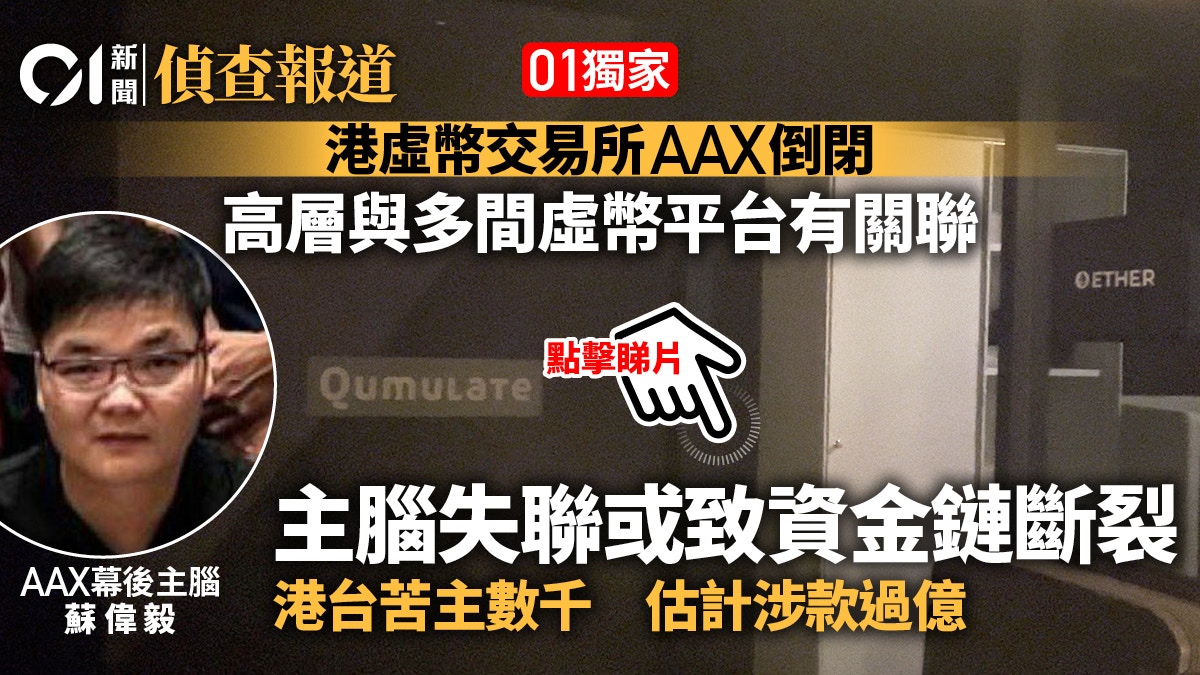

FTX, the world's second largest virtual currency trading platform, filed for bankruptcy protection, triggering a wave of bankruptcy. The Hong Kong trading platform AAX suddenly closed down in the middle of last month, high-level executives jumped ship, employees were dismissed, investors were unable to withdraw their deposits, and there were thousands of online suffering groups. Some people claimed that the loss exceeded one million yuan, and it is estimated that the total amount involved exceeded 100 million yuan.

Victor Su, the mastermind behind AAX, is also a shareholder and director of another securities company in Hong Kong. The CEO of the company admitted that the loss of Su Weiyi may lead to a squeeze and a break in the capital chain, and the company is facing operational difficulties.

AAX executives are also linked to a Hong Kong and a Singapore-based virtual currency platform, but both companies have denied it.

AAX, a virtual currency trading platform established in Hong Kong, announced "system maintenance" on November 12, and retail investors have not been able to log in to withdraw assets.

(Screenshot of AAX website)

Mid-November "maintenance" Staff unable to log into system after two weeks of working from home

AAX is a virtual currency exchange in Hong Kong. It was founded in 2018. AAX means "Atom Asset Exchange".

On November 13th, AAX issued a notice saying that it would be unable to trade due to "system maintenance". The employees were notified to work from home from now on. However, on November 28th, the employees could no longer log in to the company's system and emails, and only then did they know that the company had "an accident".

Some employees pointed out that at the beginning of December, some senior executives of the company issued dismissal notices to employees through the telegram group, acknowledging that the assets were locked and could not be withdrawn, and that they would defend their rights, and "hope the boss has a conscience to clean up."

