Contributory pensions are called that because their amount depends mainly on how much the worker has contributed to the Social Security fund.

The more you have contributed by working, the higher your future pension will be.

This principle is what underpins the entire pension architecture in Spain, the most robust pillar of the welfare state.

At the same time, this starting point is what justifies the differences between some tiny pensions, close to those of a welfare nature, and others that almost triple the minimum wage.

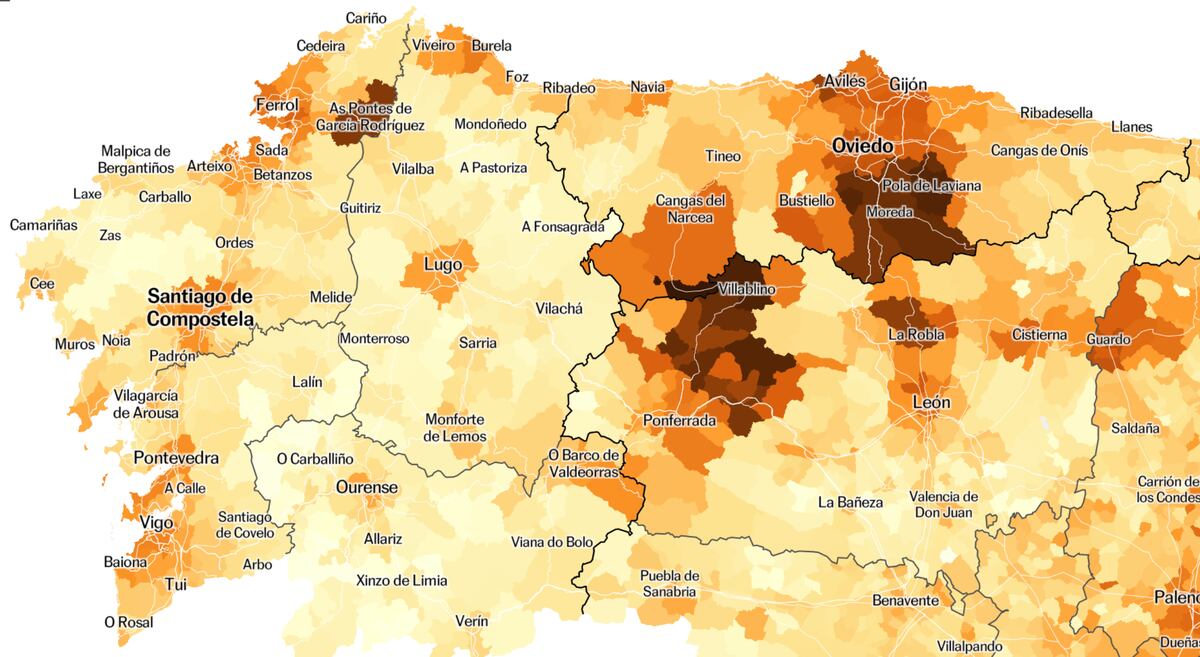

In some municipalities the former are more common and in others the latter, as shown in the following map, prepared from data from the Ministry of Social Security as of January 1, 2024. There is a gap of 1,515 euros between the average pension of 2,042 of Degaña (Asturias), the town with the best benefits in Spain, and 527 of Castroserracín (Segovia).

Charging

The map includes 8,000 average municipal contributory pensions analyzed.

The average of all of them is 1,259 gross euros in 14 payments.

It is important to highlight that the data is not limited to retirement pensions (which are the most common, 64% of the 10.13 million there are, and the highest, 1,435). There are also 23% of widow's pensions. (whose average amount is 892 euros), 9% permanent disability (1,161 euros), 3% orphanhood (500) and 0.5% in favor of relatives (737).

These data do not include welfare pensions, those of a non-contributory nature, another 445,000 and even less, about 500 euros on average.

A first look at the map leads Fernando Luján, UGT negotiator regarding pensions, to the following conclusion: “It is a reflection of salaries.

The higher they are, the better the pensions.

Tell me what your salary is and I will tell you what your future pension is,” comments the Deputy Secretary General of Union Policy.

“Where the productive fabric is more advanced, where the industry is stronger, you see better pensions,” adds this union member.

Broadening the focus somewhat, the data agree with Luján: the autonomies with the highest salaries are among those with the highest pensions.

But with nuances.

The highest pensions are those of the Basque Country (1,556 gross euros per month), also leading in salaries (2,219).

But the second region with the best pensions, Asturias (1,471), is fifth in labor compensation (1,789).

Madrid has the second best salaries (2,108) and the third best pension data (1,468).

Jose Antonio Herce, pension expert and founding partner of LoRiS, shares this part of Luján's analysis, and extends it to the cities that concentrate economic activity: “Across the Spanish geography we see regional capitals where jobs are good or, at At least, they have been at some point.”

That caveat, that look at the past, is “key” according to Herce.

“Pensions tell you more about what economic activity has been like in a place than about what it is like at that moment.

If you see that average incomes are much lower than average pensions, it means that that territory is going badly, that there is a lack of quality employment.

Where there was activity, there is no guarantee that it will continue to exist,” adds Herce, author of the BBVA report.

Social Security pensions in the Spanish autonomous communities

.

The following map shows this relationship between pensions and the average income of each municipality divided into 14 payments.

The weaker the color of the map, the more equal incomes and pensions are.

