Washington Correspondent

The end of the key rate hike, the fastest achieved by the US central bank in forty years, is approaching.

If market expectations are correct, this Wednesday in Washington, the Federal Reserve Monetary Committee should raise the Fed Funds rate by 0.25%.

The Fed ensures that the nine rate hikes carried out since March 2022 are starting to bear fruit and that an upcoming break is possible.

Over the past few weeks, in their public statements, senior Fed officials, with some nuance, have done everything to encourage people to believe that their intention was to raise by 0.25% this rate at which they let banks lend. very short-term cash.

The suspense mainly concerns the degree of certainty of the Fed on the continuation.

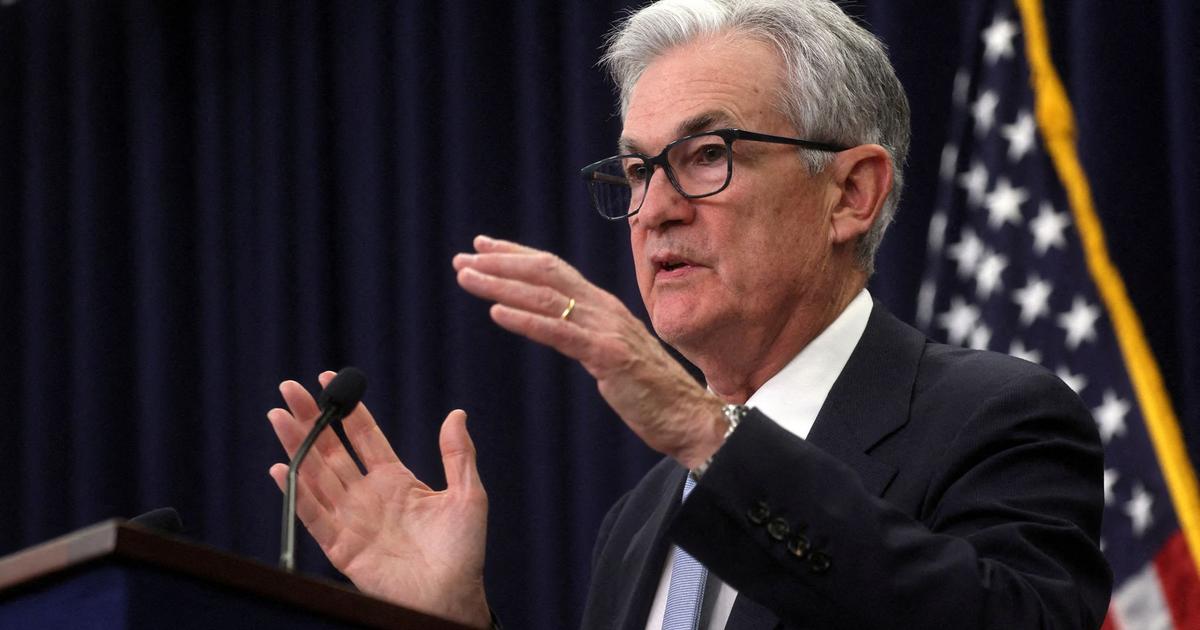

Jerome Powell, the boss of the central bank, will do everything to preserve the unanimity of the monetary committee in its decision.

He feels that as the risk…

This article is for subscribers only.

You have 85% left to discover.

Want to read more?

Unlock all items immediately.

TEST FOR €0.99

Already subscribed?

Login