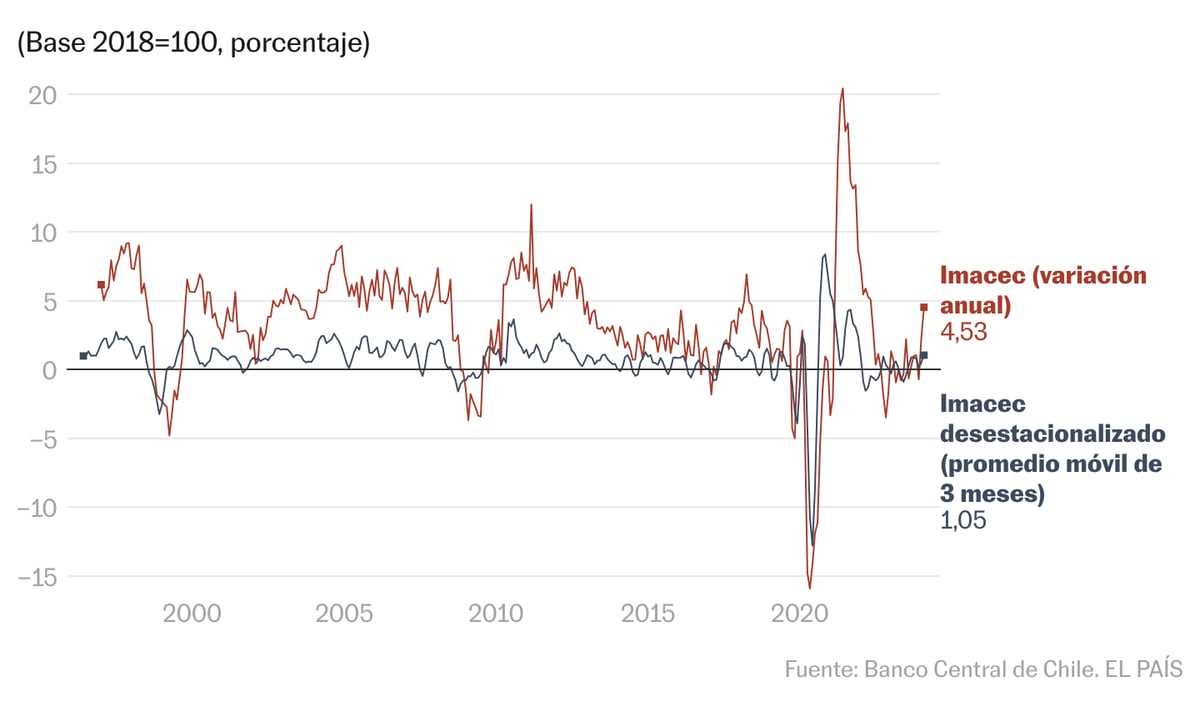

It is not proving easy for the Chilean economy to resume the path of growth, stagnant a decade ago.

This was evidenced after the Central Bank released on Tuesday the latest Monthly Indicator of Economic Activity (Imacec), corresponding to the month of March, which registered a 2.1% drop compared to the same month of the previous year. .

The drop was greater than expected by the market, which was betting on a fall range between 1.3% and 1.7%.

With this, the economy of the South American country accumulates a decline of 0.9% in the first quarter of 2023.

Following this result, some analysts interpreted that Chile had entered a technical recession – a phenomenon that occurs when two consecutive quarters show negative figures – because between October and December 2022 activity contracted by 2.3%.

According to Gabriel Ugarte, a researcher at the Centro de Estudios Públicos (CEP), if there was a feeling that economic activity had been slowing down at a slower pace than expected, the March figure indicates that the slowdown rate will remain at 2023. Faced with this scenario, "there will be greater pressure on the Central Bank to decide when is the optimal time to start the normalization of monetary policy," the economist explained to EL PAÍS.

Ugarte also suggests that the March Imacec is related to the performance shown by the labor market.

Last week, the Chilean National Statistics Institute (INE) announced the fifth consecutive rise in the unemployment rate, which stood at 8.8% during the January-March quarter.

"The labor market was already giving signals that gave an account of what was coming and showed that deep down it is not in normal figures," says the researcher from the CEP, a liberal think tank.

Along the same lines, a report from the investment bank with Chilean capital, Bice Inversiones, stated that the negative surprise in activity could change the outlook on the evolution of the economy.

"At their last meeting, the authorities of the Central Bank of Chile mentioned that the economy was showing greater resilience, so inflation would take longer to decrease," the letter states.

According to the report from the bank's analysis department, if these negative surprises continue, inflation could drop faster, so the Central Bank's reference rate would also be cut sooner than expected.

Currently, the governing interest rate of the economy in Chile stands at 11.25%.

Treasury's explanations

The decline of the Chilean economy in March had already been anticipated by the market, mainly due to the drop in mining activity (8.5%).

According to the National Mining Society (Sonami), this setback was related to lower copper production during that month –which represents 90% of the mining Gross Domestic Product– due to the drop in ore grades and technical problems in some chores.

In fact, the non-mining Imacec presented a decrease of 1.0% in 12 months, while, in seasonally adjusted terms (elimination of the seasonal component) it grew 0.2% compared to the previous month.

Commerce was another of the activities that showed a decrease during March with a drop of 5.4%, due to lower sales in supermarkets, large stores and establishments specialized in clothing and footwear.

The seasonally adjusted figures showed a contraction of 1.8% compared to the previous month.

Meanwhile, the services sector experienced a rebound of 0.9%.

But the Chilean Finance Minister, Mario Marcel, flatly ruled out that the country is going through a technical recession and defended the positive trend that, according to him, the Chilean economy has had since the end of last year.

The first authority of the economic area of the Government of Gabriel Boric, explained: “When one thinks how to take the temperature of the economy, if it is measured with variations with respect to 12 months ago, it is also incorporating what happened a year ago.

But it turns out that a year ago the economy was in a downward inflection.

And today, the economy is in an upward inflection.”

The economist close to the Socialist Party said, instead, that the correct thing to evaluate a technical recession is to look at the behavior month by month and not 12 months.

“The monthly figure compared to the previous month, the month of February, has a much smaller drop (-0.1%).

On the other hand, when you take away mining, which is the factor that contributed the most negatively, with a decline of 8.5%, it becomes a positive figure, ”he said in an interview with ADN radio.

Marcel added that the drop in activity was much less if the January-March quarter is compared with that of the previous quarter.

“A technical recession, which is defined as two consecutive quarters of decreased activity compared to the previous quarter, is not happening now in Chile.

Now we have the opposite situation.

The economy quarter by quarter is recovering, ”he said.

Meanwhile, from Banco Santander they warned about the structural effects that the drop in mining activity could be causing in the activity and in the recovery of the country: "The contraction of the economy is due not only to the economic cycle, but is also affected by more structural as in the case of mining, given the drop in the mineral grade and the lack of investment”.

This Tuesday, Codelco, the Chilean state copper giant, reported that its surpluses plummeted 72.5% as of March and amounted to only 418 million dollars, compared to 1,521 million dollars in the same period of 2022. The cause of the The resounding fall was due to a delay in structural projects (21%), while 79% was explained by operational difficulties, among which a lower grade in the deposits where the firm operates stands out.

/cloudfront-eu-central-1.images.arcpublishing.com/prisa/DE4CZ7OOFNESLJIBI67TD7E3TQ.jpg)

/cloudfront-eu-central-1.images.arcpublishing.com/prisa/KMEYMJKESBAZBE4MRBAM4TGHIQ.jpg)