When brown predominates, income wins (most common in the northern half of the country) and when green predominates, pensions (most common in the southern half).

There are towns that register low pensions and incomes, such as Avión (Ourense).

“There are many pensioners here who have very low benefits because they have barely contributed in Spain.

“They spent most of their lives abroad,” explains the mayor of this Galician town of 1,770 inhabitants, Antonio Montero.

It is the municipality of more than 1,000 inhabitants with the lowest average pension in Spain, 658 euros per month in 14 payments.

Particularities like these are common when analyzing the situation of the seats in the caboose.

Peculiarities for each data

“It is very possible that in some of the municipalities with smaller pensions there will be a greater volume of widow's pensions.

Being lower, they pull the stocking back.

There is a relevant gender bias to take into account in emptied Spain,” says Carlos Bravo, Secretary of Public Policies and Social Protection of CC OO and the union's main expert on the subject.

Among the municipalities with the worst pensions in Spain, the most common are towns with very few inhabitants.

Among them are Padrones de Bureba (Burgos), Miravete de la Sierra (Teruel), Las Aldehuelas (Soria) and Olmeda de Cobeta (Guadalajara), all with less than 100 inhabitants and with average pensions of around 600 euros.

“Here almost all pensioners are in the agrarian regime, with the minimum pension at most.

There is also widowhood, which is even less.

There has never been anything here that is not countryside,” explains Juan Antonio Calvo, mayor of the Alcarreño municipality.

We must also go to specific particularities to explain the highest pensions in Spain.

“The mining municipalities stand out.

Particularly high pensions are concentrated precisely in these regions,” analyzes Herce.

Most of the mines, which accounted for many accidents and left health consequences for many of the employees, gradually closed at the end of the 20th century and the beginning of the 21st, which led to the early retirement of thousands of employees.

Salaries were high (in line with the rest of industrial activity), so the resulting pensions are above average.

This explains the 2,042 euros average pension in Degaña (Asturias), the 1,949 in Estercuel (Teruel) or the 1,935 in Villablino (León), the three municipalities with the highest pensions in Spain and all closely related to mining.

However, they are far from the first positions in average income.

This gap, as Herce previously explained, speaks better about a place's economic past than about its future.

It is well seen in the following graph of Asturias, where two out of every five municipalities (with more than 100 inhabitants) are among the 10% of the highest pensions in Spain.

But rents are close to or below average.

The scenario is similar in mining areas of Aragon.

In regions like Galicia or Andalusia, pensions (memory of the economic past) and incomes (the present) are among the lowest.

In the graph that relates both values, they are crowded together at the bottom left, with few exceptions.

Among the 10 most populated cities in Spain, the best pension on average is Bilbao (1,558), followed by Madrid (1,504), Barcelona (1,463) and Zaragoza (1,462).

For these four cities, the order is copied if the variable to be taken into account is the average income, which suggests that with a large population the statistical effect of both the rise and fall of pensions is partially diluted.

Benefits are somewhat lower in Seville (1,389), Valencia (1,362), Las Palmas de Gran Canaria (1,286), Málaga (1,284), Palma (1,282) and Murcia (1,246).

It should be noted that income is a little better in the Valencian capital than in the Andalusian capital, and also that Málaga falls below both Las Palmas and Murcia in this figure.

The data are very different if we look for the highest municipal benefits in each autonomy, as seen in this table.

North-south differences

“A key reading of this map is the north-south difference.

If you go to the unemployment rate you get practically the same map,” adds Bravo.

However, he highlights that this difference would be even more profound if it were not for the “income redistribution effect” of Social Security.

“It must be taken into account that many pensioners who live in rural areas or in the south developed their working lives in more economically developed areas.

Some will remain there until the end of their lives, but others return to their areas of origin.”

That is, a man from Cádiz who worked in a factory in Barcelona benefits Cádiz financially if he returns when he retires.

“There is a moderating effect of differences, a territorial redistribution.

Pensions are the most powerful income balancing mechanism that we have in Spain.

It is worth emphasizing it,” says Bravo.

Herce, along the lines of the CC OO unionist, believes that these territorial differences are the best argument in favor of the single pension fund.

“Many municipalities could not sustain their pensions with current salaries.”

He believes that to break the decadent dynamics of some areas “it is urgent that young people have quality opportunities throughout Spanish territory;

"Everything that happens in the pension system is caused by the labor market and everything that happens in it comes from education and training, which can be greatly improved in many territories."

“Social Security,” he continues, “is exhausted (one in every four euros of the pension bill is paid with taxes and public debt).

"It is necessary that jobs improve a lot."

Spain is one of the developed countries in which the most purchasing power has been lost during the price crisis, given that salaries have grown to a lesser extent.

“The challenge for the future,” adds the UGT representative, “is to delve deeper into increasing the system's income.

This involves an increase in salaries, so that there are no such precarious jobs that barely contribute to the Social Security fund.

“We need more income to pay more pensions.”

These contributory benefits make up the largest outlay by the State: 11.5% of the Spanish treasury is allocated to them, compared to 8% dedicated to education or 5% to health.

The forecast, given the profound aging of the population, is that this proportion will climb to 15% in the coming years.

Today pensions protect 9.2 million people in Spain, 19% of the population.

Follow all the information on

Economy

and

Business

on

and

X

, or in our

weekly newsletter

Subscribe to continue reading

Read without limits

Keep reading

I am already a subscriber

_