Some employees said that they have received their salaries for November, but some local and overseas employees used the AAX platform and virtual currency to pay their wages and suffered heavy losses.

Ben Castlin (left) attended the Hong Kong FinTech Week as the vice president of AAX in early November.

After AAX collapsed, he publicly stated that he had resigned.

(AAX facebook)

Thousands of victims in Hong Kong and Taiwan are estimated to be involved in over 100 million

The vice president of the company, Ben Castlin, also said on Twitter that he had resigned, claiming that he had worked hard for the community, but none of them were accepted by the company. He also said that the current exchange no longer exists and brand trust has disappeared.

"Hong Kong 01" contacted a number of sufferers in Hong Kong and Taiwan, saying that AAX attracts the stable virtual currency "USDT" equivalent to the US dollar with high interest rates. The annual interest rate is as high as 80%, but it is currently unable to withdraw all assets.

There are more than 2,000 people in their group of online bitter hosts, many of whom said they lost tens of thousands to several million Hong Kong dollars, and their assets estimated to be over 100 million Hong Kong dollars were frozen.

The reporter sent a letter to AAX's official email to inquire about the incident, but the email was no longer able to receive emails.

The boss of AAX is Su Weiyi (SU Weiyi), whose English name is Victor. He has established companies in Hong Kong, Taiwan, Singapore and several offshore island countries, and rarely attends public events.

(provided by respondents)

The boss behind the scenes holds a Chinese passport and a Hong Kong ID card to set up companies in many places

The "Hong Kong 01" investigation found that AAX's equity is complex, and its senior management is related to other virtual currencies and cryptocurrency platforms in Hong Kong and Singapore, and even more involved in Hong Kong's securities companies.

The boss of AAX is Su Weiyi (SU Weiyi), whose English name is Victor. He was born in Fujian in 1985. He holds a Chinese passport and a Hong Kong ID card. He has opened many companies in Hong Kong, Taiwan, the mainland, Singapore and several offshore island countries.

Qumulate's office is empty and the doors are locked.

(Photographed by Hong Kong 01 reporter)

Hong Kong operates and recruits under the name of two different companies

AAX uses "AAX Limited" registered in Seychelles, an African island country, to sign transaction agreements with customers, while in Hong Kong, some businesses are registered in Hong Kong as "Atom International Technology Limited" (Atom International Technology Limited), "Qumulate Limited" Nominal recruitment and operation.

The sole shareholder and director of "Atom International Technology" is Su Weiyi, and Chen Zhenxiong is the former director; the director and shareholder of "Qumulate" is the former vice president of AAX, Ben Castlin.

The above-mentioned three companies are all working in AIA Plaza in North Point. The reporter saw signs of "Atom" and "Qumulate" on the scene, but the doors of the offices were locked and the buildings were empty. Employees of other companies on the same floor pointed out that after mid-November , You will no longer see employees going to work.

Atom company is only identified by a small logo, adjacent to Qumulate, and the gate is closed.

(Photographed by Hong Kong 01 reporter)

Ex-CEO of AAX Affiliated Company Resigned as Director of Another Trading Platform

"AAX Technology Limited" registered in Hong Kong, whose parent company is "Atom Holdings" registered in the Cayman Islands, Su Weiyi is a former shareholder and director, and the current director is CHAN Chun Hung.

Thor Chan, the former CEO of AAX, claimed to have resigned from all positions at AAX in mid-2021, but he is still serving as a director of AAX Technology. He said that he forgot to go through the resignation procedures.

(File photo/Photo by Ou Jiale)

Chen Zhenxiong, who often accepts interviews under the name "Thor Chan", is the founder and former CEO of AAX.

Chen still serves as a director of another virtual currency exchange in Hong Kong, "Hong Kong BGE Limited".

BGE is a subsidiary of the listed company "HKE Holdings" (1726). According to the HKE website, BGE "is developing a global financial technology platform that aims to provide a trading platform for multiple asset classes, especially virtual assets and stocks."

The executive director and chairman of HKE is Lian Haoman, the chief executive committee member and the chief chairman of the Kowloon Federation of Associations.

Chen Zhenxiong serves as a director of "Hong Kong BGE Limited", another virtual currency exchange in Hong Kong.

