Of money

All articles

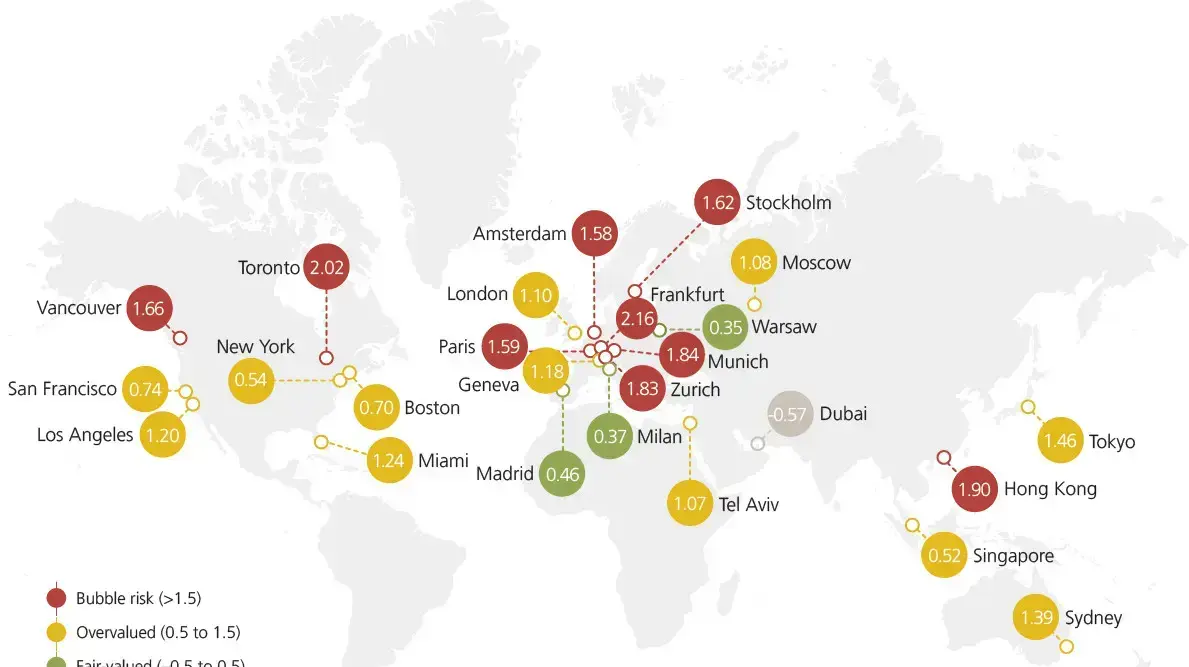

Real Estate Bubbles Index: Frankfurt at its peak, Tel Aviv in 17th place

UBS's global real estate bubble index predicts the likelihood of their formation in various parts of the world.

The corona effect is also evident for the first time: global demand for out-of-town housing is surpassing city centers

Tags

Real Estate

Real estate bubble

Overseas real estate

ubs

New York

Munich

Warsaw

Hong Kong

Walla!

Of money

Wednesday, 13 October 2021, 13:11 Updated: 14:02

Share on Facebook

Share on WhatsApp

Share on general

Share on general

Share on Twitter

Share on Email

0 comments

Zurich-based international finance firm UBS has released its 2021 Global Real Estate Bubble Index, the annual study by UBS Global Wealth Management chief investment officer, showing that on average, the risk of bubble formation has increased over the past year, as has the potential severity of repair. prices, many cities after which follows the index.

Frankfurt, Toronto and Hong Kong occupy the top places in the index of the current year, and three of them justify the assessments of the most prominent risk of a bubble in the housing markets surveyed. risk also increases in Munich and Zurich.

so in

Vancouver and Stockholm

, both Amsterdam and Paris complete the list of high-risk cities.

All cities surveyed in the US -

Miami

(which replaced Chicago this year),

Los Angeles, San Francisco, Boston and New York

- Located in the territory of overestimation.

The imbalance in the housing markets is also high in

Tokyo, Sydney, Geneva, London, Moscow, Tel Aviv and Singapore

, while

Madrid, Milan and Warsaw

are left with a fair valuation.

Dubai

is the only market with an underestimation, and also the only one categorized in a lower category than last year.

More on Walla!

