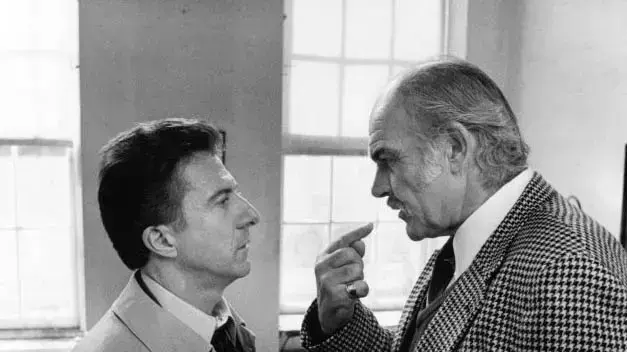

In the video: on the importance of drawing up agreements in a family business/studio and voila!

Family firms play a central role in the global economy - a role that is often not talked about or appreciated.

Family firms account for more than 70 percent of global GDP, generate a turnover of between $60 trillion and $70 trillion annually, are responsible for approximately 60 percent of global employment, and play a critical role in supporting education, health care, and infrastructure development in their communities around the world.

McKinsey's latest research confirms the adaptability, resilience, resilience and impact of family firms: these businesses have the structures and best practices required to meet business challenges in unstable times. And, in general, they show stronger performance than non-family-owned businesses.

Over the years, It is a well-known fact in the business community that family companies provide higher total shareholder returns (TSR) than other companies, but the main reasons for higher performance have been less known until now. The study provides a proven and well-analysed formula that details the factors behind the success of family companies over the years, in a way that can be learned and applied.

The research examined 600 public family companies, 600 public companies that are not family owned. In addition, in-depth interviews were conducted with 20 senior managers from among the most successful family companies in the world.

The research proves how family companies have a significant competitive advantage in almost every parameter examined, Over the years, even during times of crisis such as the credit crisis in 2008 and the Corona crisis.

And this, even though family companies face, in addition to the general market fluctuations, unique challenges for them - more on that in another article.

The researchers examined the characteristics common to all family companies, and specifically the characteristics common to the high performers, those that allow them to achieve and maintain a competitive advantage.

The researchers characterize a formula consisting of 4 patterns of thinking and 5 ways of acting.

The four mindsets common to the most successful family companies in the world:

Hagit Ibn Tzur./Official website, SMC Group

1. Commitment to a higher purpose than making profits

The study shows that 93 percent of respondents from the top performing family firms believe their company has a clear purpose beyond creating shareholder value.

This sense of purpose can take many forms.

This can be inwardly focused on building the company's legacy for example, or by maintaining a strong reputation, protecting the brand image, or fostering a strong corporate culture.

It can be outward-facing, focused on maximizing value for customers, or creating a positive impact in their communities.

In family companies, are willing to invest the time and resources necessary to bring this goal to fruition.

2. Long-term vision

Leaders of high-performing family firms cite their long-term perspective as one of the top three reasons for their success.

They ruthlessly optimize business processes for the longevity and resilience of the organization, even if it comes at the expense of short-term performance.

3. Financial conservatism

In general, family companies tend to be financially cautious, with low leverage ratios.

Family companies often prefer to invest their money in marketing, sales, production and more, and invest less in high-risk areas such as research and development.

Family-owned businesses on average distribute lower dividends than non-family-owned businesses.

The study found that family firms, in general, tend to reinvest in the business instead of extracting as much as they can from the company through dividends.

Family-owned firms have on average lower leverage ratios than non-family-owned businesses.

4. Effective decision-making processes

The conversations the researchers conducted with leaders of family companies indicate greater efficiency in decision-making, among other things, due to two factors: central but flexible processes and engaged employees.

Despite the existence of decision-making committees on various issues, the significant decisions made by leaders and teams in the performance of family firms are usually influenced by a single person or several family members who have the power to act more decisively than leaders in non-family firms.

In addition to this, the advantage of engaged employees is that once the decision is made, it is easier to put it into action.

The strategic methods of action common to the most successful family companies in the world:

1. Broad diversification in investment areas

The best performing family companies derive more than half of their income from business activities outside their core business.

2. Actively and frequently reallocate resources

An older McKinsey study proved that frequent resource allocation is one of the best ways to achieve growth in an organization.

Companies that reallocate resources more often have been shown to generate significantly higher returns for shareholders, experience long-term stability in returns, and are more likely to avoid acquisition or bankruptcy.

Leaders of high-performing family firms interviewed by the researchers say they are taking specific actions, and in some cases even cultural changes, to guard against inertia.

These leaders attribute the success of the company to the direct and personal involvement of the founders and being gifted gamblers.

3. Efficiency in operations and investments

As mentioned earlier, in their first years of life, family firms tend to have better business performance than others because they can allocate capital more efficiently.

But as these companies grow and expand, their good performance tends to come from more than just efficient operations.

Interestingly, the best family companies can do both.

4. Investing a lot of resources in recruiting, nurturing and retaining talent

The top performing family companies are obsessed with managing and retaining talent.

Many of these companies collaborate for years with academic institutions to attract the most talented graduates, invest in cultivating the attractiveness of the brand for the prominent people in the field, invest in high salaries for managers, and keep the best managers close to the owners.

They invest in the cultivation of talent over many years, and as evidence, the average seniority in these companies is 3 times that of non-family companies.

5. Constant optimization of the management mechanisms

The research reveals that successful family companies manage very seriously the separation between family affairs and business.

Most respondents in the best performing companies find that there is formal documentation in their companies with clear guidelines about the roles and responsibilities of family members.

More than 90% of better performing respondents told us that they have an effective and independent board of directors.

A high percentage of respondents report that their companies have a formal forum that meets regularly to discuss family and business issues.

A powerful solution to pain

A revolutionary pain treatment technology has been approved by the FDA for home use

In collaboration with Solio

Finally, an interesting fact

The most successful family companies in the world hire the services of experts and consultants in much higher percentages than all the others.

They value the knowledge gained from experts in various fields and do not hesitate to use it.

The study deepens the existing knowledge regarding the degree of success of family companies.

While in the past the assumption was that family companies are more profitable, the researchers bring a proven formula for the successful management of a family company over the years.

The researchers note that in their estimation any company that applies this knowledge will generate growth and prosperity.

Hagit Ibn Tzur is a senior strategic consultant at the Smc group

More on the same topic:

family business

business

Research

McKinsey