BGE is a subsidiary of the listed company "HKE Holdings" (1726).

(Photographed by Hong Kong 01 reporter)

Insist BGE has no ties to AAX: Forget to resign

When Chen Zhenxiong accepted the inquiry of "Hong Kong 01", he said that he had resigned from all positions in AAX more than a year ago, but due to formalities, he forgot to resign as a director of "AAX Technology", or forgot to dissolve the company. The company has no actual operation "At that time, I told the company (AAX) to resign as the director of all companies, and the others resigned. This company is still here, and now it has to be handed over to a lawyer. This company has not hired anyone, has no operating records, and has no transactions. "

Chen Zhenxiong emphasized that he was not aware of the collapse of AAX. BGE, who currently serves as a director, has no connection with AAX. BGE is applying for a virtual currency exchange regulatory license with the Securities Regulatory Commission, but it is inconvenient to disclose the progress of the application.

Liang Haoming, director, shareholder and CEO of Weigao Capital, emphasized that AAX has no connection with Weigao, but he admitted that Su Weiyi could no longer be contacted after AAX's accident.

(Photographed by Hong Kong 01 reporter)

The Big Boss as a director of a Hong Kong securities company lost contact or caused a break in the capital chain

Su Weiyi, the boss of AAX, also has "Vico Capital Limited" in Hong Kong. The company was originally named "Atom International Investment Limited". Su Weiyi is the largest shareholder and director.

Weigao Capital's business includes securities, private equity, asset management, etc., and it holds Type 1 (Securities Trading), Type 4 (Advising on Securities), and Type 9 (Asset Management) licenses issued by the Hong Kong Securities Regulatory Commission.

Liang Haoming, director, shareholder and CEO of Weigao Capital, told the reporter of "Hong Kong 01" that he was aware of the recent collapse of AAX and emphasized that AAX has nothing to do with Weigao. However, he admitted that after the accident at AAX, he could not contact Su Weiyi. Relying on their funds, and now they have lost contact, this place may not be able to continue to operate.” He also said that the incident put Weigao at risk of a squeeze. “This matter has a great impact on us. Some customers want to withdraw money and stocks. We've lost confidence in our company. Maybe we'll all face business difficulties."

AAX's chief strategy officer, Shi Leqi (Kiana), is one of the founders of the Singapore-based virtual currency exchange "Digifinex" and serves as a director of Digifinex's Hong Kong affiliate.

(online picture)

Another high-level executive is the founder of Singapore Digifinex and director of an affiliated company

The Chief Strategy Officer (Chief Strategy Officer) of AAX, Shi Leqi (SHEK Lok Kei), whose English name is Kiana, also holds an important position in the Singapore virtual currency exchange "Digifinex". Director of the company "DGFX HK Limited", whose parent company is "Digifinex Global Limited" registered in the Cayman Islands.

Digifinex issued a statement stating that it has no relationship with AAX. Shi Leqi has withdrawn from DigiFinex in early 2021 due to personal reasons.

Shi Leqi, the founder of Singapore-based virtual currency exchange Digifinex and director of an affiliated company, is a senior executive of AAX.

(Screenshot of Digifinex website)

SFC: AAX is not licensed

According to the Financial Services and the Treasury Bureau, AAX is not a virtual asset exchange licensed by the Securities and Futures Commission.

The SFC calls on investors to be aware that if these platforms have no connection with Hong Kong, the SFC may not have regulatory power over them.

AAX is not a virtual asset exchange licensed by the Securities Regulatory Commission.

(File photo/photo by Liang Pengwei)

01 Exclusive|FTX wants to return to Hong Kong subsidiary before the collapse and "share" high-level Hong Kong virtual currency exchange AAX with Genesis Block. It is reported that the collapsed user rights "self-help" wrote to the chief executive to expose virtual assets|Hong Kong declaration and national policy?

The mainland is going further ahead, and the digital Hong Kong dollar is expected to catch up with virtual assets|The currency circle is unstoppable. The road to virtual assets in Hong Kong is unimpeded. STO is a potential change for traditional finance. Virtual assets|Regulation is difficult and urgent. Zhang Xingzhou’s retail level is becoming conservative. Experts advocate a four-part Hong Kong business