The Saudi Arabian desert can seem endless, particularly here in the northwestern part of the country, where people are a rare sight.

For hours on end, there is only sand, rock, heat and the occasional empty road.

It seems almost unreal, almost like a fata morgana, when long columns of dump trucks suddenly appear just before the Red Sea coast.

They are followed by a swarm of excavators, digging their way through dunes and scree across several dozen kilometers.

Perhaps, grumble critics, the plans for what is to be built here are nothing more than hot air.

After all, those plans sound far too crazy to be true: a model region called NEOM, as big as the German state of Hesse, rising out of the desert, complete with technology parks, industrial production and a 170-kilometer-long futuristic city – 500 meters high, 200 meters wide, completely CO2 neutral.

Residents will move through the metropolis in flying taxis and high-speed trains.

The price tag?

Five-hundred-billion dollars.

For the first phase.

Crazy?

More like shock and awe.

A demonstration to the world of what can be done with virtually limitless monetary resources.

Mohammad bin Salman, Saudi Arabia's crown prince and ruler, is the driver behind the vision.

By 2030, the country is to have transformed into a high-tech nation, independent of oil and even more powerful than it is today.

It is a monstrous, almost surreal plan.

But the money is there—more than ever before.

Three-and-a-half trillion dollars, an unfathomable sum, are set to flow into the coffers of the six Gulf states in the next five years should the prices for oil and gas remain as high as they are today - a gift from Vladimir Putin.

Because Europe is no longer interested in importing energy from Russia, oil from Saudi Arabia and natural gas from Qatar have become the focus, no matter how high the price.

The plan currently afoot in the desert is perhaps more gigantic than any project since the construction of the pyramids.

Fully 30,000 construction workers are already laboring away in NEOM, with that number soon to explode to 300,000.

In just a single year, a town for 4,000 engineers, technicians and project planners from around the world has sprung up, complete with swimming pools, schools, restaurants and tennis courts.

Long rows of single-story homes stretch out behind barbed wire and security gates.

Nobody really knows what will ultimately become of the project - either a futuristic metropolis or an abject failure - but Saudi leaders are primarily interested in the message behind it, both domestically and abroad.

Indeed, in the government quarters of Riyadh, Doha and Abu Dhabi, officials could hardly be more full of themselves.

At a time when the West is suffering and China is showing economic vulnerability, the economies on the Gulf see nothing but a bright future and their optimism is boundless.

Some examples:

In the United Arab Emirates, per capita income is just as high as it is in Germany.

With economic growth of 7.6 percent this year, Saudi Arabia is home to the fastest growing economy of all G-20 member states.

Qatar has spent billions to host this year's World Cup.

The sovereign wealth funds of the six Gulf states are worth a combined 4 trillion euros, and they invest money around the world, including in German companies like VW, Porsche and RWE.

Or to purchase soccer teams, Formula One races or an entire professional golf league.

Saudi Arabia also has its own space program.

Those traveling from crisis-ridden Europe to the Gulf region this fall will encounter a disquieting contrast.

On the one hand, a fearful continent, wracked by self-doubt and fears of recession as it fights to maintain its prosperity and influence.

On the other, an entire region drunk on success and on its newfound international importance.

And young: Around 70 percent of the population on the Arabian Peninsula is under 30 years of age.

It seems clear that the Gulf states will place a key role in the new world order currently being established.

Qatar and Iran are sitting on the largest natural gas repositories on the planet, while Saudi Arabia is home to the second-largest oil reserves.

That was already a huge lever for global influence in the past.

But Russia's invasion of Ukraine, and the subsequent sidelining of the country, has made that lever even longer.

The West has virtually no other options available.

And it doesn't end with oil and gas.

