Colombia's export activity sinks more than expected in the regional ranking.

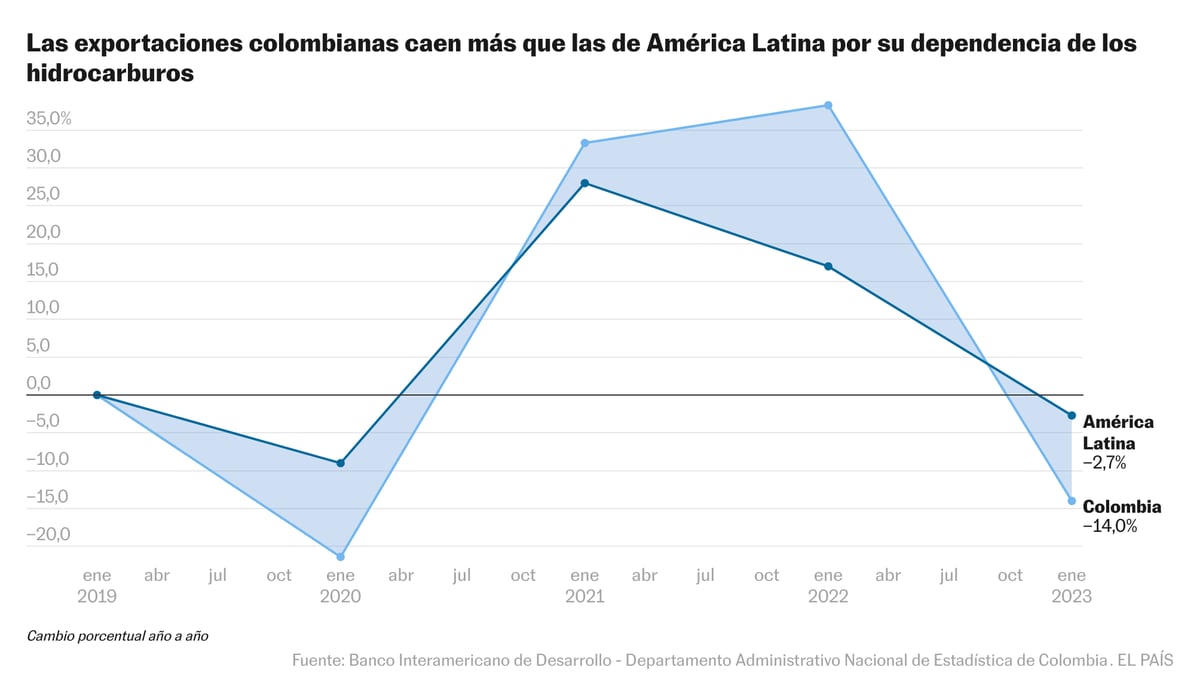

While the country's foreign trade experienced a drop of 13% in 2023, according to DANE figures, Latin America and the Caribbean had an average drop of 2.2%, according to IDB data.

More than ten percentage points of difference that serve as a clear portrait of one of the most critical periods in recent decades for a vital piece of the economy.

This is a problem linked, at one point or another, with excessive dependence on international hydrocarbon prices.

Of crude oil, but also of coal, engines of the economy during the first decade of the millennium, today in question due to its volatility as a business and environmental impact.

There are more and more voices warning about the risks of continuing to rely on raw materials and the fluctuations in their prices as the only great argument to promote trade exchanges with the rest of the world.

The total dollar value of the collapse during 2023 was 7,400 million, of which 3,000 million correspond to the fall of coal in a context of readjustment of global energy prices.

In recent years, Colombia exported 4 billion dollars, but year after year some symptoms of contraction began to appear, attributed in part to progress in the implementation of climate change agreements.

Demand for coal in European markets and other developed countries, for example, is increasingly residual.

And other partners such as Türkiye, Israel or India today seem to be moving away.

Both face complex geopolitical obstacles.

Joaquín Montes, a foreign trade expert, highlights that during 2021 and 2022 the country managed to take advantage of Chinese trade retaliations against Australia.

“The Chinese imposed technical measures to prevent Australian imports due to their insistence on investigating the origin of Covid.

Colombia managed to take advantage of this front and in 2022 exported 12 million dollars.

But in February 2023, China decided to import Australian coal again and the mini coal bonanza ended,” Montes emphasizes.

In the case of the oil market the story has been different.

The determining factor has always been the roulette wheel of the minimum international price per barrel.

Colombia has suffered it for better and worse.

Last year, oil exports also contracted by $3 billion, as in the case of coal.

Ecopetrol, the state-owned oil company, has preferred to highlight as a lifeline that the annual volume of exports increased by 3% during the last year.

But fluctuations in the price of crude oil overshadowed the results.

Sergio Olarte, chief economist at ScotiaBank Colpatria, details: “Export cycles are more pronounced because we depend on the international price.

This is complicated because it prevents deepening exports or making long-term plans.”

In Olarte's opinion, the country is still “quite closed” in terms of foreign trade.

The former Minister of Commerce and rector of the EIA University, José Manuel Restrepo, recalls for his part that although the “international reality is complex and challenging”, the problem is also linked to the “profound deterioration of private investment in Colombia in recent years.” 12 months with a reduction of -33% in the third quarter of 2023.”

Restrepo argues that the above affects the “import of capital goods and intermediate goods” necessary for the production and export process.

In his opinion, government announcements about the suspension of oil and gas exploration contracts only result in low expectations of the private sector.

Javier Díaz, president of the National Foreign Trade Association (ANALDEX), adds that the slowdown in the economy between 2022 and 2023 also impacted a good part of the exports of agricultural products such as bananas or coffee.

In fact, the drop in exports of bags of coffee added an additional 1,000 million to the 7,400 million in the total collapse.

A behavior attributed by Joaquín Montes to two factors that seem transversal in this story: the decline in international grain prices and the effects of the climate crisis on crops.

“There is also a supply problem.

Colombia is not able to produce all the coffee that the world demands.

In addition, we are importing to supply domestic consumption, which seems to be undersupplied.”

The labyrinth of exports is now celebrating 12 months of online decline, and Colombia has only avoided a greater impact thanks to the increase in remittances.

It has been of little use that the US economy, Colombia's largest commercial economy, has improved its performance.

For now, José Manuel Restrepo believes that the strategy and promotion of agreements, as well as the commercial and health diplomacy of the Petro Government is very weak.

A factor that gives rise to remembering that not only prices have fallen but also the volume of exports.

In other lines such as oils, sugar, flowers or food, Joaquín Montes shows some stability that could be sustained in the long term after these years in which they experienced a slight recent decline: “The industry, for now, is doing well. .

Solid and stable growth stands out in the pharmaceutical, electrical machinery and cosmetics sectors.”

And Javier Díaz concludes: “Colombia is a small economy that depends on international dynamics, and since we are so concentrated on the export of mining and energy products, a big difference is generated in the dynamics with the rest of the countries in the region that take better advantage of the international scene.”

Subscribe here

to the EL PAÍS newsletter about Colombia and

here to the WhatsApp channel

, and receive all the key information on current events in the country.

Subscribe to continue reading

Read without limits

Keep reading

I am already a subscriber

_