The US economy added 263,000 jobs in September, and the unemployment rate fell to 3.5%, showing the resistance of the labor market, above experts' forecasts, despite the cooling caused by the rise in interest rates of the Federal Reserve, to which this figure will offer greater room for maneuver for further hikes.

The September figure, published this Friday, represents in any case the smallest monthly increase since December 2020 and a decrease compared to the average of 438,000 new jobs registered between January and August.

However, from any historical point of view, it is still healthy.

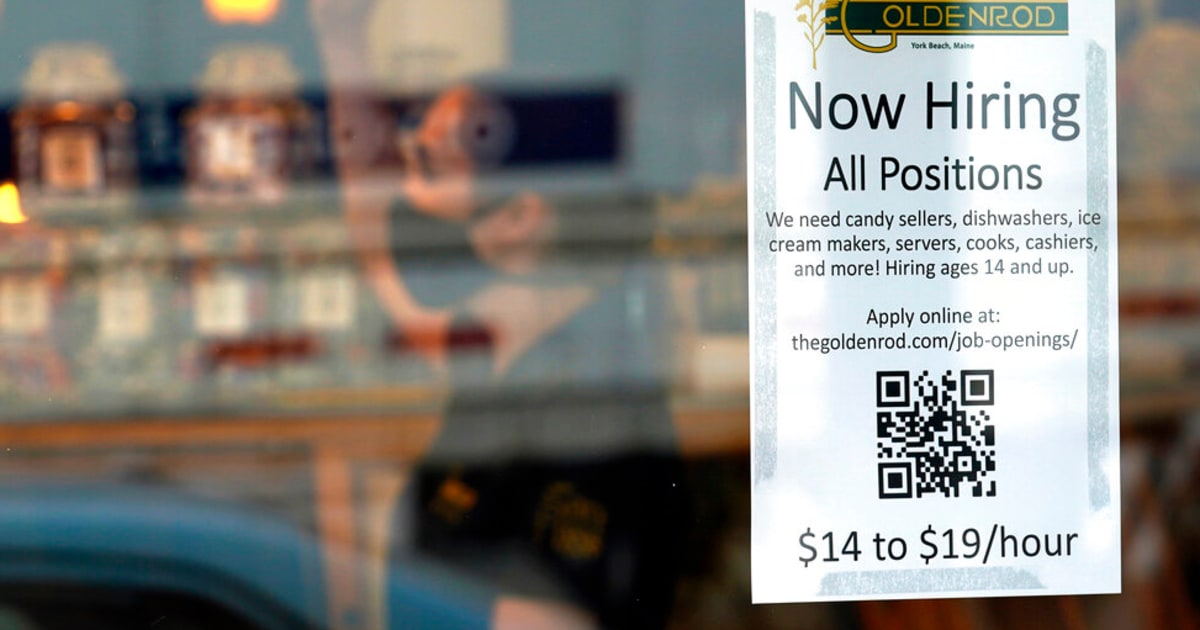

Robert F. Bukaty/AP

The Federal Reserve (Fed, for its acronym in English) is immersed in a battle to curb inflation, which in June reached its highest level in the last 40 years and has since fallen only slightly.

It has raised its benchmark interest rate five times this year with the aim of slowing economic growth enough to reduce price increases towards 2%.

The road ahead is long.

In August, a key measure of year-on-year inflation, the consumer price index, stood at 8.3%.

Fed Chairman Jerome Powell has bluntly warned that fighting inflation "will bring some pain," not least in the form of layoffs and higher unemployment.

Some economists remain hopeful that, despite persistent inflationary pressures, the institution will achieve a so-called soft landing: curbing growth to tame inflation, without tipping the economy into recession.

It is a complicated task at a dangerous moment.

The world economy, weakened by food shortages and rising energy prices as a result of the Russian invasion of Ukraine, may be on the verge of recession.

Kristalina Georgieva, managing director of the International Monetary Fund (IMF), warned Thursday that the entity is lowering its estimates of world economic growth by 4 trillion dollars until 2026 and that “things are more likely to get worse before they get better”.

The public's anger at high prices and fear of the prospect of a recession also have political consequences, since the Democratic Party of the president, Joe Biden, is in the midst of an electoral battle to maintain control of Congress in the elections of November midterm.

Meanwhile, the Federal Reserve is closely monitoring the labor market.

In the past two years, many employers have been unable to fill all the jobs they need, raising wages to try to attract or keep workers.

Those higher wages are fueling inflation as companies raise prices to offset their higher labor costs.

Powell and members of the Fed's policy committee want to see signs that the abundance of available jobs -- there are now 1.7 openings for every unemployed American -- will steadily shrink.

Many economists considered the pace of hiring in August, when employers added 315,000 jobs, an achievement.

Encouraging news came this week, when the Department of Labor reported that job openings fell by 1.1 million in August to 10.1 million, the lowest number since June 2021.

Nick Bunker, head of economic research at the Indeed Hiring Lab, suggested that among the items on the “flight to soft landing” checklist is “a decline in job openings without a spike in the unemployment rate, and that is what we have seen in recent months.”

On the other hand, by the yardstick of history, opens remain extraordinarily high: In records going back to 2000, they had never exceeded 10 million in a month until last year.

"There are still 10.1 million open jobs," said Michelle Reisdorf, who oversees human resources consulting firm Robert Half's operations in Illinois and Indiana.

“Candidates still have options.

It's not like they have a single job to look at,'' he added.

Economist Daniel Zhou of the jobs website Glassdoor argues that focusing solely on the job market might be overkill.

Regardless of what happens to employment and wages, Zhou suggested, the Fed's policymakers are likely not to back down from their rate-hike campaign until they see evidence that they are actually hitting their target.

“They want to see inflation slow down,” he said.

/cloudfront-eu-central-1.images.arcpublishing.com/prisa/JHLX47SHC5CTZBAKK7AZFYX7WY.jpg)