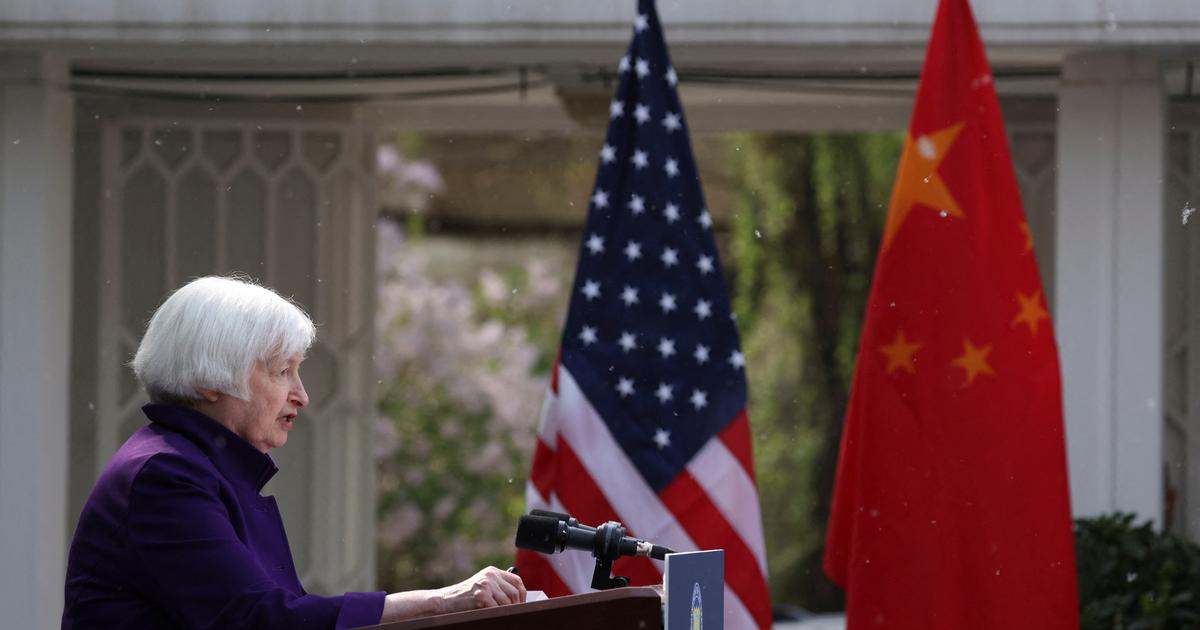

U.S. Treasury Secretary Janet Yellen warns of a government default. © Manuel Balce Ceneta/AP/dpa

Again and again, there is talk of progress in the US debt dispute. However, no one has yet presented a solution. Now Treasury Secretary Yellen is speaking out - with a new warning.

Washington - U.S. Treasury Secretary Janet Yellen has increased her pressure in the U.S. debt dispute and updated her forecast for the impending default. Based on the latest available data, she now estimates that her department would run out of funds if Congress did not raise or suspend the debt ceiling by June 5, Yellen wrote to the Republican leader of the U.S. House of Representatives on Friday. Earlier, Yellen had warned of a possible government default in early June - possibly as early as June 1. She now mentions the new date with greater certainty. US President Joe Biden said on Friday evening (local time) that an agreement was within reach.

For weeks, Biden's Democrats and the Republicans have been arguing in tough rounds of negotiations about raising the debt ceiling. The new date now gives the two negotiating parties a brief respite. But it could also just drag out the dispute further. Yellen made it clear that the situation was serious and that the treasury was all but empty. The debt ceiling is currently $31.4 trillion. This cap has already been reached for months, and the US can only stay afloat with fiscal tricks - called "extraordinary measures" in technical jargon. Yellen said that if the U.S. waited until the last minute to raise the cap, there could already be serious consequences.

Default could trigger global financial crisis

As early as 2011, a Republican majority in the U.S. House of Representatives delayed raising the debt ceiling for so long that the U.S. credit rating was downgraded for the only time in history. At that time, the rating agency Standard & Poor's cancelled the top rating of "AAA" and since then has only rated the USA "AA+" - i.e. one grade worse. The rating agency Fitch also threatened this week with a possible downgrade of the top credit rating. It is believed that the risk has increased that the debt ceiling will not be raised in time and that the US government will no longer meet its payment obligations, it said.

In the United States, parliament decides the maximum amount of money the state can borrow. In the US, this repeatedly leads to a dispute over raising the upper limit if the ruling party does not have a majority in both chambers of Congress. An unprecedented default by the U.S. government could lead to a global financial and economic crisis. In the US, economists and labor market experts fear that millions of people could lose their jobs as a result.

Clear criticism from IMF chief Georgieva

The Republicans emphasized again on Friday that there was progress in the talks with the Democrats. However, they also made it clear that there are always new points of contention that delay an agreement. Biden, on the other hand, was optimistic and said he hoped to know in a few hours if there was an agreement. The Republicans, with their majority in the U.S. House of Representatives, want to use the negotiations to slash spending on certain social programs. They are also calling for recipients of certain benefits to be obliged to work. The Democrats oppose this, arguing that this would hit the weakest in society even harder.

The head of the International Monetary Fund, Kristalina Georgieva, also criticized the United States on Friday. The stability of the global financial system is at stake, she warned. It is "frustrating" that an agreement to raise the debt ceiling is waited until the last minute. It was just before twelve, she said. Dpa