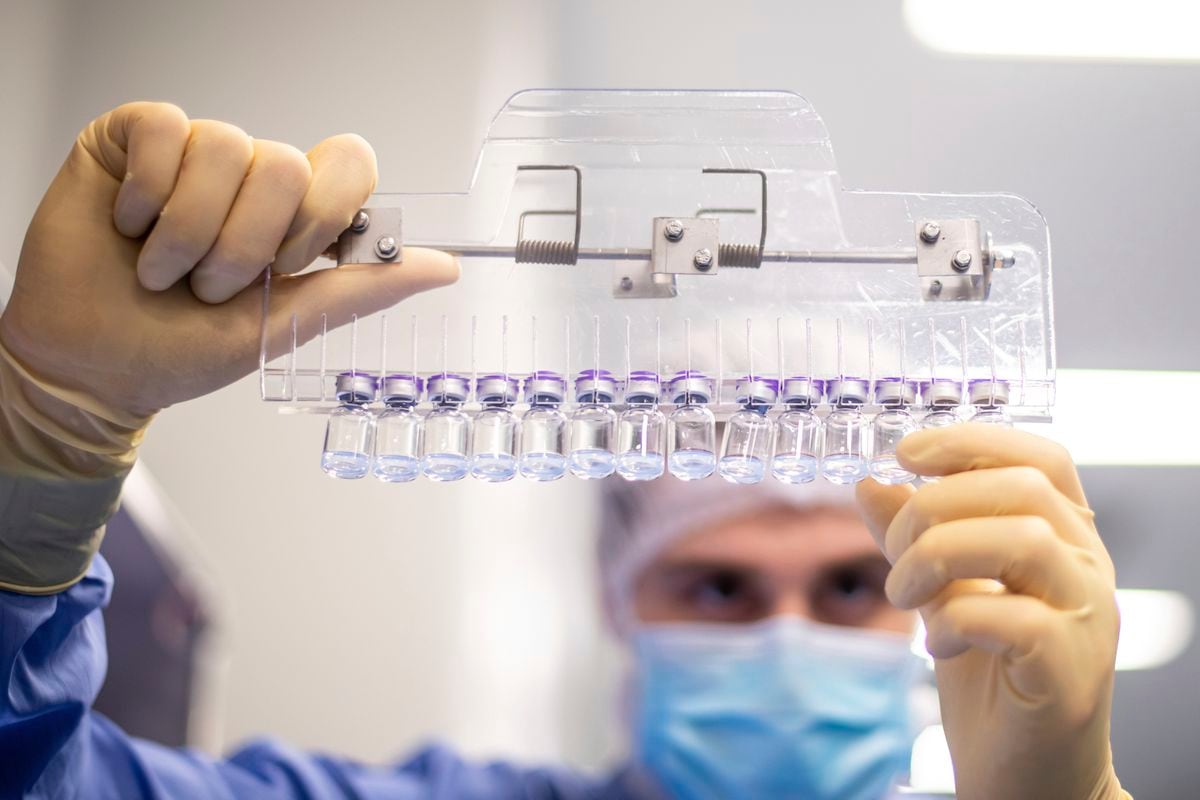

The vaccine developed and produced by Pfizer and BioNTech has helped the world overcome the pandemic and the American pharmaceutical company to achieve the greatest profits in its history.

Comirnaty's sales have come to account for half of the income of the giant Pfizer.

Together with those of Paxlovid, its pill for those who have already contracted the disease, and which was approved at the end of 2021, they have allowed the company to achieve profits of 31,372 million dollars in 2022 (close to 29,000 million euros at the current exchange rate). ), 43% more than a year earlier, when it already touched the record of 22,000 million that it earned in 2013, the year of the sale of its subsidiary Zoetis.

The approval of the vaccine for more and more age groups and the booster doses to prevent covid have also allowed the company to achieve record revenues of 100.330 million dollars, with growth of 23% compared to the previous year.

Comirnaty contributes to that total 37,800 million, while Paxlovid adds 18,900 million.

In total, both account for more than 56% of the company's revenue last year.

The vaccine achieves its highest revenues in Europe, while the main market for the pill has been the United States.

Albert Bourla, Chairman and CEO of Pfizer, said in a statement: “2022 was a record year for Pfizer, not only in terms of revenue and earnings per share, which were the highest in our long history, but, most importantly, in terms of the percentage of patients who have a positive perception of Pfizer and the work we do.”

Pfizer has become largely reliant on its covid vaccine and (less successful) pill, and now that the pandemic is subsiding, analysts have doubts about the evolution of its business.

The recommendations to repeat the vaccine periodically, as with the flu, can mitigate the drop in sales, but the drop in income derived from the fight against the coronavirus is irreversible.

The company itself has admitted that it expects revenue to fall between 29% and 33% this year, to around $67-71 billion.

The profit will also sink, practically in half, according to the guidance that the company has communicated.

All of that is due to covid-related products, especially the vaccine.

Comirnaty's sales will plunge 64% to $13.5 billion, according to the company.

Those of Paxlovid, 58%, up to about 8,000 million.

In the rest of its portfolio, it expects turnover to grow between 7% and 9%.

To try to fuel its growth, Pfizer has been using the stream of money received from its coronavirus products to launch an acquisition race for pharmaceutical companies with promising compounds, expanding its business into new markets.

Last August it announced the acquisition of Global Blood Therapeutics (GBT), a San Francisco-based biotech specializing in hematology, for $5.4 billion (about $5.3 billion).

It was the fourth major operation in just over a year.

In May 2022, it acquired Biohaven Pharmaceutical, a biotech specializing in neurological diseases and rare disorders whose main product is a treatment for migraine, both chronic and acute, for $11.6 billion, for $11.6 billion, its biggest deal in six years. .

In December 2021, it announced the purchase of Arena Pharmaceuticals, which develops various treatments against autoimmune inflammatory diseases for 6.7 billion dollars, an operation that was already closed last March.

In April of that year, it acquired ReViral for 525 million,

The company's financial director has highlighted that Pfizer has 10 medicines or vaccines that billed more than 1,000 million dollars in 2022, but none shadows the vaccine and the pill against covid.