Filling out the property tax declaration: This is something that owners must bear in mind

Created: 2022-11-15 05:13

By: Lisa Mayerhofer

The new property tax calculation will apply from 2025 – but time is of the essence: Owners in Germany must submit the property tax return by January 31st.

An overview.

Berlin – The property tax declaration is still on the to-do list for many owners.

After an extension of the deadline, you now have until the end of January 2023 to submit your declaration.

An overview shows what owners of land, apartments and houses should consider.

Why do I have to file a property tax return?

The property tax must be recalculated.

The Federal Constitutional Court had demanded this, because the tax offices recently calculated the value of a property on the basis of completely outdated data: from 1935 in East Germany and from 1964 in West Germany.

Property tax is one of the most important sources of income for municipalities in Germany.

The owners are now required to submit data on their properties, apartments or houses in the form of a one-off declaration to the tax authorities.

On this basis, the real estate tax is recalculated - almost 36 million properties have to be revalued.

From 2025, the new property tax will then apply.

By when do I have to submit the property tax return?

The deadline for submitting the property tax return is January 31, 2023. The deadline was originally supposed to expire at the end of October.

But after only a few property tax declarations had reached the authorities by the autumn, the state finance ministers gave the owners a further delay.

Criticism of this came from the SME and Economic Union (MIT).

"A three-month extension of the deadline is not enough," said its chairwoman Gitta Connemann.

Many citizens are overwhelmed or unsure.

What if I miss the deadline?

Owners should avoid this if possible - because they can face penalties from the tax office, such as a late payment penalty.

The surcharge is 0.25 percent of the assessed tax for each missed month, or at least 25 euros.

Owners still have to submit the property tax return.

also read

One-time payments for families, tenants, owners: there is so much money from the state now

Pension: Strong increase in 2023 - table shows how much money there is

A toy house and a replica of euro banknotes lie on a tax assessment notice for the payment of property tax.

© Jens Büttner/dpa-Zentralbild/dpa/Symbolbild

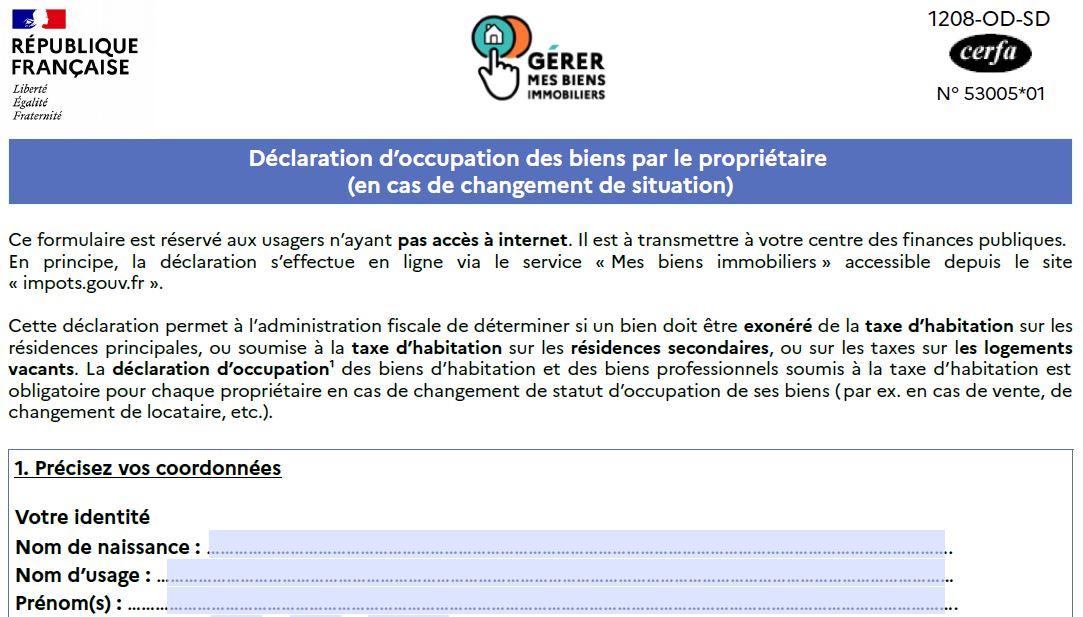

How do I submit the property tax return?

The property tax return can be uploaded digitally via the "Elster" tax software or a portal of the Ministry of Finance (for private individuals with simple ownership).

If you still have to register for Elster, you should note that activating your account can take about a week, since the tax office first has to send you the activation data.

According to the

Handelsblatt

, submission on paper is usually no longer possible.

Exception: Bavaria.

What documents do I need for the property tax return?

The Federal Ministry of Finance has prepared an overview of the data and documents on its website that owners should have at hand when filling out the forms:

land area

Land register number (if available), district, corridor, parcel

For condominiums: co-ownership share in the property

Tax number/file number of the property (to be found on the letter of request for the declaration of assessment or in the last property tax notice)

ground value

Exact year of construction of the building (from a year of construction 1949)

living space

Number of garage parking spaces

Contact details of the owners and their ownership interests

Important: Depending on the federal state, different models are used to calculate the property tax - this is why different information is requested in some cases.

After all, owners do not have to submit any additional documents to their information when submitting the property tax return.

What happens after the declaration is submitted?

Then it's the turn of the tax authorities.

You need to recalculate the property tax factors.

In total, owners who have submitted their property tax return will receive three property tax assessment notices.

There are two of them in the first letter: the property tax assessment notice with the property tax value and the property tax assessment notice with the property tax amount.

Only in the third letter, which will probably not be sent until 2024, will those affected receive the actual property tax assessment and then find out how much property tax they will have to pay from 2025.

How should I react to the letter from the tax office?

According to experts, owners should carefully check the values in the first two notices and check whether the information is correct.

"Anyone who discovers errors can lodge an objection with the tax office within one month of notification," says Claudia Kalina-Kerschbaum from the Federal Chamber of Tax Advisors to the news

portal

chip.de.

Later complaints are excluded.

How much property tax will I have to pay from 2025?

That is still completely unclear.

Because the amount of the property tax depends crucially on the so-called assessment rates of the municipalities.

However, the municipalities will only set the assessment rates for 2025 once the new property tax values have been determined.

However, experts assume that owners in the new federal states will have to reckon with significantly higher costs.

(dpa/lm)