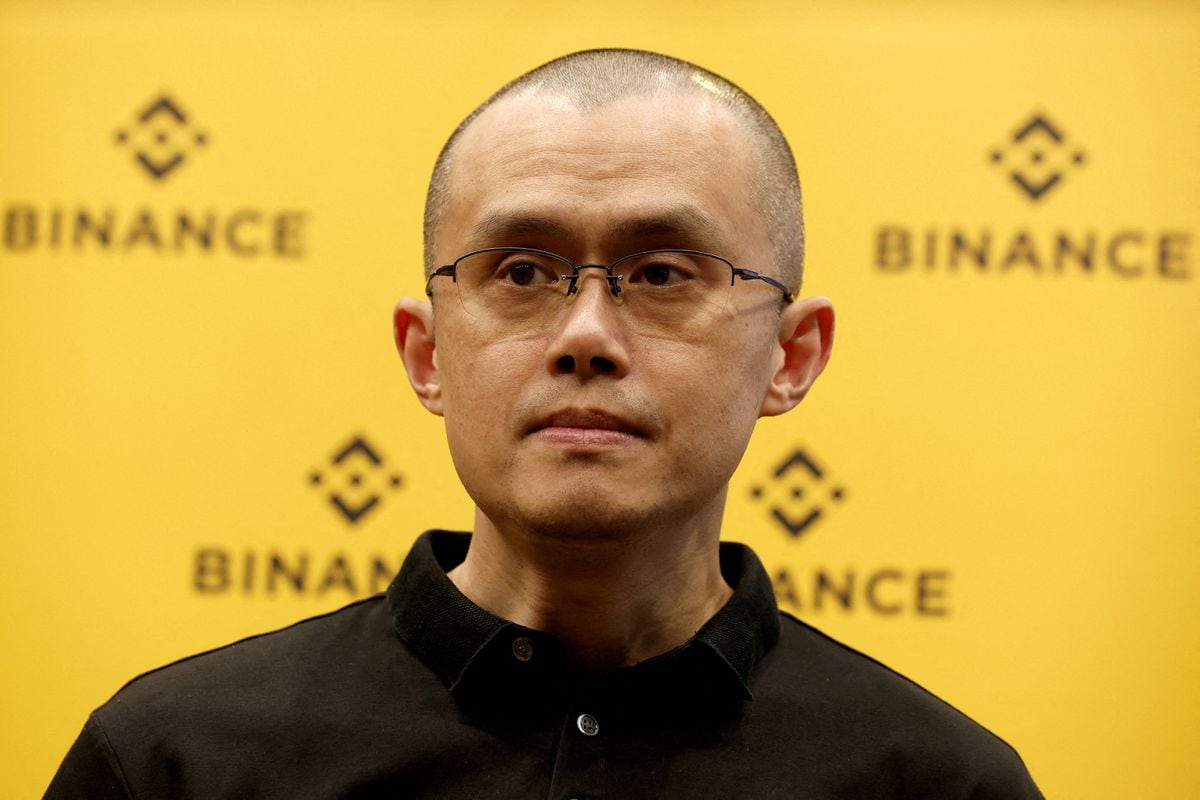

U.S. regulators accuse Binance, the world's largest cryptocurrency exchange, of "diverting clients' assets at will" and mixing them with others without any control, in violation of the law. The U.S. Securities and Exchange Commission (SEC) has filed a 13-count indictment against Binance and its founder and boss, Changpeng Zhao. The SEC thus joins the offensive opened by the CFTC, the regulator of the commodity market, which already sued Binance and Zhao last March. The complaint has caused a sharp drop in the price of bitcoin, ethereum and other cryptocurrencies.

The SEC says that Binance entered 11,600 million dollars in income from, among other things, commissions for transactions of US clients without being properly registered for it. Those responsible for the platform declare themselves "disheartened" by the supervisor's performance. "Any allegation that the assets of users of the platform have Binance.US ever been compromised is simply wrong," the firm said in a statement.

