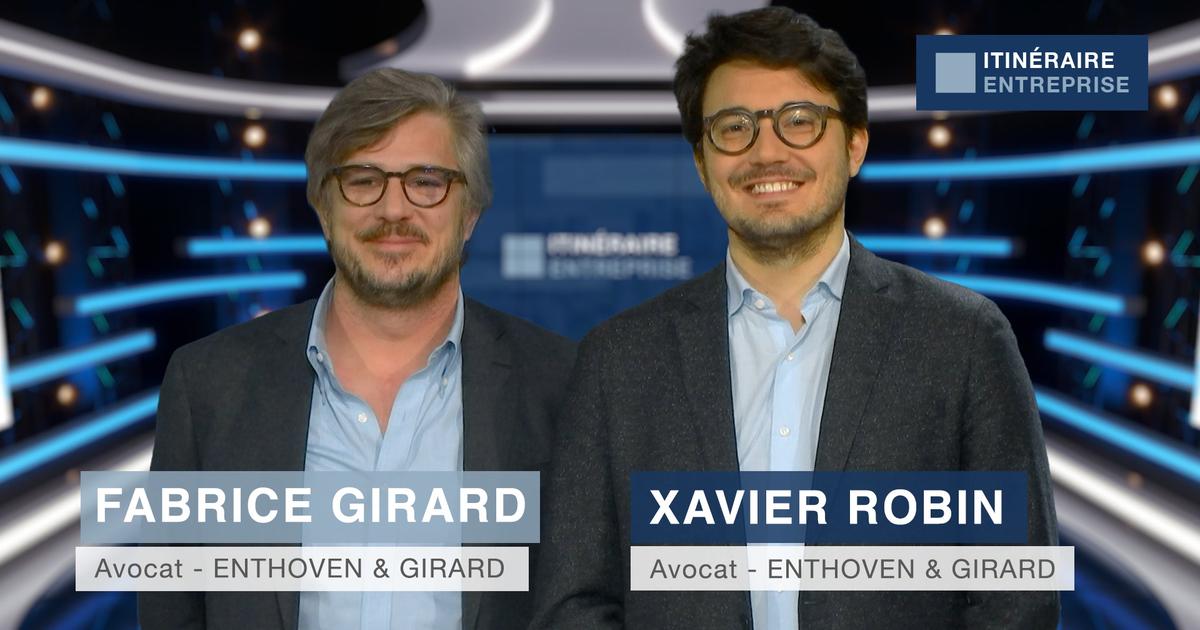

Enthoven Girard

advises companies, whatever their activity, in the management of their operational, financial and legal difficulties.

In addition to a mission of assistance in the processing and follow-up of files, the firm intends to be part of a real partnership with its clients, allowing them in doing so to ensure the recovery and the sustainability of their activity.

The firm has developed particular expertise in supporting debtors but also their managers and shareholders at all stages of restructuring.

At the same time, he supports creditors and prospective buyers (

prepack,

sale plans).

Enthoven Girard supports companies in crisis contexts

Ⓒ Enthoven Girard

Bouncing back in the face of a gloomy economic context

If the Covid period marked a slowdown in business failures thanks to financial aid from the State (PGE, deferral of tax and social security debts) which had made it possible to avoid cessation of payments, since the end of 2022 an increase in requests for initiation of bankruptcy proceedings is observed.

Initially emanating from VSEs, they now concern SMEs and even ETIs.

Indeed today, in addition to the end of State aid and the reimbursement of the PGE, the leaders have to face new problems in the forefront of which the energy crisis and the rise in the price of raw materials.

Caught in the middle, having not had time to see a rebound in activity before the arrival of new crises, plunged into a gloomy economic context with unclear prospects,

Enthoven Girard

accompanies them and reassures them in a tense situation for which they were not trained.

Through its permanent commitment to the search for pragmatic solutions, the firm intervenes in crisis or emergency contexts in order to implement complex investment, disposal, development of shareholder pacts and restructuring operations. in the event of operational and/or financial difficulties.

Knowing how to choose your strategy

Intervening in restructurings both in the preventive framework (

ad hoc

mandate , conciliation) and in the context of collective proceedings (safeguard, receivership or judicial liquidation), Enthoven Girard deploys the full range of its expertise.

Favored in first intention, amicable procedures make it possible to negotiate in a confidential framework with the main creditors in order to reschedule the maturities which are likely to become unsustainable for the company.

As for the safeguard procedure, intended as an incentive by the legislator, it intervenes before the state of cessation of payments, thereby increasing the chances of debt restructuring.

The reorganization procedure, for its part, takes place when the company no longer has the assets available to meet its current liabilities.

She is then forced to seek the help of the court.

In the context of these two procedures, the court freezes the previous liabilities, thereby allowing the company to recreate cash and reorganize itself in order to give itself a new dynamic, maintain employment and avoid compulsory liquidation.

For a liability rescheduling strategy

The PGE now constitutes additional debt that must be repaid in addition to the initial operating debt.

However, if initially the interest rate of the PGE was very favourable, this rate no longer applies in the event of an amicable restructuring of the said assistance.

Currently, restructuring a PGE over time leads to the payment of interest at more than 4.2 points, which adds an additional difficulty to companies.

This is why, faced with this additional financial burden, it is necessary to analyze the file as a whole in order to define a strategy for rescheduling the liabilities according to all the parameters of the file.