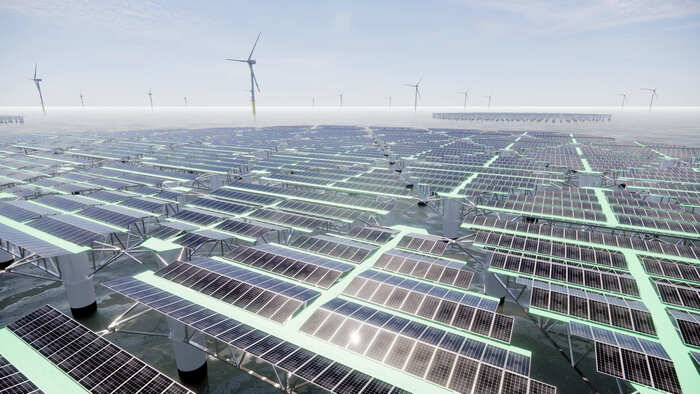

The energy source of the future is hydrogen, produced with solar and wind.

The deserts of the Arabian Peninsula offer perfect conditions for such renewable energy sources.

Ultimately, more hydrogen may be exported from the Emirates and Saudi Arabia in the future than oil is today.

Germany promises to be a primary destination.

The development, though, is not without danger: The energy boom is taking place in a time of significant geopolitical upheaval.

Globalization is slowing and the world appears to be in the process of once again dividing itself up into blocks: China against the West;

autocracies against democracies.

Toxic alliances suddenly appear to be a very real possibility.

Since the beginning of Russia's war in Ukraine, leading politicians in Berlin have been pushing to bind influential countries to Europe in this multipolar world.

Or at least to avoid losing them to Russia or China.

And Germany is not alone.

Indeed, Western heads of government have been lining up for months for audiences with Arabian rulers: French President Emmanuel Macron, ex-British Prime Minister Boris Johnson, German Chancellor Olaf Scholz and US President Joe Biden have all made recent trips to the region.

The European Union intends to install a special envoy for the region.

That alone demonstrates the new balance of power.

But the fact that many of the trips have produced no results is perhaps even more indicative.

German Economy Minister Robert Habeck, a member of the environmentalist Green Party, was widely mocked for his almost desperate appeals during his springtime trip to Qatar in the search for natural gas.

Thus far, though, no contracts for liquefied natural gas (LNG) have been forthcoming.

And when Biden, during his trip to Riyadh in summer, asked that the country boost its oil production to tamp down gas prices in the US, the Saudis did precisely the opposite.

Cooperating with strong and increasingly self-confident Gulf States requires a certain amount of imagination, particularly for a Berlin governing coalition that has professed its dedication to a values-based foreign policy.

How, though, should the West deal with economically and politically indispensable autocracies, countries that are undemocratic, ruled by despots, frequently show little respect for human rights and treat women and migrants as commodities?

Countries which, on the other hand, are capable of extremely rapid progress, not just economic but also social.

In Saudi Arabia, for example, the share of women in the tech sector is higher than it is in Germany.

So, should Germany give its age-old doctrine of change through trade, suddenly abandoned in the wake of Russia's belligerence, another try?

It would certainly benefit the German economy: Almost nowhere in the world is more money currently changing hands.

Companies of all sizes are streaming into the region to earn their fair share from the gigantic wind parks and hydrogen facilities that are coming.

Abu Dhabi almost seems like a beautiful city when the muezzins call for sunset prayers and the humid November heat finally loosens its grip, when dusk makes everything seem a bit softer and friendlier – the almost 400-meter-tall skyscrapers reflecting the Persian Gulf, framed by beaches, islands and mangrove forests.

It is a fleeting moment of calm, quickly dispelled by 12-lane highways and endless checkerboard city quarters.

The capital city of the United Arab Emirates has grown too quickly to exude the natural charm of other global metropolises.

In the 1960s, there was neither electricity nor a sewer system in many places - today it is home to some 1.5 million people.

Soon, the population is expected to hit 3 million.

None of the city's landmarks are older than 20 years: the offshoot of the Louvre, designed by star architect Jean Nouvel;

a palatial luxury hotel, where cappuccinos are served with flakes of 24-carat gold;

and the Leaning Tower of Abu Dhabi, which reaches 160 meters into the sky and has a lean four times as severe as the tower in Pisa.

