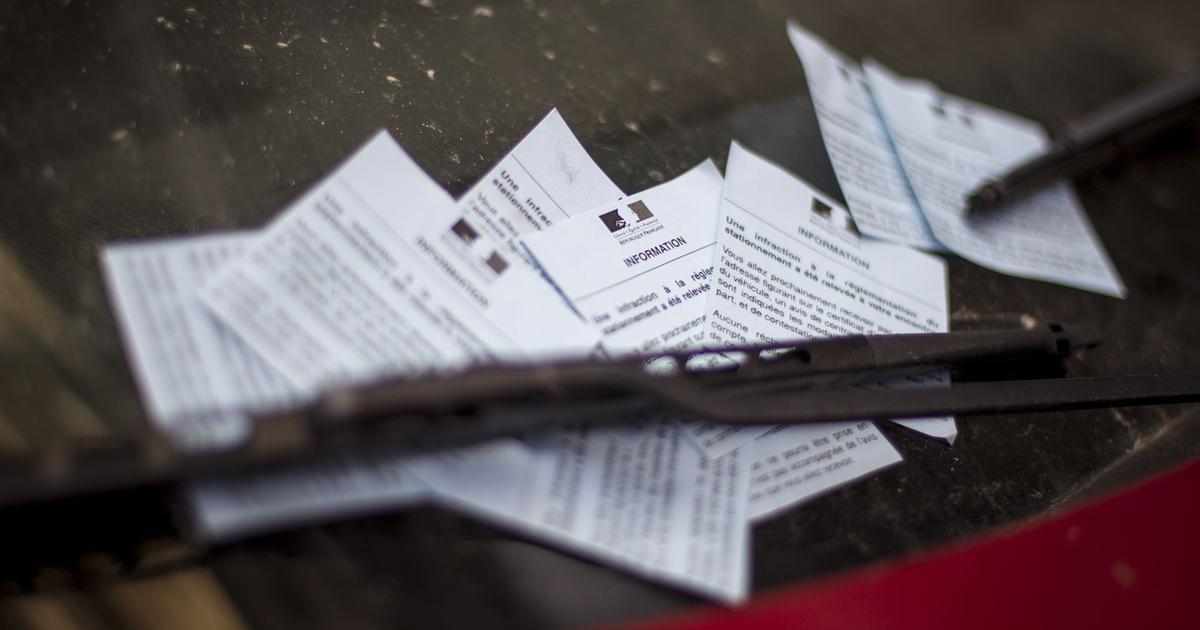

Post-parking packages are tax deductible. The reform of paid parking has come into force on January 1, 2018.

The charge is therefore tax deductible as long as it is justified (FPS payment notice) and the expense is incurred for the purposes of the economic activity. You must have all proof of expenses relating to the professional use of the vehicle. These parking costs are also added to the limitations of the mileage scale published each year by the administration, provided that the portion corresponding to private use is deducted and that necessary justification can be provided.