The Bank of Israel has ruled: the interest rate will rise by 0.5% to 1.25%

The increase in the interest rate was expected in light of inflation, which is at the upper limit of the target set by the bank only about two months ago.

The good news: curbing housing prices

Between Ashkenazi

04/07/2022

Monday, 04 July 2022, 15:51 Updated: 16:14

Share on Facebook

Share on WhatsApp

Share on Twitter

Share on Email

Share on general

Comments

Comments

The Monetary Committee of the Bank of Israel raised the interest rate in the economy, which to date has stood at 0.75%, by an additional 0.5%, to a level of 1.25%

.

Alongside the decision to raise interest rates, the bank's research division, headed by Michel Strawczynski, publishes a forecast regarding the expected volume of growth and inflation, which according to consumer price indices stands at 4.1% per year (according to the May index, the latest known at this time).

Three months ago, the research division updated its forecasts, in light of the contraction in GDP in the first quarter and the sharp rise in prices, especially in the field of energy, as a result of Russia's invasion of Ukraine.

According to most economists in Israel, the interest rate will rise to 1.5% -2% by the end of 2022.

More on Walla!

Hair, skin and nails: a dietary supplement that changes the rules of the game

In collaboration with SupHerb

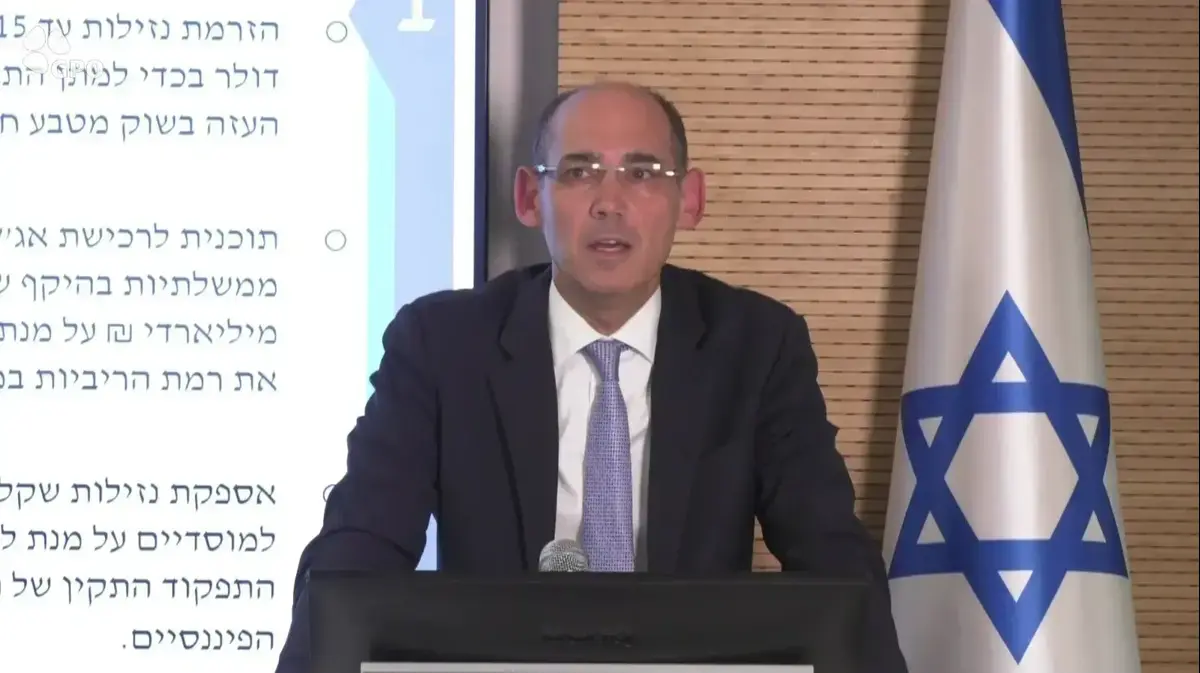

Governor of the Bank of Israel, Prof. Amir Yaron.

Third rise in interest rates, at a relatively moderate rate (Photo: Reuters)

The Bank's Research Division stated: "Our estimates of developments in the global environment are mainly based on forecasts made by international institutions and foreign investment houses. Accordingly, we assume that growth in developed economies will amount to 2.7% in 2022 and 1.9% in 2023 ( 0.3 percentage points lower than in the previous forecast for the two years.) In

relation to the inflation rate in developed economies, we assume that it will be 6.7% and 2.3% in 2022 and 2023, respectively (compared with 5.0% and 2.0% in the previous forecast). Inflation was also accompanied by a significant update of the global interest rate forecast, so that at the end of 2022 the average interest rate of developed economies is expected to be 2.2% (compared with 1.1% in the previous forecast) and at the end of 2023 at 2.4% (compared to 1.6% in the previous forecast). In June, at an average level of about $ 118 per barrel, a higher level than what prevailed at the time of the previous forecast (about $ 100 per barrel). "

The forecast for real activity in Israel has also been updated:

"GDP is expected to grow at a rate of 5.0% in 2022, and at a rate of 3.5% in 2023 (Table 1). Which are working to curb private consumption and investment.These factors also led to a reduction in the import forecast in 2023 after for 2022 it was updated slightly upwards following the national accounts data in the first quarter of the year which were higher than expected.

The forecast for exports in 2023 has also been updated below due to the decline in the global growth forecast.

As for developments in the labor market, we estimate that the unemployment rate in 2022 and 2023 will be 3.3% and 3.5%, respectively, and that the employment rate (ages 25-64) will be 78.3% in 2022 and 77.7% in 2023, so The employment rate will be similar to its average level in 2019. It should be noted that the starting point of the forecast (second quarter of 2022) is that of a farm that closed the gaps in activity during the corona period (ie, reducing the deviation of GDP from the pre-crisis trend) with a tight labor market "At a high level of employment. Even after lowering the growth forecast, we do not expect a slack in GDP and employment.

As for the state budget, in light of higher-than-expected tax receipts, the deficit is expected to be lower than our estimate in the previous forecast.

Inflation and interest rates

The inflation rate in the next four quarters ending in the second quarter of 2023 is expected to stand at 3.3%.

In 2022, the inflation rate is expected to be 4.5%, higher than the previous forecast by one percentage point;

And in 2023 it is expected to stand at 2.4%, higher than the previous forecast by half a percentage point.

The upward revision of the forecast is mainly due to the upward revision of the world inflation forecast and the devaluation that has taken place in the exchange rate since the publication of the April forecast.

"The inflation forecast expresses an estimate that both the domestic component of the index and the imported component will rise at a rate higher than 3% for most of the forecast period, moderating towards the end. As for the domestic component of the index, Tight labor market As for the imported component, its high rate of increase is due to the high inflation forecast in the world as well as the effects of the lagging of the devaluation that has taken place in recent months.I estimate that global inflation Significant rate of increase in imported component during 2023 ".

The interest rate is expected to stand at 2.75% on average in the second quarter of 2023. This estimate reflects a significant increase from the current level of interest rates, and is a result of the inflation forecast higher than the target in the coming quarters. .

The data show that the Research Division's forecast for inflation in the coming year is similar to the average of forecasters' forecasts and slightly lower than expectations derived from the capital market.

Regarding the Research Division's forecast for interest rates in a year's, this is higher than the average forecasters' forecasts, and lower than the expected interest rate derived from the capital market.

Of money

news

Tags

Bank of Israel

interest