At its foot is the convention center, with the elite of the energy world gathering here in late October every year.

More than 2,000 senior executives from multinationals like BP and Shell, along with more than 40 oil, energy or economy ministers were present.

All of them eager to rub elbows with the sheikhs and negotiate new deals: oil and natural gas for today, hydrogen for tomorrow.

This year, Klaus-Dieter Maubach made the trip, the head of Uniper, Germany's largest natural gas trader, freshly bailed out by German taxpayers to the tune of 40 billion euros.

Historically, Uniper has imported almost all of its gas from Russia.

But now, it must go shopping elsewhere, leading to a smiling Maubach sitting on a podium before skeptical Emiratis, Saudis and other energy traders and talking about the future.

About Uniper's LNG terminal in Wilhelmshaven, set to begin operations in November, and about where the gas will come from.

"Our priority is securing the supply of natural gas for Germany and Europe," the executive intoned.

Uniper, he said, has the experience to do so: "The global procurement of natural gas is in our DNA."

However, there aren't too many options left in the world for Uniper.

And certainly not at an acceptable price.

The pipelines leading from gas-producing countries to Central Europe are either at maximum capacity, destroyed or politically taboo.

And on the global market for LNG, much of the product is already accounted for by long-term contracts with countries like Japan, South Korea and China.

Indeed, it was even cause for celebration when, following the German chancellor's visit to Abu Dhabi, the state-owned energy company Adnoc promised the delivery of a single tanker full of LNG to the German company RWE.

Securing the delivery of one shipment at a time, as many as possible, that will be the main goal of Uniper executives in the Gulf for some time to come.

It is not likely to be easy to develop a long-term delivery cooperation with the United Arab Emirates.

Abu Dhabi, after all, doesn't just want to be in the position of filling the gaps in Germany's supply this winter and next.

"We told Germany: If you want natural gas from us, then we need a long-term contract," says Mariam bint Mohammed Almheiri.

"It is a large investment for us, it also has to be sustainable."

To meet the UAE's minister for environment and climate, you have to head out to the middle of nowhere in Dubai, to a mundane glass structure between the highway and the desert.

Almheiri speaks a mixture of English and accent-free German, her native language.

A smart and eloquent woman, Almheiri's mother is from the Rhineland region of Germany and her father is from the UAE She knows Germany well, having gone to university in Aachen and working as an engineer for the rolling manufacturer bearings Cerobear before moving to the country of her father.

She doesn't wear a headscarf.

She frequently spends her holidays visiting relatives in Lower Saxony.

The minister knows precisely what the Germans need: energy for their factories, for heating and for power plants.

And that fits in well with the plans laid out by Abu Dhabi's government and the country's state-owned firms.

The emirates are following a two-pronged strategy.

On the one hand, they want to continue selling their oil and gas for as long as possible.

On the other hand, they want to become a major power when it comes to renewable energies.

By 2030, ruler Mohammed Bin Zayed has announced that the country – population 10 million – is to be responsible for a quarter of the global hydrogen market.

That aspiration explains why the emirates have long been one of the most important factors in Germany's energy future.

Germany hopes to become climate neutral by 2045, a goal which will be impossible to reach without green hydrogen.

The energy source is easy to transport and store, which also makes it easy to import.

Otherwise, all of Lower Saxony and half of Bavaria would likely have to be covered in solar panels to generate sufficient quantities of renewable energy.

Beginning in 2030, Germany will need around 100 terawatt hours of green hydrogen each year, according to an Environment Ministry estimate.

And that will require the kind of industrial production capacities that don't yet exist.

Which explains why one of Economy Minister Robert Habeck's first trips as a cabinet member was to the United Arab Emirates in March.

"Conditions here are such that a huge amount of energy comes down from the sky," Habeck says.

And it's cheap.

