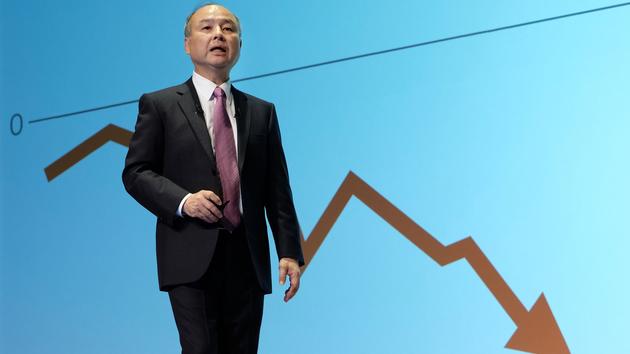

Certainly, everything is disproportionate in Masayoshi Son. The charismatic Japanese boss of SoftBank Group, known for betting billions of dollars on Uber or WeWork, is paying a heavy price today for the current crisis. His group expects a net loss of nearly $ 7 billion (6.3 billion euros) for the fiscal year ending in March.

Mainly involved, a massive depreciation of $ 17 billion in its "Vision" fund specializing in tech, all due to "a degraded environment ," said the group in a statement released Monday evening. With $ 100 billion in wagers, it is the largest tech investment vehicle in the world. Today, observers say, this plunge must have wiped out all of its previous gains. The fund, which was designed to make investments over twelve years in a hundred companies with high potential, therefore risky, has lost about 6% since its creation in 2017. But the valuation of SoftBank Group, it plunged 30 % in one year.

Despite billions of dollars in losses, the situation is not dramatic

Pierre Ferragu, New Street Research"The Vision Fund made a very honorable start ," recalls Pierre Ferragu, associate director at New Street Research. But since last summer, he lost his earnings. The failed IPO of Uber, the problems of WeWork, the bankruptcy of OneWeb: this information represents billions of dollars in losses. But in reality, it is not dramatic. ” To hear the analyst, the coronavirus only accelerates the correction observed on technology companies like Uber or WeWork.

“Unchanged” vision

Masayoshi Son does not seem to want to go against the bursting of this bubble. In November, he warned that he would not hand over a dollar in plans to bail out his stakes. He let the German OneWeb sink, which filed for bankruptcy in late March. In an interview with Forbes magazine, the Japanese magnate even indicated that he envisioned that a dozen of his holdings would stay on the carpet during this crisis. But his vision remained "unchanged" , he assured.

"We must not analyze the Vision fund like a classic fund ," continues Pierre Ferragu. In the world of tech, we do not try not to make an investment error, but not to miss a nugget, even if it means seeing a lot of it. The investment vehicle is programmed to make a hundred investments over twelve years. If only 15 of these participations succeed, it will do much more than compensate for the 25 or 30 others who will finish on the carpet. In a word, it will win even if a third of its interests file for bankruptcy. ”

The virus has simply revealed which societies are most fragile

Duncan Davidson, investor at Bullpen CapitalOthers point to drifts in Masayoshi Son's strategy. It would have notably fueled the bubble on tech unicorns (companies valued at more than a billion dollars). "It would have exploded without even the virus ," said Duncan Davidson, an investor at Bullpen Capital, quoted by the New York Times . The virus has simply revealed which societies are most fragile. ”

Observers also wonder about the debt accumulated by SoftBank. This amounts to $ 180 billion (consolidated debt). It is to reimburse part of it, as well as to raise the SoftBank Group share price, that Masayoshi Son recently announced a large asset sale program of $ 41 billion over the next twelve months. He thus yielded to pressure from the activist fund Elliott, which demanded such a measure. Finally, the Japanese billionaire had to personally pledge up to 60% of his shares in SoftBank with his borrowers, when the value of the latter was at its lowest in mid-March.