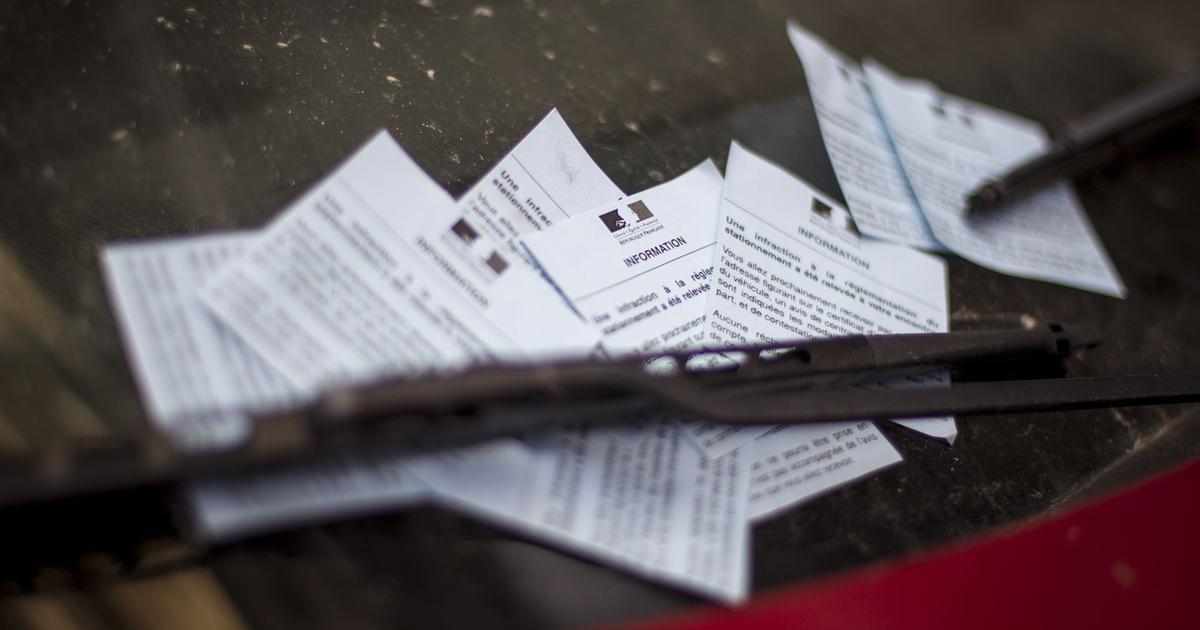

Since January 1, 2018, the reform of paid parking has come into force, and the criminal fine for unpaid parking has given way to the post-parking fee (FPS), the amount of which is set by the community concerned.

This decriminalization of parking has at least one beneficial effect for users: it is tax deductible.

Indeed, be aware that for individuals, having opted for actual expenses as part of their taxation (by waiving the 10% flat-rate deduction), as for all professionals, using a vehicle, the costs incurred in a professional capacity are tax and accounting deductible.

This parking fee is counted as a parking cost.

This charge is therefore tax deductible as long as it is justified (FPS payment notice) and the expense is incurred for the purposes of the economic activity in the fraction relating to the mileage traveled professionally.

You must therefore have all proof of expenses relating to the professional use of the vehicle.

These parking costs are also added to the limitations of the mileage scale published each year by the administration, provided that the portion corresponding to private use is deducted and that the necessary justification can be provided.