A kilowatt hour of solar power from the Arabian Desert costs just 1.34 cents.

The emirate of Dubai already began producing green hydrogen last year with the largest contiguous solar park in the world – a facility built with the help of Siemens.

"The region is extremely important because it shows how the energy transformation works," says Dietmar Siersdorfer.

The Siemens executive has been heading up the company's activities in the Gulf region for more than a decade, including more than 100 energy products and 3,000 employees.

Internal documents make it clear why the Middle East is so lucrative for the multinational.

Some 50 million people in the region are still without electricity, with new power plants needed to fill the gap.

The oil and gas industries need technology for decarbonation.

The company can also be helpful in turning the Gulf into a key energy partner for Europe.

Dubai, for example, says Siersdorfer, is investing in wind and solar to produce hydrogen with renewable energies from the get-go.

Siemens Energy is a consultant.

As such, Siersdorfer is optimistic that the company will receive lucrative contracts once the projects really start moving.

And Siemens Energy turbines, which run on gas today, can be powered by hydrogen in the future, the executive says.

The Gulf states, says Siersdorfer, are extremely pleased with the new interest in the region from Europe.

Thus far, EU countries had primarily been focused on China and the United States.

"But the Gulf states are still looking for their place in the world."

For Europeans, he says, that is an opportunity provided they aren't only interested in rapid deliveries of LNG.

"People here value stable contacts and long-term energy partnerships."

Particularly given the ambitious plans the emirates are pursuing.

Additional gigantic solar parks are under construction, with the state-owned oil company Adnoc, the sovereign wealth fund Mubadala and the energy supplier Taqa providing the billions in investment necessary.

Insiders say that the primary target market for the green hydrogen that will be produced is Germany, through companies like Uniper and RWE.

The deal hasn't been signed yet, though.

"There are so many countries knocking on our door at the moment," says Minister Almheiri.

On the other hand, the emirates aren't the only possible partner in the region.

There are others as well.

"I am certain that Saudi Arabia will play a central role in the hydrogen revolution, because we are home to wind, sun, space and the geographical location to supply Europe and Asia," says Peter Terium.

"And the Saudis are very good at building huge infrastructure facilities."

Terium was head of RWE for many years.

But in 2018, he was headhunted by the Saudi leadership to set up the energy supply for the model region NEOM.

By 2030, it will be home to 1.5 million residents and numerous technology parks and companies, all of which are to be powered by renewable energies, as a model for the entire country.

Currently, the share of renewable energies in Saudi Arabia's energy mix is less than 1 percent, but plans call for that number to rise to 50 percent by 2030. It is, Terium says, a realistic goal, since it is possible for Saudi Arabia to obtain solar power at a price of just 1 cent per kilowatt hour.

Terium is one of the pioneers of Saudi Arabia's prestigious project and will soon have been living for four years in one of the small homes at the construction site.

He is head of the energy subsidiary spun off from NEOM.

Surrounding his home are hundreds of others, slapped together for thousands of engineers and technicians, along with their families.

NEOM Community 1 looks like an insulated university campus, but it is large enough that electric scooters and bicycles are parked on every corner so that workers can get back and forth between their homes and their offices.

Work continues seven days a week, around the clock.

Even late at night, workers are assembling new office barracks.

"The first wave of the energy transformation was low prices for solar and wind energy," says Terium.

"The second wave is starting now: Industry can only be decarbonized with hydrogen."

Terium wants to ensure that NEOM "drives this paradigm shift."

Just a few minutes' drive from NEOM Community 1 in a Jeep through the desert is the centerpiece of his plans: One of the world's largest hydrogen factories, with an output of 2,000 megawatts.

The foundation and the first pipes can already be seen, and completion is set for 2025. The Saudis are hoping it is the first step toward dominating the 700-billion-dollar global hydrogen market – and to leaving the United Arab Emirates in their dust.

The German company Thyssenkrupp is expected to make a major contribution to those plans.