Rebbe Rabbi Pinto: "This is how you will be doctors of the period"

To the full article

Map of the dangers of creating a real estate bubble (Photo: UBS)

Rise in apartment prices, the question is until when?

Growth in housing prices jumped by about 6% in inflation-adjusted terms between mid-2020 and mid-2021. All but four cities - Milan, Paris, New York and San Francisco - experienced a rise in housing prices. Five cities even showed double-digit growth: Moscow, Stockholm and the cities in the Pacific: Sydney, Tokyo and Vancouver. It was a combination of special circumstances that ignited this price race.

Claudio Safotelli, director of real estate at UBS Global Wealth Management

, explained: "The Corona plague has imprisoned many people within the four walls of their homes, stressing the importance of their living space and leading them to be more willing to pay for housing." As a result, financing conditions, which were already quite good, improved even more as it became easier to obtain loans from homebuyers, moreover, higher savings rates and yield-providing stock markets released additional capital in favor of buying apartments.

Cities of the world according to the risk factor for the formation of a real estate bubble. Tel Aviv with a slight (positive) decline, to 17th place (Photo: UBS)

More leverage, more risk

Today, the lower cost for real estate owners compared to rents, along with the expectation of a steady rise in housing prices, makes apartment ownership attractive to households, regardless of price levels and leverage. This logic may maintain the current state of the markets, but economies The home must borrow increasing amounts of money to keep pace with rising real estate prices.

In fact, unpaid mortgage growth has accelerated in recent quarters almost everywhere, and debt-to-income ratios have also grown. Overall, housing markets have become even more dependent on extremely low interest rates, so tightening lending terms could lead to a sharp halt in price increases in most markets. Despite this, leverage and debt growth rates in many countries are still well below their all-time highs. From this point of view, the housing market is not expected to cause severe disruptions in the global financial markets.

The first time we have demonstrated the underperformance of the urban housing market in the last 25 years in

addition to the lower financing costs, the urbanization process has in the last decade been the main axis for the rise in housing prices in city centers. However, urban life has suffered a considerable blow due to the closures.

Economic activity has spread from the city centers outwards, towards the suburbs and their (sometimes distant) satellite cities - and so has the demand for housing. As a result, for the first time since the early 1990s, housing prices in non-urban areas have risen faster than within the cities themselves, in the last four quarters.

While some of these effects may be transient, this reversal weakens the argument for a rise in seemingly guaranteed housing prices in city centers. The impact of this development will probably be even greater in areas with populations that step on the spot and even shrink (for example, in Europe), since supply will be easier to maintain the pace of demand.

Matthias Holzie, lead author of the study and head of real estate in Switzerland at UBS Global Wealth Management

, concludes: "There is a growing likelihood of a weak period in the urban housing market"

Times Square in New York: Still Too Expensive, and Despite This, U.S. East Coast cities have shown relative stability over the past five years (Photo: ShutterStock)

USA: City of Angels is developing a bubble?

The index ratings in East Coast cities have been relatively stable over the past five years.

In contrast, West Coast markets have evolved less consistently.

In Los Angeles, the index continued to grow, while in San Francisco valuations fell due to falling housing prices.

Overall, the decline in mortgage rates to historically low levels has supported U.S. housing prices. But price changes in the cities surveyed are keeping pace with the national average. The

continued migration to lower-cost countries that are also more tax, business and regulatory friendly has accelerated this trend.

Marian-Platz in the heart of Munich, Germany.

Continues to be among the cities with the highest real estate prices in Europe (Photo: ShutterStock)

Europe: Illusions about London

The imbalance continues in the skies in

Frankfurt, Munich, Paris and Amsterdam

, cities that are at the heart of the Eurozone. The housing markets continue to be affected by the negative interest rate policy and favorable lending conditions of the European Central Bank.

Rising prices have slowed in the past year and started lagging behind national averages, respectively, as city centers have become less accessible in terms of price and demand has moved towards the suburbs and satellite cities. Despite this, price correction is not expected as long as job creation in these cities continues to be strong and interest rates remain negative.

In contrast, the housing markets of

Milan and Madrid

suffered a severe blow due to the plague. The tight and lengthy closures halted the recovery of the housing market. A period of healthy and sustainable economic growth is needed to drive prosperity in the housing sector in these cities.

Although price growth in

London

Still trailing behind the national average, the plague has caused the housing market in this city to bottom out and remain in a state of overestimation.

