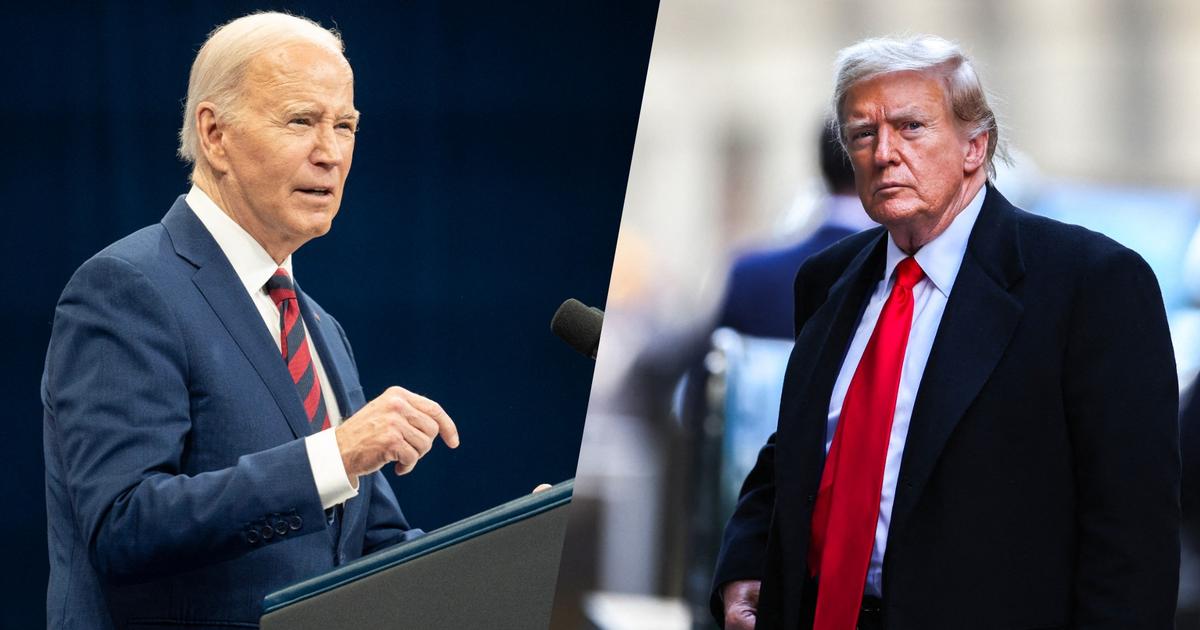

Prof. Oliver Holtemöller is Deputy President of the Halle Institute for Economic Research (IWH). © Imago/Litzka © Michael Kappeler

The latest data on German economic growth in the first quarter have caused quite a stir. At the beginning of the year, gross domestic product shrank for the second quarter in a row. With two negative quarters in a row, economists speak of a technical recession. However, the IWH's head of economic affairs, Prof. Oliver Holtemöller, urges restraint in evaluating the data - because of the often comprehensive corrections.

Halle (Saale) – At the end of April, the Federal Statistical Office presented the preliminary flash estimate for gross domestic product (GDP) in the first quarter of 2023. Thereafter, the growth rate amounted to 0.046 percent (rounded 0.0 percent) after -0.537 percent in the fourth quarter of 2022. With the publication of the detailed results for the first quarter, the rate has now been significantly revised to -0.335 percent.

A common definition is that a recession occurs when price-, seasonally and calendar-adjusted gross domestic product has declined for two consecutive quarters. According to current data, this would therefore be the case in the winter half of 2022/2023.

Voice of economists

Climate change, the coronavirus pandemic, the war in Ukraine: Rarely before has interest in economics been as great as it is now. This applies to current news, but also to very fundamental questions: How do the billions in coronavirus aid and the debt brake fit together? What can we do about the climate crisis without jeopardizing our competitiveness? How do we secure our pension? And how do we generate the prosperity of tomorrow?

In our Voice of the Economists series, Germany's leading economists provide guest articles on assessments, insights and study results on the most important topics in the economy - profoundly, competently and opinionated.

Recession data may change retrospectively

In real time, however, we do not know for sure whether economic output has fallen or risen in the past two quarters. As a rule, the calculation of the quarterly gross domestic product is updated by the Federal Statistical Office until the summer revision four years after the reporting year, because additional statistical information is received by then. This regularly leads to more or less large corrections.

According to data from the Deutsche Bundesbank's real-time database, which starts with the May 2005 publication date, the average absolute revision (neglecting the sign) of the flash estimate for the quarterly rate of change is 0.26 percentage points, and the standard deviation of the revisions is 0.35 percentage points. The current revision of just under 0.4 percentage points for the first quarter is therefore not clearly out of the ordinary.

This also means that with a current estimate of -0.3 percent, an actual positive rate can by no means be statistically ruled out; and even the current report of a decline of half a percent in the fourth quarter of 2022 offers no certainty that the final value will actually be negative. For example, there was a change in the revision for the first quarter of 2018: the flash estimate was +0.3 percent, now the official statistics are -0.6 percent.

The 95 percent "forecast" interval for the growth rate of price-adjusted gross domestic product (current estimate plus or minus two standard deviations based on previous revisions) in the fourth quarter of 2022 ranges from -1.1 percent to +0.1 percent and for the first quarter of 2023 from -1.0 percent to +0.4 percent. Both intervals therefore contain positive and negative values. So we simply don't know for sure whether or not we've just had two consecutive quarters of negative GDP rates.

Economic policy should not be based on flash GDP estimates

The statistical uncertainty raises doubts about the usefulness of the question of a current recession. In any case, the GDP flash estimate is only of limited use as a yardstick for current economic policy. In addition, according to estimates by the Joint Economic Forecast, the potential growth rate of the German economy (the growth rate at normal capacity utilization) will decline from an annual average of 1.3 percent in the period 1996 to 2022 to 0.7 percent in the years 2022 to 2027, partly due to the declining volume of work. Quarterly rates will also fall – from an average of just over 0.3 percent to just under 0.2 percent in the future – so that the first flash estimates will be around zero more often in the border region.

For me, this leads to two conclusions: firstly, economic policy should not be too much based on the first flash estimate of gross domestic product. It is more important to keep an eye on the major structural phenomena such as demography, decarbonisation and digitalisation.

Secondly, it would be useful to improve the reliability of the flash estimates. This is not a criticism of the methodological work of the statistical institutes. Rather, we need more and, above all, more up-to-date data for a more reliable economic assessment in real time. But even if it were possible to increase the accuracy of the flash estimate, it is not particularly relevant whether the growth rate of gross domestic product is just below or just above zero in the short term. Theoretically, the comparison with the potential growth rate is more meaningful, so that one can assess the change in the degree of utilization of the economy. However, the real-time potential growth rate is even more difficult to estimate than the actual rate.

About the author: Prof. Dr. Oliver Holtemöller is Deputy President of the Halle Institute for Economic Research (IWH) and Professor of Economics, esp. Macroeconomics at the Martin Luther University Halle-Wittenberg.