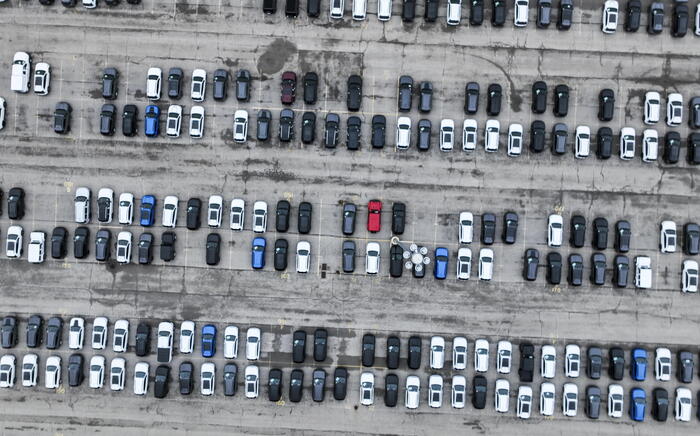

There were 1,316,702 registrations in Italy in 2022, down by 9.7% compared to the previous year.

In the last month there has been a leap in sales, equal to 104,915, 21% more than December 2021, the fifth consecutive positive sign.

The Stellantis group registered 461,178 cars in Italy in 2022, with a decrease of 15.9% compared to 2021. The share is equal to 35.1% compared to 37.8% a year ago.

In December, the group registered 32,420, 2.3% more than in the same month in 2021, with the share decreasing from 36.6% to 31.2%.

One of the worst years of the last half century ends in style for the automobile.

The

Centro Studi Promotor underlines this

which highlights how compared to 2019 there was a decrease of 25.3% in December and 31.3% in the year.

The result for 2022 - explains the Csp - exceeds the level of 2013 by only 0.9%, the worst result since 1978. The improvement in the supply of microchips and other essential components for cars determined the turnaround.

It is reasonable to expect that this will continue to improve in 2023 with beneficial effects on sales, but the return to normal levels for the Italian market, i.e. above 2,000,000 units per year, still appears a long way off.

In this context - observes Gian Primo Quagliano, president of the Centro Studi Promotor - the recovery of registrations must also be supported by public incentives as, moreover, has happened in recent years.

For 2023, the Government has allocated 630 million for new incentives with a formula similar to the one adopted in 2022 which saw the allocation for traditionally fueled cars with emissions not exceeding 135 grams of CO2 per kilometer and largely unused run out in a very short time appropriations for pure electric cars and surroundings.

It is very probable that the solution adopted for 2023 will produce similar results, i.e. largely unsatisfactory.

It is therefore desirable that the provision be modified to make the incentives for electric cars economically accessible even to motorists with limited spending power and to make an effective and significant contribution to the elimination of older and more polluting cars.

The constant growth in the last five months is not sufficient to bring the balance sheet for the entire year 2022 back into the surplus, which closes and a level not far from the historic low of 2013. This was underlined

by the Unrae

, the association of foreign car manufacturers in Italy.

"Faced with this far from exciting picture - comments the president Michele Crisci - it is a pity that in such an important and profoundly changing moment in the automotive world, the Budget Law that has just been approved does not include anything new for a sector that has to face rapidly a profound industrial and commercial reconversion of the supply chain to support the transition towards sustainable mobility. Although appreciable, what has been done so far is not enough, the data clearly demonstrate it, and we hope that improvement measures can soon be envisaged to achieve this goal".

Crisci remembers the indications of the

Unrae in the open letter sent to Prime Minister Giorgia Meloni and reiterates the interventions that the automotive sector considers a priority.

"We ask the Government - explains Crisci - for a clear indication for the acceptance of new technologies and, in the meantime, the maintenance and enhancement of purchase incentives for the renewal of the vehicle fleet at least until 2026 for individuals and companies, providing for the elimination or at least the raising of the price thresholds. Equally urgent are the elaboration of an infrastructural policy for electric recharging and hydrogen supply, and the structural revision of the sector's taxation".

the maintenance and enhancement of purchase incentives for the renewal of the circulating fleet at least until 2026 for individuals and companies, providing for the elimination or at least the raising of the price thresholds.

Equally urgent are the development of an infrastructure policy for electric recharging and hydrogen refueling, and the structural review of the sector's taxation".

the maintenance and enhancement of purchase incentives for the renewal of the circulating fleet at least until 2026 for individuals and companies, providing for the elimination or at least the raising of the price thresholds.

Equally urgent are the development of an infrastructure policy for electric recharging and hydrogen refueling, and the structural review of the sector's taxation".