The Swiss finance minister said the Swiss economy would likely have collapsed if Credit Suisse had gone bankrupt, in an interview published by the daily

Le Temps

.

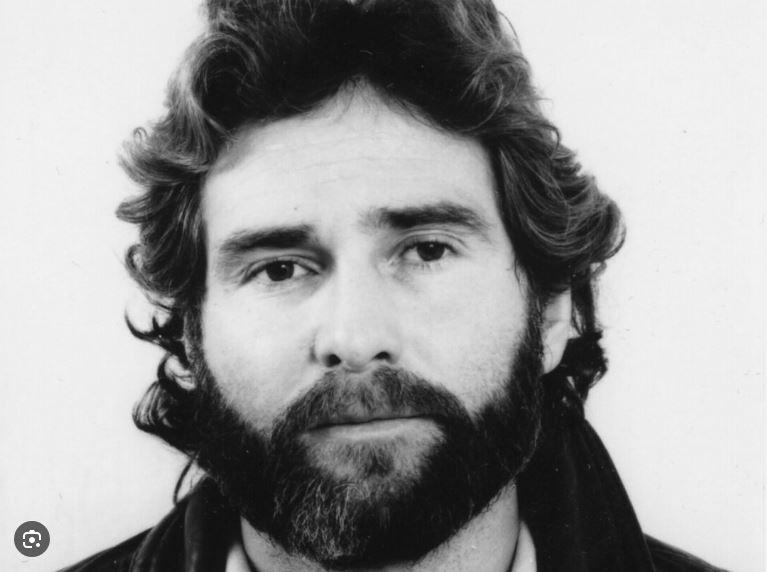

Karin Keller-Sutter said the government acted in the best interest of the country by quickly arranging the takeover of Switzerland's second-largest bank by UBS, its main rival in the country.

Following fears of a global banking crisis last month, investor confidence in Credit Suisse plummeted on March 15 as the government orchestrated a takeover the weekend before markets reopened on March 15. March 20.

Some 109 billion Swiss francs ($120 billion) have been put on the table, between government guarantees and liquidity made available by the Swiss central bank.

"

Given the circumstances, we have acted as best we can to minimize the burden for the state and taxpayers

," said Karin Keller-Sutter.

“

We must not forget that without determined intervention by the authorities, the alternative would have been a bankruptcy of Credit Suisse on Monday morning, accompanied by a probable collapse of the Swiss economy,

” she argued.

“

Why?

Because over the years there has been a culture that seems to have created the wrong incentives.

Because there have been a lot of scandals

,” said the minister.

Read alsoUBS calls for help from its ex-boss to digest Credit Suisse

Too early to talk about the future structure of UBS

Like UBS, Credit Suisse is among the 30 banks worldwide deemed to be of global importance to the international banking system and therefore too big to fail.

But in recent years it has become mired in a series of scandals and when three US regional banks collapsed in March it emerged as the weak link in global finance.

Talks for its takeover by UBS were hastily conducted at the Finance Ministry, held by Karin Keller-Sutter in Bern and the $3.25 billion deal was announced on the evening of March 19.

As to whether executives would be brought to justice, the minister replied: “

It is difficult and complex

”.

She felt that the government's priority was to complete the merger.

UBS had indicated on Wednesday that it should complete the takeover in the coming months.

The finance minister told the newspaper that it was too early to talk about the future structure of UBS, which will become a megabank with some $5 trillion in invested assets.

Karin Keller-Sutter clarified that the government should analyze what happened in full, then adapt the regulations on banks considered too big to fail "Let's not forget that

we faced a crisis of confidence and as I said on March 19, trust cannot be regulated

,” the minister said.