The company is building the electrolysis plant for hydrogen production at a cost of almost a billion euros.

It is one of the biggest contracts awarded to date and a major step for the Essen-based company to become a key player in future technologies.

"It is now up to industry to breathe life into the new energy partnerships in the Gulf initiated by the German government," says Thyssenkrupp CEO Martina Merz.

"We need to reduce dependencies and develop partnerships that are not simple supplier relationships but mutual partnerships."

Thyssenkrupp isn't interested in talking much about its involvement, at least not officially.

Relations with Saudi Arabia's rulers aren't just morally fraught.

In the future, the royal family would like to build up technology industries of its own.

In particular, it hopes to participate in the research and development of hydrogen technologies, an advantage that Thyssenkrupp and other German industrial companies aren't interested in giving up.

Saudi Arabia is currently building its own hydrogen research center, part of a huge innovation hub being built at the southern end of NEOM on the Red Sea, an industrial district that is set to become the world's largest floating structure.

Excavators are excavating in the basin ahead of building a fully automated port conveniently located near the Suez Canal.

Does Terium, the sober-minded executive who began his career at the Dutch Finance Ministry, believe in all these megavisions?

His answer is guarded: NEOM is ultimately the personal showcase project of Crown Prince Mohammed bin Salman, he says.

At the very least, Terium has clear ideas about what the next steps must be in transforming Saudi Arabia from an oil giant into a hydrogen giant.

"Build the infrastructure to export all over the world," he says, preferably a pipeline through the Mediterranean to Europe.

While technically feasible, it would be extremely complex from a political perspective.

The pipeline would have to pass through many different sovereign territories.

Nevertheless, Riyadh is mulling the idea.

"We don't know if this will work, but it would be a complete gamechanger for Saudi Arabia," says Mohammed Al Balaihed, head of the energy division of Saudi Arabia's powerful sovereign wealth fund.

"We're certainly willing to put in the resources and the effort to find out if it can be done."

The question, though, is whether Europe wants to bind itself so closely to Saudi Arabia.

It was barely two years ago that US President Joe Biden declared the country a "pariah" after journalist and

Washington Post

columnist Jamal Khashoggi was murdered and brutally dismembered in Istanbul in 2018 – by what are believed to be Saudi agents.

Western intelligence agencies would later say that the order to kill him came from the highest levels of government in Riyadh.

The Saudi Arabian government denies the allegations.

And that, too, is Saudi Arabia: According to a press release from the Interior Ministry, 81 people were executed on a single day in March.

Human rights are also violated in the other Gulf states.

In Qatar, immigrant workers died because of disastrous conditions at the construction sites of the World Cup stadiums.

Amnesty International denounces "arbitrary detention, cruel and inhumane treatment of detainees, suppression of freedom of expression and violation of the right to privacy" in the UAE

But Saudi Arabia is in a league of its own.

The state religion, Wahabism, is a particularly radical version of Islam, and Shariah law is interpreted in an extremely conservative manner, including public floggings.

For years, music in public and even movie theaters were banned in the country.

To this day, women often only go outside in a niqab, a face veil that leaves only the area around the eyes free.

Homosexuality is punishable with the death penally.

Opposition figures are harshly persecuted.

And human rights activists claim that torture is routine in Saudi Arabian prisons.

Nominally, the country, an absolutist monarchy, is led by King Salman, 86. But it is common knowledge that Crown Prince Mohammed bin Salman, MbS for short, has long had a firm grip on power.

He has eliminated all competitors in a way that is impressively nefarious even for despots.

Including the man who should be the actual heir to the throne: He lured his cousin, Prince Mohammed bin Nayef into a trap.

The same happened to numerous relatives and business leaders in the country.

That, at least, is the story told by reports from Western intelligence services and numerous investigative media outlets.

In 2017, MbS invited the international financial elite to an investment conference in Riyadh, billed as an intimate offshoot of the World Economic Forum in Switzerland and thus fondly dubbed "Davos in the Desert."

