(CNN) --

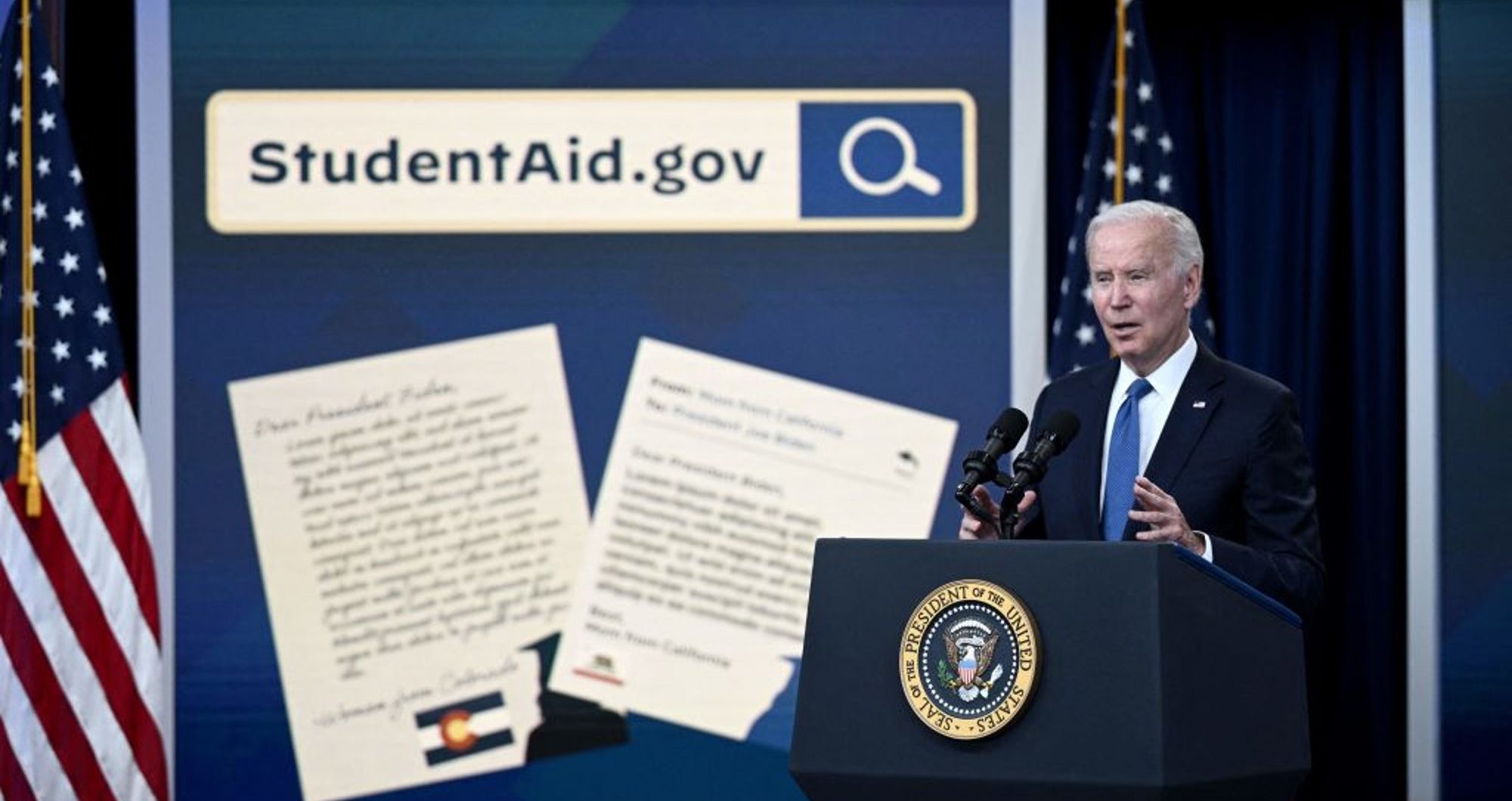

Student loan recipients are now on an indefinite wait to find out whether or not they will receive debt relief under President Joe Biden's loan forgiveness plan after a federal judge in Texas ruled so. illegal, invalidating it in fact.

The Justice Department immediately appealed to the 5th Circuit Court of Appeals, but the case will have to be resolved before the Biden administration can cancel any federal student loan debt under the program.

