The concept of inflation is associated with a process of continuous increase in all the prices of goods and services in an economy, and is generally explained by excess demand induced by irresponsible fiscal and monetary policies.

On occasions, the general level of prices can also rise due to supply problems associated with natural phenomena, salary conflicts or wars.

The "bubbles" are related to the evolution of asset prices and are usually the reflection of exaggerated expectations and irresponsible monetary policies, since the price of assets is always associated with the expectations of future profits discounted by the interest rate. interest.

It is very unusual for inflation and “bubble” phenomena to coincide, but in 2022 the world economy experienced the combination of the highest rate of inflation in decades with the largest “bubble” in asset prices in almost a century.

The last high inflation rates had been recorded in developed countries at the beginning of the 1980s -coinciding with the second oil crisis-, and at the beginning of the 1990s worldwide -coinciding with the breakup of the Soviet bloc- .

In the case of assets, the relationship between the net worth of families and the GDP of the United States remained stable for almost 50 years, with wealth 3.5 times higher than the GDP, but this relationship was broken with the rise in the technology stock prices in the late 1990s, and again in 2008 with rising real estate prices.

The current bubble raised that ratio to 6.15 (the highest since detailed records exist, but presumably not the highest ever) and was matched by similar bubbles in other countries.

Faced with this situation, the authorities in almost all countries were forced to take severe measures to lower inflation and to “deflate” the bubble (without saying so).

Historical experience shows that it is very difficult to achieve both objectives without falling into recession, because the measures that are implemented necessarily reduce global demand and because the falls in the prices of assets are reflected in capital losses that further reduce the expenses of the individuals.

The US decision to fight inflation in 1980 was reflected in a drop in its GDP that lasted almost three years, which slowed down the growth rate of the world economy and negatively affected the prices of raw materials.

For Argentina, it was the beginning of the "lost decade": The adjustment of the "technological bubble" at the beginning of the 21st century was also reflected in a slowdown in the growth rate of the world economy, accompanied by a fall in the prices of raw materials. and in a decline in the savings rate in the United States – something that had not happened in the early 1980s.

Argentina was once again negatively affected.

The bursting of the “housing bubble” in 2008 generated the first decline in global GDP since the Great Depression, with falls of more than 2% in developed countries, declines in savings rates larger than those observed in the early 2000s, and significant declines in the prices of raw materials.

The impact in Argentina was very significant, aggravated by a severe drought, with a year-on-year drop in GDP of more than 10% at the worst moment of the crisis.

The big question is what will happen now?

Will it be possible to achieve both objectives without the world economy entering a deep recession?

Although it is something very difficult to achieve, it is not impossible.

Many analysts argue that the world economy is already in recession and that the impact could be very severe in 2023, aggravated by the conflict in Ukraine and the crisis in the energy markets, and argue that the reversal of the "yield curve" (interest rates should normally be higher at longer terms, but sometimes the opposite is true) it is almost always accompanied by a recession.

The evidence shows that during 2022 the rate of GDP growth slowed down in almost all the countries after the post-Covid rebound, but it returned to levels just below those considered "normal", with some negative quarters associated with variations in inventories. .

The fact that in the midst of an almost unprecedented war and energy crisis, Europe has not entered a recession is surprising.

The IMF forecasts for 2023 show a slight slowdown in the growth rate of the world economy (from 3.2% to 2.7%) with greater declines in developed countries, but without falling into recession (from 2% to 0. 8%), at the same time that inflation is significantly lowered.

I personally believe that it is possible to avoid a recession but that it will be difficult to avoid negative growth rates being recorded in any quarter, particularly in developed countries.

To have avoided a recession so far with restrictive fiscal and monetary policies, in the middle of a war and with serious problems in the energy markets is almost a miracle.

In the Argentine case the situation is a little more complicated.

With normal mobility levels, after the drop due to the pandemic (the main explanatory factor for the 2020 recession and the "rebound" of 2021 and early 2022), with the most severe drought since 2008/2009, with small drops in raw material prices, and with a political rift that will worsen in an election year, it is very difficult to project a positive year even with the favorable outlook for the energy sector.

The data from the monthly indicator of economic activity clearly show this trend (three consecutive months of decline).

Our best hope in the short term is focused on the transition from “la niña” to “el niño” that could contribute to improve the next harvest, but none of this will work if we do not implement the structural reforms that our economy needs.

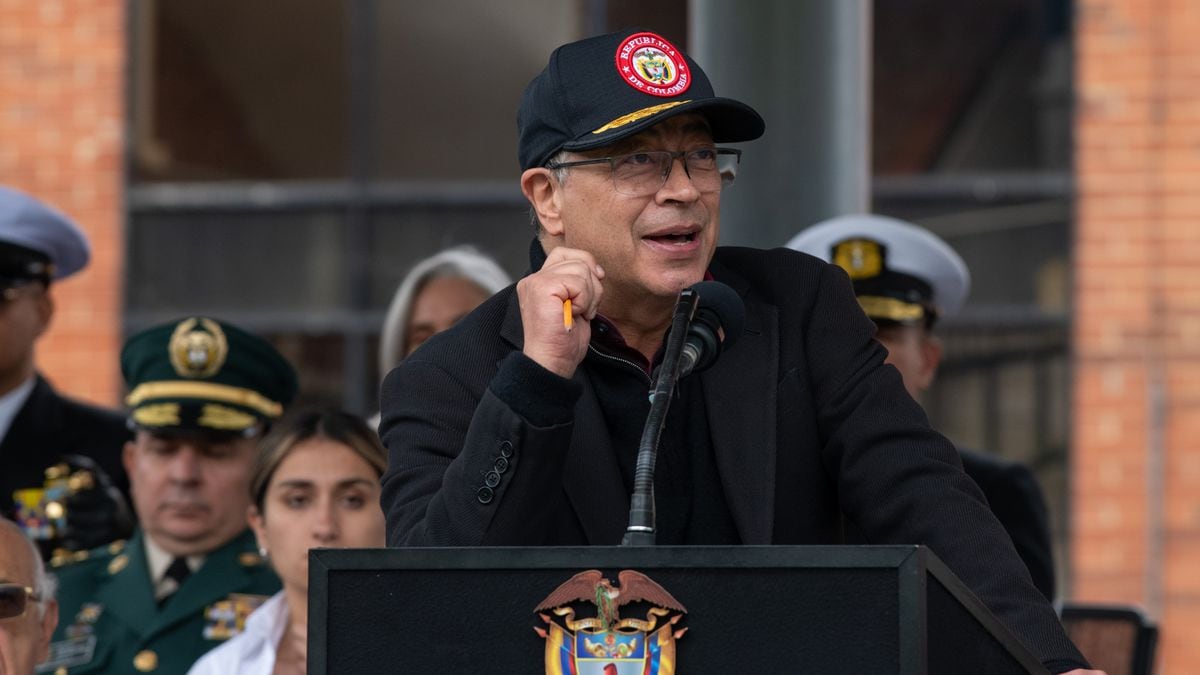

Ricardo H. Arriazu is an economist.