The growth of flexible models of apartments and offices has driven an increase in demand and accelerated the rise in prices of more spacious homes and more affordable prices (i.e., outside the city center).

In contrast, the housing market in central London has taken a particularly hard hit from the Corona.

Moscow and Stockholm, which enjoy favorable financing terms, recorded the highest price growth rates among the cities surveyed over the past four quarters, and the market imbalance soared sharply.

The

Warsaw

housing market was

left with a fair appreciation of prices as price growth began to lag behind the national average.

The promenade in Tel Aviv: The real estate market is approaching the point of risk (Photo: ShutterStock, Shutterstock)

Middle East: Tel Aviv is approaching a high level of risk

In Tel Aviv

, falling mortgage rates and rapid population growth have pushed prices up.

Moreover, the government has reduced the purchase tax of second homes, which has also encouraged speculation in the housing market as this market gets closer again to the territory of bubble risk.

As a result, the market is now experiencing high overestimation.

In contrast, prices in

Dubai

still continued to fall towards the end of 2020, and the market is now under-underestimated.

The increase in availability due to favorable prices, the lighter mortgage regulations, the rise in oil prices and the economic rebound - all of these seem to have finally initiated a kind of recovery.

Although the pace of construction has slowed, the fundamentally unlimited supply poses a risk to the prospect of rising prices in the long run

Hong Kong, according to the report, is the only market in Asia that is at risk for a real estate bubble (Photo: ShutterStock)

Asia-Pacific: Beware of Hong Kong

The market imbalance increased between mid-2020 and mid-2021 in all Asia-Pacific cities surveyed.

Hong Kong

is the only market in the risk zone for the bubble, despite three years of real estate prices almost in place. But the housing market is showing signs of renewed warming. Price growth has accelerated, and sales have reached an all-time high, thanks in part to solid demand Luxury and real estate at high prices.

However, the government is eager to actively increase the supply of new dwellings in the medium to long term, which could lead to structural effects of price impairment. Housing prices and income growth in

Singapore have

matched each other for over two decades. But since 2018, there has again been a stronger growth in prices as the city has benefited from the increase in demand from foreign nationals.

The market is now in the territory of some overestimation, as prices have started to leave rent and income behind. But the imbalance still seems modest compared to most of the other cities surveyed in our study.

The repair period of the housing market in

Sydney

was short. More favorable loan terms and lower interest rates by the Reserve Bank of Australia have led to market reflection. Without a turnaround in interest rates, the upward trend in house prices that has been going on for a decade is expected to continue, given the continued growth of the population.

Real estate prices in

Tokyo

have been growing almost continuously for more than two decades, benefiting from attractive financing conditions and population growth.

Zurich, beautiful, expensive and exposed to change in interest rates rising around the world (Photo: ShutterStock, Shutterstock)

Switzerland: Zurich continues to lead

UBS devotes an extensive chapter in the report to its addict, Switzerland:

housing in

Zurich

remains in the bubble risk zone, and its rating soared sharply between mid-2020 and mid-2021. The market has warmed excessively, and proposed housing volumes have fallen to an all-time low.

Especially when it comes to the process of bidding, buyers are at risk of paying exorbitant prices relative to other areas in Switzerland, as expectations of price increases are rooted there deep in the mind.

Moreover, Zurich has the highest price-to-rent ratio of all the cities surveyed, making the market there very vulnerable to rising interest rates.

Zurich's price and index ratings continue to be higher than those of Geneva.

The

Geneva

rankings

The index has been rising gradually since 2018, and it is an overvalued territory.

Prices reached an all-time high and even surpassed the previous record from 2013.

Since Geneva's rental market is highly regulated, and rents there are inflated, apartment ownership is still considered attractive, a fact supported by historically low mortgage rates.

In both cities a broad correction of the market is not expected in the short term.

Geneva continues to enjoy its relative stability and international status, and Zurich maintains great attractiveness as a place to conduct business and also now enjoys solid growth in employment rates.

But in the long run there is cause for concern regarding these two cities.

If interest rates continue to rise and demand growth continues to migrate to the suburbs and the periphery given the high prices in city centers, inflated prices today will not be able to be sustainable.

Share on Facebook

Share on WhatsApp

Share on general

Share on general

Share on Twitter

Share on Email

0 comments