The White House estimates that Biden's plan to pay off some student loan debt costs $379 billion.

Although the Biden administration has faced several legal challenges to the student loan forgiveness program since it was announced in August, Thursday's ruling is the biggest setback so far, prompting the Education Department to stop accepting applications for debt reduction.

Biden's program was already on hold due to another legal challenge, but the administration had continued to accept applications, having received $26 million to date.

Under program rules, eligible low- and middle-income borrowers can receive up to $10,000 in federal student loan forgiveness and up to $20,000 if they also received a Pell Grant while enrolled in college.

advertising

What happens now with the recipients of student loans?

Borrowers will have to wait for the Government's appeal to the 5th Circuit Court to be resolved.

Although it can be difficult to keep up with all the legal challenges, borrowers can subscribe to updates from the Department of Education and check the Federal Student Aid website for more information.

The court could take months to issue a final ruling.

If it overturns the Texas trial court's ruling, the Biden administration could start writing off student debt.

The Justice Department could also request an emergency stay of the Texas judge's order.

If granted — and if another appellate court ends his temporary suspension from the program in a separate case — the administration could discharge the debt before the 5th Circuit makes a final judgment.

Initially, the Biden administration said it would begin granting student loan forgiveness before payments resume in January after a years-long hiatus due to the pandemic.

But Thursday's ruling in Texas puts that deadline in jeopardy.

"For the 26 million borrowers who have already provided the Department of Education with the information necessary to be considered for debt relief — 16 million of whom have already been approved for relief — the Department will retain their information so that it can process quickly your relief once we succeed in court," House press secretary Blanca Karine Jean-Pierre said in a statement Thursday.

"We strongly disagree with the district court's ruling on our student debt relief program," he said.

What are the legal arguments?

The Biden administration has argued that Congress gave the education secretary the power to broadly write off student loan debt in a 2003 law known as the HEROES Act.

However, a federal judge in Texas found that the law does not give the executive branch clear authorization from Congress to create the student loan forgiveness program.

"The program is therefore an unconstitutional exercise of the legislative power of Congress and should be struck down," Judge Mark Pittman, who was nominated for the post by then-President Donald Trump, wrote.

"In this country we are not governed by an all-powerful executive with a pen and a telephone," he continued.

The Texas lawsuit was filed in October by a conservative group, the Job Creators Network Foundation, on behalf of two borrowers who did not qualify for debt relief.

One of the plaintiffs was ineligible for student loan forgiveness because his loans are not held by the federal government, and the other plaintiff is only eligible for a $10,000 debt reduction because he did not receive a Pell Grant.

They argued that they were unable to disagree with the program's rules because the administration failed to subject the program to a formal rulemaking notice and comment process under the Administrative Procedure Act.

"This ruling protects the rule of law that requires the federal government to listen to all Americans," Elaine Parker, president of the Job Creators Network Foundation, said in a statement Thursday.

The advocacy group was founded by Bernie Marcus, a major Trump donor and former CEO of Home Depot.

What is the status of the other demands?

The Biden administration has been barred from writing off any debt since the US 8th Circuit Court of Appeals placed an administrative stay on the program on Oct. 21.

The appeals court has yet to rule on that lawsuit, brought by six Republican-led states.

A trial judge dismissed the lawsuit on October 20, ruling that the states did not have the legal capacity to bring the action.

The Biden administration faces other legal challenges against the program.

Supreme Court Judge Amy Coney Barrett has denied two separate requests to challenge the program.

Who is eligible for student loan forgiveness?

If the Biden program is allowed to go ahead, individual borrowers who earned less than $125,000 in 2020 or 2021 and married couples or heads of households who earned less than $250,000 annually in those years could receive a reduction in the debt of up to $10,000.

If a qualified borrower also received a Federal Pell Grant while enrolled in college, they are eligible for forgiveness of up to $20,000.

There are a variety of federal student loans, and not all of them are eligible for relief.

Federal Direct Loans, including subsidized loans, unsubsidized loans, parent PLUS loans, and graduate PLUS loans are eligible.

In contrast, federal student loans that are guaranteed by the government but held by private lenders are not eligible unless the borrower has applied to consolidate those loans into a Direct Loan before September 29.

student loans