Enlarge image

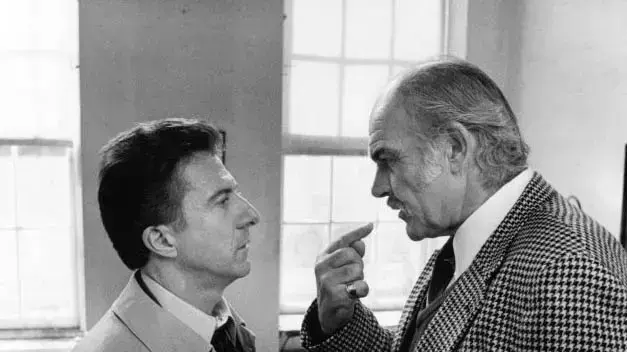

Patagonia founder Chouinard: "We don't go public, we dedicate ourselves to a good cause".

In Germany, steward-ownership is possible, but complicated

Photo: Patagonia / dpa

Yvon Chouinard

(83) caused a worldwide sensation in September.

The founder of the outdoor brand Patagonia transferred all company shares worth around 3 billion dollars to a foundation structure dedicated to environmental protection.

Chouinard and his family no longer have access to the assets.

Instead, the Patagonia Perpetual Purpose Trust serves the goal of fighting climate change forever.

A later IPO with the hyped fashion company is no longer an option for Chouinard's descendants: "Instead of going public, we are going purpose," said the clan chief - instead of going public, one dedicates oneself to a good cause.

Patagonia voting rights are now irrevocably separated from profit rights.

While the former are held by the Purpose Trust, future profit sharing will go to a charitable foundation.

The radical step is by no means the exception of a green-spirited billionaire from the other side of the world.

The idea of dedicating oneself to a "purpose" has global supporters under the catchphrase "steward-ownership".

In the USA, for example, the messenger service Signal or the search engine Mozilla, in Germany the companies Zeiss, Bosch or Ecosia are pursuing similar goals with their foundation models.

It could – especially in the debate about the fair distribution of wealth – be a model for using capital for ecological or social purposes.

However, the implementation is still so complex that many shy away from it.

Decouple voting rights and property rights

"Responsibility ownership breaks with the shareholder value logic by separating power and money: voting and property rights are decoupled, with the result that company profits can no longer be taken for personal purposes," says

Achim Hensen

, co-founder of Purpose Stiftung GmbH .

He sees a growing interest from medium-sized entrepreneurs and founders to remain independent in the long term, but at the same time to give the company a "purpose".

According to the Purpose Foundation, more than 1,200 entrepreneurs in Germany have already called for new legal forms to make steward-ownership in business easier and more flexible in the future.

Flexibility and common good – does that go together?

But entrepreneurs who want to combine non-profit "purpose" and private profit encounter legal hurdles in Germany.

"Foundation law in Germany is still quite rigid," says

Bertold Schmidt-Thomé

, an expert in foundation law and corporate succession at the Berlin law firm dtb Rechtsanwälte.

"It differentiates between charitable and private purposes: If you want to mix these purposes, you need two different foundations."

Many entrepreneurs who have the common good in mind, but also do not want to completely hand over corporate control, therefore opt for a so-called double foundation.

Similar to the Patagonia model, this model combines two different foundations: A charitable foundation holds a large share of the capital but only a few voting rights in a company.

And a private-benefit family foundation with a small capital share and the majority of voting rights, so that the entrepreneurial family can continue to determine the fate of the company.

Tax advantages – but problems with eternity

A purely non-profit foundation offers considerable tax advantages and is an enticing scenario for entrepreneurs who are planning their succession.

But: "Anyone who wants to regulate the company succession in the form of a foundation must be aware that a charitable foundation is designed for eternity," says Schmidt-Thomé.

This means: The company is permanently withdrawn from the family.

Once the foundation has been established, it can hardly be changed or reversed.

"Conflicts are programmed with it," says the lawyer.

The problem: A company has to adapt to changing market conditions over time.

It cannot provide the same services and products forever.

For this, the owners and the management need room for maneuver and flexibility, which is not provided for in a charitable "eternity foundation".

"An entrepreneur must take this into account before placing his company in the hands of foundation bodies."

Distributions are not maintenance

Second: Within a charitable foundation, support for one's own family is only possible within very narrow limits.

A charitable foundation may use a maximum of one third of its income to support the founder and the next of kin "appropriately".

"Any payment that has the character of a distribution is not permitted," says Schmidt-Thomé.

In addition, adequate care for one's own family is limited in time, namely until the death of the grandsons of the founder.

An eternity foundation serves charitable purposes for an unlimited period of time, but not the perpetual care of one's own relatives.

Do good – but also think of the family

In practice, this regularly leads to discussions when it comes to succession in companies.

"Doing good for the community, but also thinking about the family - that doesn't quite fit with traditional German foundation law," says Schmidt-Thomé.

"In addition, many entrepreneurial families want to determine part of the value creation themselves - and retain their entrepreneurial freedom."

After all, the legislator has reacted with a reform of foundation law: From the second half of 2023 there will be uniform regulations for changing foundation statutes, at least throughout Germany.

However, the world of foundations still has to wait for more flexibility.

So far, options for introducing a legal framework for steward-ownership are only included in the coalition agreement of the traffic light government.

Steps for concrete implementation, for example in a legal mixed form: None.

Medium-sized companies and family businesses are increasingly asking for such a mixed form, says Schmidt-Thomé.

In such a "hybrid foundation" different types of foundations are combined.

This allows the founders to pursue both charitable purposes for the benefit of society and private purposes with their foundation.

The previous reform of foundation law is therefore only a first step to make it easier to establish a Patagonia model in Germany.