The stock market supervisor maintains that Binance has operated "with blatant disregard of federal securities laws and the protections these laws provide to investors and the market." "In doing so, the defendants have enriched themselves with billions of U.S. dollars while putting investors' assets at significant risk."

The complaint filed in federal court accuses the platform of diverting billions of customer dollars to a subsidiary called Merit Peak Limited controlled by Zhao himself. At one point in the 136-page complaint, the SEC puts the amount derived to that firm at $20 billion. "As Merit Peak was a supposedly independent entity, sending client funds from Binance to Merit Peak put those funds at risk, including loss or theft, and was done without notifying customers," the text says.

The structure of the group's operations, according to the SEC, "has given and continues to give Zhao and Binance free rein to handle billions of dollars in crypto assets that clients have deposited, held, traded and/or accumulated on the Binance.US platform without oversight or controls to ensure the assets are properly insured," Says.

After the fraudulent collapse of FTX and the fall of its founder, Sam Bankman-Fried, the authorities have targeted other markets that operated by taking advantage of legal loopholes or, directly, bypassing the regulations. They have issued several fines and filed lawsuits against various firms among which this is perhaps the most important.

Binance has responded with a statement to the filing of the complaint. Its officials declare themselves "disappointed", assure that they have cooperated with the supervisor and that they have "participated in extensive discussions in good faith to reach a negotiated agreement to resolve their investigations". "Despite our efforts, with its complaint today the SEC abandons that process and chooses to act unilaterally and litigate. We are disheartened by this decision," the note said.

"It is an attack on the entire sector," tweeted its founder, who ensures that customers who are requesting it are being allowed to withdraw the money.

Among the accusations of the stock market supervisor, is that the firm did not take adequate measures to avoid targeting US investors, thereby circumventing the regulations. According to the SEC, although Zhao and Binance publicly claimed that U.S. customers were restricted from trading in Binance.com, they actually subverted their own controls to secretly allow large customers to continue operating.

"Across 13 charges, we allege that the Zhao and Binance entities engaged in an extensive network of deception, conflicts of interest, non-disclosure and calculated evasion of the law," SEC Chairman Gary Gensler said in a statement. "As alleged, Zhao and Binance misled investors about their risk controls and corrupted trading volumes while actively concealing who operated the platform, manipulative trading from its affiliate market maker, and even where and with whom investors' funds and crypto assets were guarded."

According to Gensler, Binance and its founder "attempted to circumvent U.S. securities legislation by announcing false controls that they ignored behind the scenes in order to keep high-value U.S. clients on their platforms." "The public should be wary of investing any of their hard-earned assets with or in these illegal platforms."

The Futures Market Commission (CFTC) has already accused the firm, its founder and the head of regulatory compliance of bypassing regulation that requires futures and derivatives trading on commodities and other assets to be done through regulated markets. "Don't leave anything in writing," Zhao said as he gave instructions on how to break the law using the Signal app, with messages automatically deleted.

Binance came to consider the purchase of the bankrupt FTX and is one of the great preachers of cryptoactives around the world. Although Binance said it was staying out of the U.S. market, it was a lie, according to the lawsuit filed by the CFTC, which claimed that the platform offered and executed derivatives transactions to U.S. customers. "Under Zhao's direction, Binance has instructed its employees and customers to circumvent compliance controls in order to maximize corporate profits," the CFTC said.

Binance has been targeted by U.S. authorities for years. In the wake of FTX's fall, supervisors are tightening vigilance. Coinbase reached an agreement in January to pay a $50 million fine for lack of anti-money laundering controls and other shortcomings. The Securities and Exchange Commission (SEC) has put sanctions and opened files on numerous firms in the sector, as well as celebrities who advertised crypto assets covertly.

The last of the big ones to fall was Genesis, a cryptocurrency firm that the SEC had recently accused of irregular practices and that already froze last November the withdrawal of funds from clients. In January he made good forecasts and filed for bankruptcy.

Follow all the information of Economy and Business on Facebook and Twitter, or in our weekly newsletter