The IRS thwarted an attempt to smuggle 20 kg of gold hidden in a vehicle at the Allenby crossing/IRS

The Tax Authority today publishes the file of decisions of ransom committees for 2022 which contains 87 decisions, of which 41 are decisions in income tax and real estate taxation cases and 46 are decisions in customs and VAT cases. According to the tax laws, one of the ways to end investigative cases on suspicion of tax offenses is the ransom procedure as an alternative to the procedure For this purpose

,

the Authority has extortion committees that discuss income tax and real estate taxation and extortion committees that discuss VAT, customs and purchase tax issues.

We note that the amount of the imposed ransom is in addition to the requirement to pay the tax, which is paid as part of the civil procedure.

The highest ransom in this file, in the amount of NIS 337,000, was imposed on Rachel Vakanin, a resident of Jerusalem.

The ransom was imposed for omitting rental income between 2010-2018, in order to avoid paying a tax of NIS 2.2 million.

A ransom of NIS 300,000 was imposed on Said Bokai, a money changer and owner of a jewelry business from the northern region.

The ransom was imposed for omitting income in the years 2016-2018 in the amount of approximately NIS 1 million.

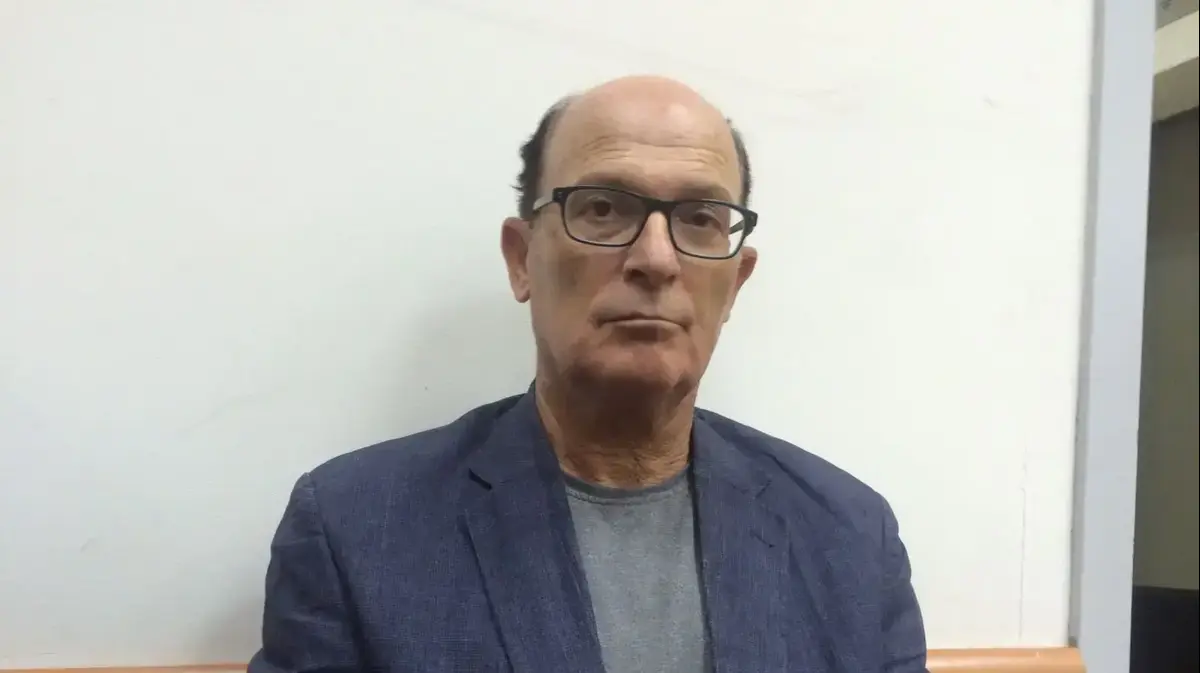

Bar Yosef.

Did not report income from rent close to one million shekels/Walla! system, Machi Hoff

11% of the ransom decisions in 2022 concern the omission of rental income, compared to 7% in 2021.

For example, a ransom of NIS 145,000 was imposed on Avriel Bar Yosef, the former deputy head of the MLA and accused of accepting bribes in the submarine case. The ransom was imposed for not reporting Rent income between 2008-2016 in the amount of approximately NIS 970,000.

Among the contractors, renovators, traders and marketers, the name of Professor Rosa Laykin, Dean of the Faculty of Education of the University of Haifa, stands out no less. "It was nothing," she says Wow! In reference to Prof. Rosa Laykin, who expresses surprise at the publication.

"It was some kind of mistake in the report.

I made a mistake.

There was a lack of understanding.

Of course I'm not happy it happened.

And it won't happen.

Of course I'm sorry.

The affair is behind us.

I felt very bad about this story.

I didn't do anything on purpose and I didn't hide anything on purpose.

Totally wrong.

I paid everything.

the debt and the ransom but I don't remember how much I paid, I didn't stand and count.

I paid as much as they told me.

If I didn't pay, I would be in court," Laikin said.

More on the same topic:

Internal Revenue Service

tax evasion

evasion of income

Rent