse for Musk, Chancellor Kathaleen McCormick, who presided over his case, ruled against the original acquirer in a similar case just last year.

The case involved DecoPac, a cake decorating supplier.

The holders of DecoPac struck a $550 million buyout with private equity firm Kohlberg at the start of the pandemic in March 2020.

Since then, the "stay-at-home order" has been implemented in many places in the United States, and DecoPac's business has plummeted. Kohlberg immediately cited the so-called "Material Adverse Effect" as a reason for withdrawing from the acquisition agreement, which was eventually dismissed by McCornick.

The woman who controls the fate of the Twitter/Musk saga, Chancellor Kathaleen St. J. McCormick, of the Delaware Court of Chancery. 🍿$TWTR pic.twitter.com/VkKBTlCEpP

— Ivan the K™ (@IvanTheK) July 16, 2022

Coincidentally, Musk's main reason for withdrawing from Twitter's acquisition is precisely the misleading method of estimating false accounts that he refers to constitutes "significant benefit without impact", which has the same legal logic as the DecoPac case.

However, in the DecoPac case, the amount involved was $550 million; in the Twitter case, the amount involved was $44 billion.

Regarding DecoPac's judgment, Harvard Law School's analysis pointed out that the threshold for proving the existence of "material adverse effects" is very high.

By August, the SEC admitted that two days before Musk formally walked away from the deal, Peiter Zatko, a former security chief who was fired by Twitter earlier this year, complained to the SEC, accusing Twitter of failing to comply with the FTC. ) 2011 decision on Twitter's data privacy rights, management's disregard for data security issues, acquiescence in the Indian government's placement in Twitter, etc.

Zatko later claimed in congressional hearings that any Twitter employee could control the account of any senator, and that the FBI had notified Twitter that there was at least one Chinese state security officer.

The DecoPac case has the same legal logic as the Twitter case, but the amount involved in the latter is nearly a hundred times higher.

(Screenshot from DecoPac website)

Musk's request to add Zatko's new allegations to his lawsuit was soon granted by Judge McCornick.

However, the general analysis believes that although Zatko's allegations damage Twitter's corporate image, it does not involve evidence that Twitter deliberately misled Musk, and its allegations are difficult to reach the threshold of "material adverse effect" - Musk's comments on Twitter The acquisition agreement also includes two specific clauses that likely preclude Musk's reliance on Zatko's allegations.

In court documents made public recently, private communications before Musk’s decision to buy Twitter in April seem to show that Musk has a deep understanding of Twitter’s serious fake account situation.

At the time, he told a Twitter board member that getting rid of fake accounts would require "dramatic" action, "as a public company, that would be difficult because clearing fake users would make the data ugly, so a recalibration would require as a private enterprise."

According to Bloomberg, Musk's legal team has foreseen that the judge will not rule in Musk's favor.

This could be the "last straw on the camel's back" in Musk's legal battle with Twitter.

Of course, the fickle Musk still has a chance to change his mind even if the acquisition has not been finalized one day.

However, since Musk’s Tesla and SpaceX are also registered in Delaware, and the state’s Chancery Court has just ruled in another case that the shares of these companies are personal assets within the jurisdiction of the court, if Musk Ultimately losing the case, this court will also have the ability to force Musk to "change his mind."

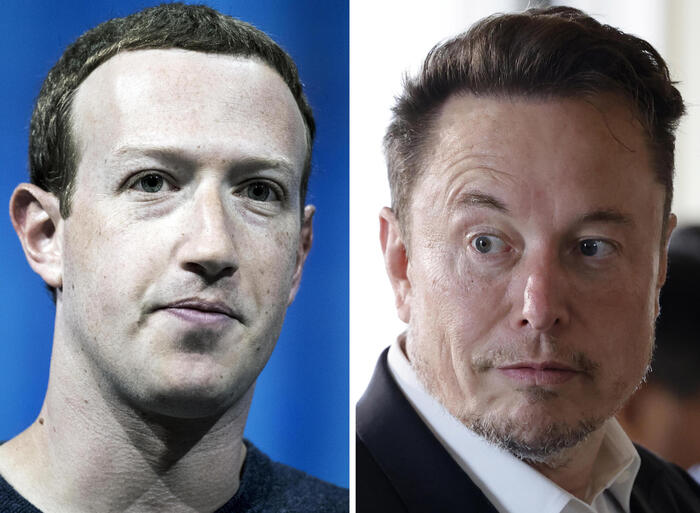

Musk has said he will bring Trump back to Twitter.

(Getty Images)

The consequences of being forced to buy Twitter

Forcing Musk to buy Twitter at a high price of $54.2 per share is certainly profitable for Twitter shareholders.

But for Twitter's growth, that doesn't seem like a cause for celebration.

At this moment, Musk's acquisition of Twitter is basically the same as handing Twitter to a madman who made it clear that he didn't want Twitter, spent months "singing" Twitter, and had to give in only because of legal restrictions.

Therefore, if the acquisition goes through, it will also be a "lose-lose" situation for Musk, who paid a high acquisition price, and Twitter's corporate development.

According to Nasdaq's estimates of the overall trend this year, without Musk's acquisition, Twitter's stock price would probably only be at the level of $30 per share, so Musk almost overpaid Twitter's "true value" by 80% price to buy.

And Musk's acquisition may also force him to sell Tesla stock again, which will put pressure on the latter's share price and even Musk's net worth.

And, compared to other social media, Twitter has always been an influential but unprofitable company.

On the one hand, Twitter has had little success in innovating since its founding in 2006.

Twitter once acquired Vine, a short-video program like TikTok, and ended up failing to manage its operations; Twitter also copied Snapchat’s disappearing tweets (“Fleets”), and even Clubhouse’s real-time voice conversations (“Spaces”), the former failed. , while the latter is only in its infancy.

In August of this year, it was even reported that Twitter even considered launching an "adult content" service earlier this year, hoping to capture the porn market similar to OnlyFans.

Twitter founder Jack Dorsey, known as the "CEO of Absenteeism".

(Getty Images)

On the other hand, although Twitter has many users in politics, academia and the media industry (up to 70% of American journalists consider themselves highly dependent on Twitter), the number of active users is more than ten times lower than that of Facebook, and the advertising revenue per user is also higher than that of Facebook. Facebook is more than 50% lower, and even the newly emerging TikTok’s global digital advertising market share is twice as high as Twitter’s.

Although Twitter hopes to attract monthly users with services such as "recycled tweets" to supplement its advertising revenue (which accounts for 90% of its revenue), this is not very attractive to the general user.

Many analysts believe that Twitter's woes may be related to the management of its founder and former CEO Jack Dorsey (until the end of 2021).

On the one hand, he is too idealistic (Dorsey recently said that turning Twitter into a company is his biggest regret), and on the other hand, he is also ignorant of company management (Dorsey moved to Africa for a few months in 2020, and has been It also has the name of "absentee CEO" since then).

However, if Musk does take over the management of Twitter, he may also become another "absentee CEO."

After all, Musk is already busy developing electric vehicles (Tesla), sending humans to Mars (Space), developing human brains and computer interfaces (Neuralink), and more.

Faced with Twitter's stagnant development and ongoing political controversy, does Musk, who has spent months rejecting Twitter, really have the time and heart to deal with it?

Elon Musk's proposal to buy Twitter soars 22%, closes high Tesla rises 3% Twitter shareholders reportedly accept Elon Musk's acquisition of $44 billion