Business

Robinie explodes on Robin Hood: Toss disaster on people

The economist who predicted the 2008 subprime crisis is launching an attack on Wall Street, criticizing the Robin Hood app, storming the cryptocurrencies and slamming into the millennial generation.

On the way he also criticizes the Democrats for the plan to distribute checks to US citizens and claims that we are in the "mother of all bubbles"

Tags

Nuriel Rubini

Roi Barak

Thursday, 04 March 2021, 06:27

Share on Facebook

Share on WhatsApp

Share on general

Share on general

Share on Twitter

Share on Email

0 comments

"Doomsday Doctor" does it again.

Economist Nuriel Rovini provides gloomy forecasts based on recent Wall Street events and those to come in the U.S. following the Biden administration's Corona aid package: Another exploitation of a group of hopeless, jobless, incompetent and indebted people. "

Robinie, a professor of economics at New York University, has been dubbed" Doomsday Doctor "or" Doctor DOOM "following his pessimistic (fulfilled) predictions about the future of the global economy. Before the subprime crisis of 2008. This time he warns in an opinion column in the British newspaper The Guardian that the Robin Hood app and the bitcoin trade will wreak havoc mainly on the segment of the population who cannot afford to lose the money he gambles with.

According to him, those millennials who were persuaded to borrow money and invest it in assets called "financial democratization" before the 2008 crisis, are "the same" people who today deceive them into investing through investment apps without understanding a thing and a half and selling them false narratives using "dumping" memes. The Wall Street Sharks.

More on Walla!

NEWS

How do you continue to train for the Olympics at home during the corona?

To the full article

Does not spare criticism.

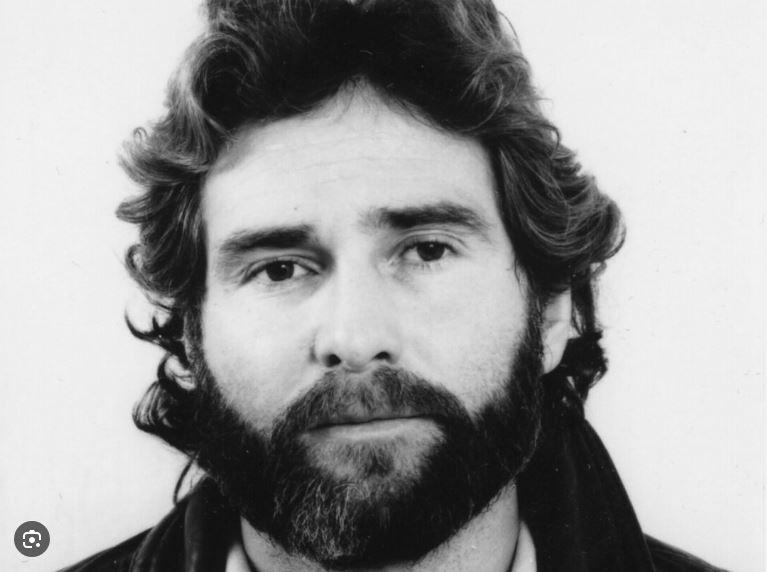

Nuriel Rubini (Photo: GettyImages, Stephen Loveski)

Before attacking the implications of the Robin Hood and the Silence app, Robinie attacked the growing disconnect between "Wall Street and Main Street" (an image of the "regular" streets in the U.S. where small businesses and small people - RB) are located, he said. "The bottom five deciles of wealth distribution hold only 0.7% of total assets in the market," he wrote, "while the first decile holds 87.2%, and the top 1% holds. 51.8%.

"The 50 richest people in the United States possess a wealth equal to that of the 165 million Americans who are at the bottom."

Rovini also referred to the growing inequality created precisely by the meteoric rise of "big tech" companies that some claim are "locomotives leading the economy."

"For every job Amazon creates, three retail jobs are disappearing. Similar dynamics exist in other sectors dominated by technology giants," he wrote, making it clear that when it comes to "today's social and economic pressures," this is not a new phenomenon.

For decades, he wrote, workers with financial liquidity difficulties have been unable to keep up with the pace of life due to the stagnation in median income alongside living costs and more.

"The 'solution' to this problem was 'democratization' of funding so that poor and struggling households could borrow more money from banks to buy houses they could not actually afford, and then use those houses as cash machines," Robinie reiterated his predictions from previous years.

"But this expansion of consumer credit, which included mortgages and other debt, led to a bubble that ended with the financial crisis in 2008, which left millions losing their jobs, homes and savings."

Rovini warns in the article that those millennials who were deceived before the subprime crisis are now getting a new "lifeline" that will eventually be used for their own hanging, called "financial democratization."

"Millions have opened accounts in Robin Hood and other investment apps, where they can try to leverage their savings and meager earnings several times over to gamble on worthless stocks."

A tool for self-hanging.

Robin Hood (Photo: ShutterStock)

"GameStop's narrative," Rovini wrote, "presented a heroic unified front that small day traders fought bad hedge funds that 'short', hiding an ugly reality of further exploitation of a group of hopeless, jobless, unskilled and indebted people.

" of them were convinced that financial success lies not in the good work, hard work or savings and long-term investment, but Btocniot-lhtasr-mhr, quick bets on inherently worthless assets such as cryptographic coins (or as I prefer to call them SHITCOINS). "

" Do Make a mistake, "warns Robinie," the populist meme according to which an entire army of Millennials (David) that overthrows Wall Street (Goliath) only serves as a plot to attract

unimaginable

amateur investors.

"" As in 2008, the inevitable result will be another asset bubble.

"The difference is that this time populist congressmen are recklessly attacking financial intermediaries for not allowing vulnerable investors to leverage themselves even more."

"If all the scams and bubbles"

Later in the article, Robinie attacked the $ 1.9 billion rescue package for Corona victims that is expected to be approved next week in the Senate. According to his analysis, since millions of Americans are already in arrears with rent, mortgage, credit card debt and other loans, a significant portion of those payments will be transferred to debt repayment and savings. It is estimated that only about a third of the incentive money will go to real spending.

If this is indeed the case as Dr. predicts, it will have a smaller impact than expected on growth, inflation and bond yields, as "eventually the additional savings will be redirected back to the purchase of government bonds", and thus the program designed to rescue households in difficulty will become effective bailout plan banks and lenders others.

About a month ago, after Elon Musk acquired (via Tesla) Bitcoins worth $ 1.5 billion, attacked Roubini article B"fiinsl Times "coins cryptographic especially the Bitcoin saying that these are" if any fraud and bubbles ".

The unpredictable volatility of the value of the "currency", which can wipe out profits, is no better than the economic system that existed in the Stone Age, he wrote at the time. "Even the ancestral family ('the Flintstones') had a more sophisticated monetary system based on an agreed benchmark."

Roubini repeated in recent years whereby the crypt represents even worse bubble in tulip bubble "(Tolifmanih) of the 17th century, when a burst led to the bankruptcy of many investors and many other ripples in the market.

shortly afterwards attacked on Twitter Roubini c Yam Kramer, presenter of the popular financial program "Med Money" after it said that a member Those who do not invest their money in Bitcoin act irresponsibly. "Kramer is a fucking idiot," Robinie wrote on Twitter, "he screwed up big before the 2008 economic crisis when he served as the head of the cheerleading band of the bubble that exploded on him and showed the whole world that he was stupid."

Share on Facebook

Share on WhatsApp

Share on general

Share on general

Share on Twitter

Share on Email

0 comments

/cloudfront-eu-central-1.images.arcpublishing.com/prisa/LHD7AFJIJRDATGI2BJ6XL263EY.jpg)