Wall Street giants and politicians from around the world came as did the Saudi business elite.

After the conference in the palatial Ritz-Carlton, MbS imprisoned the most influential Saudis there and forced them to surrender much of their wealth.

Some disappeared for years.

MbS then named himself head of the supervisory board of the sovereign wealth fund and waged war against Yemen, Saudi Arabia's southern neighbor.

He almost invaded Qatar.

The Saudi ruler responded to strong criticism from the West by high-fiving Vladimir Putin in front of the cameras at the 2018 G-20 summit.

The situation, one might think, is clear: an Islamist country led by a brutal despot.

A no-go for Western governments and corporations.

But it's not as simple as that.

Saudi Arabia has transformed so rapidly in the past five years that many barely recognize their own country.

MbS pushed through reforms that would have seemed unthinkable only recently.

Music, concerts and even dating apps are now permitted, the religious police have largely disappeared from the streets, women are allowed to work, they can travel on their own and they are no longer officially required to wear a veil.

Several billion euros have been pumped into efforts to expand the education system.

In 2019, the country introduced visas for tourists, and foreign visitors are now welcome for the first time.

All across the country, billions are being invested in world-class tourist centers, such as al-Ula, an impressive UNESCO World Heritage site in the desert an hour's flight west of Riyadh: hewn rock tombs of long-gone kingdoms that could be straight out of an Indiana Jones movie.

The history behind it is explained by young female guides in English.

How do they speak the language so well?

Were they sent to school abroad?

No, one answer with a smile.

"Watching a lot of Netflix."

For many young Saudi Arabians, MbS, himself only 37, is a beacon of hope.

A man who is paving the way to a more cosmopolitan, modern future.

At one of the country's newly established technical universities, women are trained to become engineers and computer scientists.

Many of the country's prominent startups have been founded by women.

"The change we are seeing in everyday economic life here is astonishing," says Dalia Samra-Rohte, the delegate of German industry and commerce for Saudi Arabia, Bahrain and Yemen at the German-Saudi Arabian Liaison Office for Economic Affairs.

And it is clearly felt when you drive around the country and talk to young female engineers, startup founders and project managers.

They tell you: We're not all sullen and threatening, we're just trying to become freer and more progressive, and for that we need recognition, not the eternal moralizing arrogance of the West.

But the truth also includes the fact that no one here likes to be quoted by name and that talking about politics is dangerous.

MbS alone decides the extent of the country's freedoms.

And that leaves many in Berlin, Brussels and Washington wondering: Mustn't we support this process of opening?

Can we really be partners with such countries?

Barely a year ago, the answer to that probably would have been yes, of course.

Transformation through trade.

But Putin's tanks have flattened that decades-old guiding principle of German international economic policy.

As such, it's really no surprise that German politicians have to walk on egg shells every time they pay a visit to the region.

German Chancellor Scholz first listened to a long monologue about the crown prince's economic visions when he met with MbS in September.

Afterwards, in a private conversation, the chancellor claims he addressed Khashoggi's murder.

Cautiously.

The journalists accompanying Scholz on that three-day trip at the end of September didn't get to see the crown prince.

No one who might ask any critical questions was allowed to approach him.

And the chancellor, and this was conspicuous during the long flight in the government airplane, doesn't want to alienate the Arab despots under any circumstances.

In Berlin, many are assuming that Putin will be around for some time to come, and no one wants to continue buying energy from Russia while he is still in the Kremlin.

Politically, too, there are some reasons for Germany and the West to come to terms with the Gulf states.

In the short term, they are needed for isolating Putin.

During his talks in Qatar and the United Arab Emirates, Scholz heard from leaders who criticized the Russian leader and distanced themselves from him.

The Saudi crown prince, though, was more reserved.

In the long term, a systemic battle between democracies and authoritarian states is to be expected around the world.

In principle, the Gulf region belongs to the authoritarian camp, but that doesn't mean it has to end up there if the conflict comes to a head.

