More and more Argentines find

opportunities abroad

working remotely and decide to export their services to generate income in dollars.

However, a big obstacle for freelancers involves the settlement of salaries and the receipt of foreign currency.

In Argentina, the bank pesifies the income at an exchange rate that does not follow the

blue dollar

, so the employee loses a certain amount of money.

In this context, many in the country consider the possibility of

opening an account in dollars in the United States

, but it is an operation that through traditional American entities is practically impossible.

The

GrabrFi platform

emerges as an alternative by offering the possibility of

shielding savings in dollars

in a foreign account, far from the uncertainties and risks of the local economy.

Many Argentines who work abroad are considering the possibility of opening an account in dollars in the US. Photo: EFE

How does the app that allows you to open an account in the US work virtually and free of charge?

This is the

fintech GrabrFi

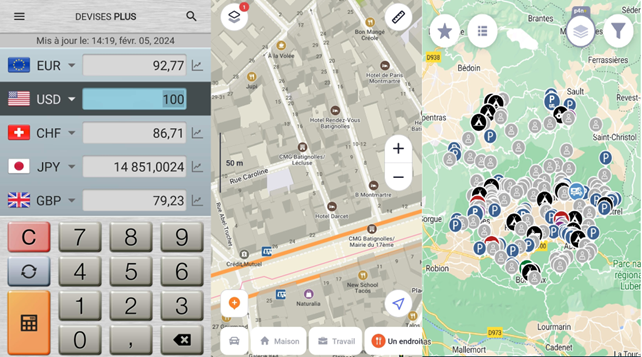

, an application that allows you to open an account in US dollars,

totally free

,

100% virtual

, and with no monthly maintenance cost, available for

web, iOS and Android versions

.

It allows

you to receive, transfer and save dollars

, without having to worry about currency fluctuations, excessive fees or bank bureaucracy.

This innovative fintech belongs to Grabr's new line of business, the app that allows you to buy abroad and receive these products in our country from the hand of a traveler, who has been in the Argentine market for more than 8 years with a growing community bigger and more consolidated.

"It is safe and is already available not only in Argentina but also in Chile, Brazil, Canada, Colombia, France, Germany, Italy, Mexico, Portugal, Spain, England, the US and Vietnam," said Daria Rebenok, CMO

and

Co- Founder of Grabr and GrabrFi, who also detailed that the money,

up to $250,000

, is protected by the US government and US banking partner, Member FDIC Lineage Bank.

GrabrFi also provides its users with a Mastercard debit card in dollars.

Photo: File

GrabrFi also provides its users with a

Mastercard debit card in dollars

with which they can

buy air tickets

,

book hotels

, or

buy food or products

, without worrying about currency exchange rates or taxes.

It can also be used to pay for

services and subscriptions

in dollars, and add the card to Google Pay or Apple Pay.

Meanwhile, with the account offered by the app,

Argentine

freelancers and freelancers who

work abroad

can

collect fees and receive payments from

international companies and clients without losing money due to taxes, commissions and exchange rates.

They can also take advantage of and

connect their Grabrfi card and account as a means of payment on other platforms

.

The fintech, which has a

24-hour assistance service

and is also aimed at those who want to save without restrictions in the most stable currency in the world and protected by the FDIC (Federal Deposit Insurance Corporation). Deposit Insurance) .

So that money does not lose value in this inflationary situation, the platform allows you

to keep your income in dollars or transfer it back to Argentina

as long as the exchange rate is in favor of the user.

LN

look also

Safe deposit boxes: how much does it cost to rent one and how many dollars go into it

How to apply for Italian citizenship if a relative already has it: what are the requirements

Italian citizenship: 5 alternatives to find out from Argentina where your great-grandfather was born

Italian citizenship: what is the key document to obtain it and that many are unaware of

The 6 most common cyberattacks and 10 tips to protect your personal data