Manage the business correctly in a few simple steps (Photo: ShutterStock)

You opened a business, recruited employees, maybe even took a loan and you are investing everything you have to make your dream come true and bring the business to prosperity.

But something is not working.

You don't see the profits, you don't see an increase in income, and in general the words "accounting" sound like foreign words.

Proper financial management is essential to the success of any business.

It involves planning, controlling and monitoring the financial resources of the company to ensure that it operates efficiently.

It just sounds complicated.

In fact, there are some small but very significant steps in which you can lead your business to financial efficiency, which means profits and success.

CPA Roi Karta from the office of CPA Karta & Co., which accompanies companies and small businesses with financial and business advice, explains how in a few simple steps you can manage your business correctly.

Financial strategy

- every business needs an action plan, which will determine how you will measure the performance level of the business, how the findings should be analyzed and what action plans should be issued.

"The business forecast of the business," says CPA Carta, "is actually our WAZE."

If we do not specify the destination in the application, we will not reach it.

It is important to establish a plan for six months to a year ahead, goals for money and actions.

If you meet the goals, you will jumpstart your business, even if you did not stick to it 100 percent."

Cash flow

- Cash flow is actually the management of the money that comes in and out of your business. It is important to take care of the cash flow of the business to ensure that there is enough money to cover expenses and invest in new opportunities.

"Once you follow the money that comes in and goes out," says CPA Karta, "you will be able to understand the nature of the company's activity in relation to the movement of funds, plan the foreseeable future in the best possible way and also make decisions accordingly."

- A budget is a financial plan that describes how much money the business will earn and how it will be invested.

Preparing a budget helps to identify times when various actions are required ahead of time, such as holidays, as well as to examine the impact of various actions on the business activity, such as a marketing campaign or the purchase of a machine.

The preparation of the budget will actually help the business owner to control his activity and advance him to financial success.

When there is a budget and control over it, the business owner knows his business better, has his finger on the pulse and can make better decisions.

Tax assessment

- it is recommended to ask the accountant of the business to perform, at least once a year, a tax assessment.

This is actually a "mini report" for examining the results of the business from the point of view of the income tax and examining the total advances paid to the income tax. The tax assessment may save you an unnecessary headache when submitting the annual report to the tax authorities, and you will also make sure that you are not accumulating unnecessary debt for the business, which will meet with you further down the road.

Balance point in the business

- This is the point where the total income covers the total expenses, i.e. the point where the business neither makes a profit nor loses, and starting from that every shekel the business brings in will lead it to profit.

It is important to be proactive when it comes to financial management and make adjustments as needed to stay on top of things.

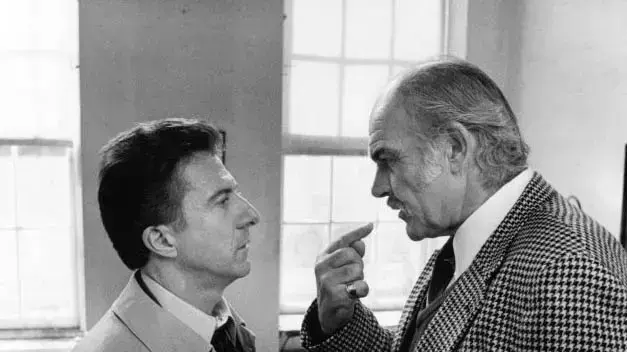

Roy Karta (Photo: Public Relations)

Why is it important to find the balance point?

According to CPA Karta, this is a critical indicator of the business owner in his financial view. "Every business," says CPA Karta, "can have three stages: the stage where it loses, meaning that the owner of the company has to transfer money from 'home' and this is also the case where he may find himself in debt. In the second situation, the business neither loses nor profits, that is, the business is at its break-even point. The third stage is of course the optimal one, where the business starts to make a profit. The break-even point presents you with a view of the state of the business and helps formulate the strategy for the rest of the way And therefore its importance. This is the red line that cannot be crossed, because then the business becomes unprofitable."

accompaniment and support

- Every business, and it doesn't matter what its field, also includes within it a variety of actions that are not directly related to the business itself but are a necessity.

Among other things, employee management, salaries, accounting, sales and more.

The business owner cannot focus exclusively on his business area, but is the one who is actually responsible for the rest of the administration related to it.

The business owner does not always understand the financial field and is not always able to deal with the development, promotion and management of his business as well as with its economic aspect.

"The business owner," explains CPA Karta, "must identify the weak points of his business, recognize them, strengthen them and turn them into strengths.

Accompanying and supporting in the financial field may be the thing that separates the failure of the business from its success, especially when it comes to someone who does not come from the financial world."

Although guidance and support in the financial field is an additional expense of the business, it is a worthwhile expense, one that will both save the business owner money and also prevent him from making mistakes that will cost him dearly later, such as in matters of taxes or employee rights.

At the same time, it is extremely important to carefully check who the consultant from whom the service is provided is in order to make sure that you will receive honest, decent and professional advice.

"Especially in the field of finance," CPA Karta clarifies, "the business owner needs to know what the result will be, where exactly he is going and not be satisfied with slogans that could blind his eyes.

It must examine what the required actions are, how long each action is expected to take and where it will end up."

By following these steps you can create a solid financial foundation for your business and ensure that it operates efficiently and effectively. It is important to be proactive when it comes to financial management and make adjustments as necessary to stay in your financial affairs.

Karta & Co. CPA office provides accounting services, accounts and financial management, consulting and saving and accompanying businesses for financial success. To contact us and for more details contact here or

by

phone

- 03-5488888

The article is courtesy of Zap Legal

The information presented in the article does not constitute legal advice or a substitute for it and is not constitutes a recommendation for taking procedures or avoiding procedures. Anyone who relies on the information appearing in the article does so at their own risk

In collaboration with legal zap

Sentence

additional subjects

Tags

Business

Accounting