The West's relations with countries like Saudi Arabia and Qatar have traditionally been good;

those countries, in turn, tend to sympathize with the states with which they can make the best deals.

And that used to be the West.

The temptation to see the emirs and the princes as good partners is thus significant. On the other hand, though, is the West’s desire to be the protectors of universal claim to human rights – and of the values-based foreign policy that Germany has committed itself to in Chancellor Scholz’s coalition agreement.

In that agreement, the German government also reiterated its commitment to the weapons embargo that was implemented against Saudi Arabia in 2018. Arms developed by German companies in partnership with other European firms, though, are excluded from that embargo.

Furthermore, Germany’s Foreign Ministry, under the leadership of Annalena Baerbock, has focused heavily on climate issues – and Saudi Arabia, with its emphasis on hydrogen, makes for a logical partner. Baerbock’s staff believes there are opportunities to be had in the Gulf, with ministry officials speaking of "complementary relationships." Baerbock’s party ally Habeck, over in the Economy Ministry, echoes that sentiment: "Energy partnerships," he says, "are a contribution to détente."

But neither the Saudi Arabians nor the Qataris have proven to be the obliging raw materials suppliers that Berlin had been hoping for. Christoph Ploss, a member of parliament with the opposition Christian Democrats (CDU) and chairman of the parliamentary group focusing on relations with the Arab world, accuses the Scholz administration of "having no strategy for the Gulf region." In his conversations with people in the region, he says, he often gets the sense of wounded pride.

Ploss is demanding that the arms embargo against Saudi Arabia be lifted. "Germany must decide on weapons deliveries on a case-by-case basis. It is ultimately legitimate that Saudi Arabia wants to protect its maritime trade routes and oil refineries from attack – by Iran, for example," says Ploss.

Arms deliveries are, of course, a political measure to prevent the Gulf states from sliding further toward Russia and China. Particularly given that in both Saudi Arabia and the U.A.E., a consensus is developing that the U.S. is no longer a reliable guarantor of security. And if Iran does become a nuclear power, the Saudis may very well welcome assistance from Russia.

In other words: Being the moral victor could be dangerous for Europe in this era of a changing world order. A purely values-driven foreign and economic policy may be desirable, but preventing an alliance of despots is even more important.

The flipside of such realpolitik could be seen in Riyadh just a few weeks ago. The crown prince was again hosting his global investment conference, and it was once again held in the horribly pompous Ritz Carlton, where he once locked up his adversaries and robbed them of their power. Just like the murder of Khashoggi, that incident is no longer an issue for the world’s financial and economic elite – for the 7,000 senior executives, bankers and politicians who have arrived to consort with the Saudi leadership.

Outside, the desert sun is beating down, but inside, the leaders of Goldman Sachs and Blackrock are discussing "a new global order" together with energy ministers, sovereign wealth managers and former heads of government from the West. An order that will naturally include a greater role for the Gulf states.

"Saudi Arabia and the United States have been allies for more than 75 years," says Jamie Dimon, head of JPMorgan Chase, adding that it will remain that way in the future. He was echoing the message of U.S. Treasury Secretary Janet Yellen, who has touted the concept of "friend shoring" in times of war and conflict, which essentially means doing business only with allied nations. The Saudis in the venue applauded when Goldman Sachs CEO David Solomon praised the "strong American leadership." Global politics in the Riyadh test tube.

In times of shifting power blocks and new power centers, it was left to Yasir Al-Rumayyan, governor of the 620-billion-dollar Saudi Arabian sovereign wealth fund – and a close friend of MbS – to provide a vision for the future.

"I believe strongly in a new global order, if all of us here cooperate closely, as partners."

The problem, said Al-Rumayyan, are governments that "think ideologically and not pragmatically," a clear reference to Western countries.

Yet the answer, from the point of view of Riyadh, Doha and Abu Dhabi, could be so simple: Let money lead the way.