Residential property tax collection rates in Arab neighborhoods in East Jerusalem, where the level of services and infrastructure is poor, are significantly lower than those in the capital's Jewish neighborhoods, according to the latest statistical yearbook of Jerusalem, published by the Jerusalem Institute for Policy Research. The data were analyzed by council member Yosef Speiser, who even approached Interior Minister Moshe Arbel on this matter.

Against the background of the religious and national struggle in the capital, the data show that in 2022, the average collection rate of residential property taxes in 37 Jewish neighborhoods was 91.5% (about 600,19 people live in these areas), while the average residential property tax collection rate in 400 Arab neighborhoods, which currently house about 71,3 people, was only <>.<>%.

Yosef Speiser, Photo: Oren Ben Hakon

Hundreds of thousands don't pay

This means that in Jewish neighborhoods, the share of non-payers out of all residential property tax debtors stands at 8.5%, while in Arab neighborhoods the rate of non-payers is 28.7%. In the Jewish neighborhoods, there are about 180,64 apartments, while in the Arab neighborhoods there are about <>,<> apartments.

A particularly low rate of collection by residential property taxpayers in East Jerusalem was recorded in the Shu'fat refugee camp, beyond the security fence, where there is great neglect in many areas. Only 23% of its residents pay municipal taxes, and in Isawiya, near Mount Scopus, only 66%.

A particularly high collection rate in East Jerusalem, of 82%, was recorded only in one place – Beit Safafa, which until 1967 was divided between Jordan and Israel.

As mentioned, in Jewish neighborhoods the rate of those paying is many times higher. For example, in Pisgat Ze'ev, 96% of debtors pay municipal taxes, in Neve Yaakov – 94%, in Gilo – 95%, and in Har Homa – about 96%. In Haredi neighborhoods, the collection rate is slightly lower, but even there it is higher than in East Jerusalem: Har Nof - 93%, Bayit Vagan - 92%, Ramat Shlomo - 88%, Sanhedria - 87%, and Geula Mea Shearim - 81%.

"Abandonment of governance"

Council member Speiser notes in his letter to Interior Minister Moshe Arbel that the municipality finds it difficult to collect tens of millions of shekels from residents of East Jerusalem, without taking into account illegal construction on a very large scale, for which municipal taxes are also not collected.

According to Speiser, "Beyond the matter of principle and the abandonment of governance in the city, the tens of millions will enable the municipality to improve the infrastructure for the city's residents and act to provide good and efficient service for all residents." Speiser asks the interior minister to "get in the thick of it."

In response, the Jerusalem Municipality said that it "collects municipal taxes equally from all residents of the city. Enforcement procedures for debtors include the imposition of foreclosures and lawsuits, in a uniform manner for all residents and businesses. The total collection in East Jerusalem for 2022," says the municipality in its response, "amounted to NIS 320 million, and the lion's share of residents pay municipal taxes." The municipality further notes that "as in every city, there are areas where municipal tax collection is more complex and requires additional enforcement procedures. As a result, the current collection rates in these areas are lower."

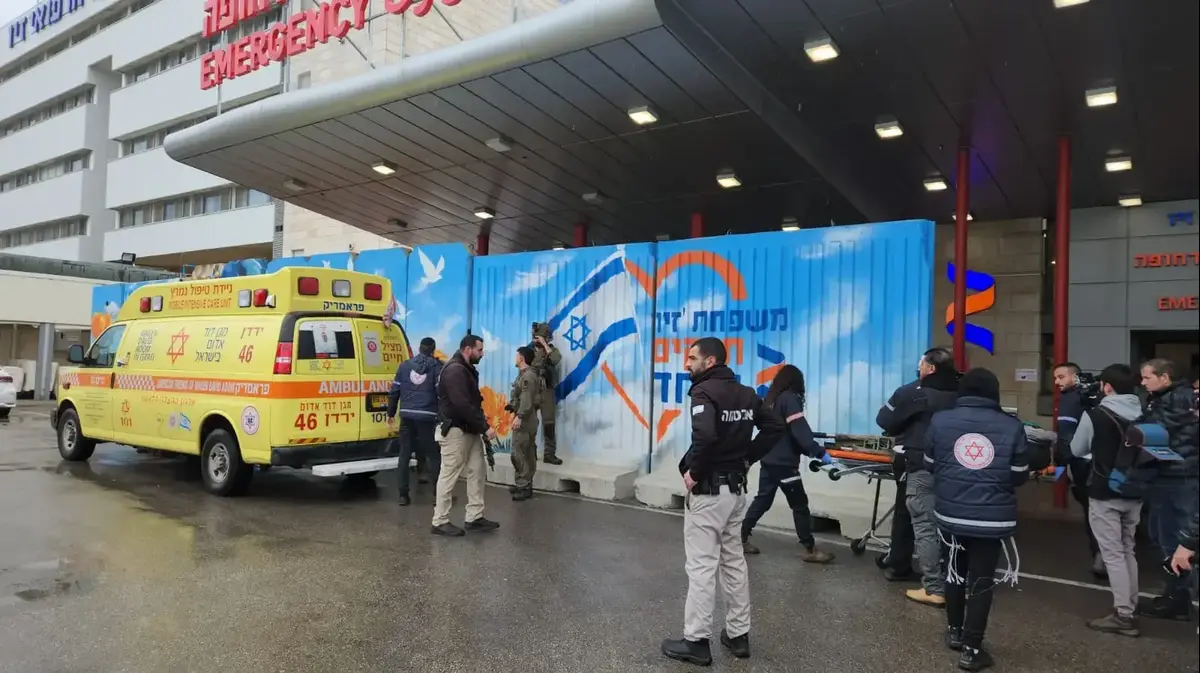

Shuafat Refugee Camp (archive), photo: Oren Ben Hakon

It should be noted that alongside high rates of illegal construction in East Jerusalem, for which it is unclear whether municipal taxes are collected, the gaps in the level of services and infrastructure between the Jewish and Arab neighborhoods are particularly large, sometimes gaps of thousands of percent, in elementary areas such as lighting, roads, sidewalks, public parks, classrooms or garbage disposal. In recent years, the government has indeed increased budgets for East Jerusalem as part of five-year plans, and billions of shekels are allocated there in an attempt to close the gaps, but these are still very deep.

Wrong? We'll fix it! If you find a mistake in the article, please share with us