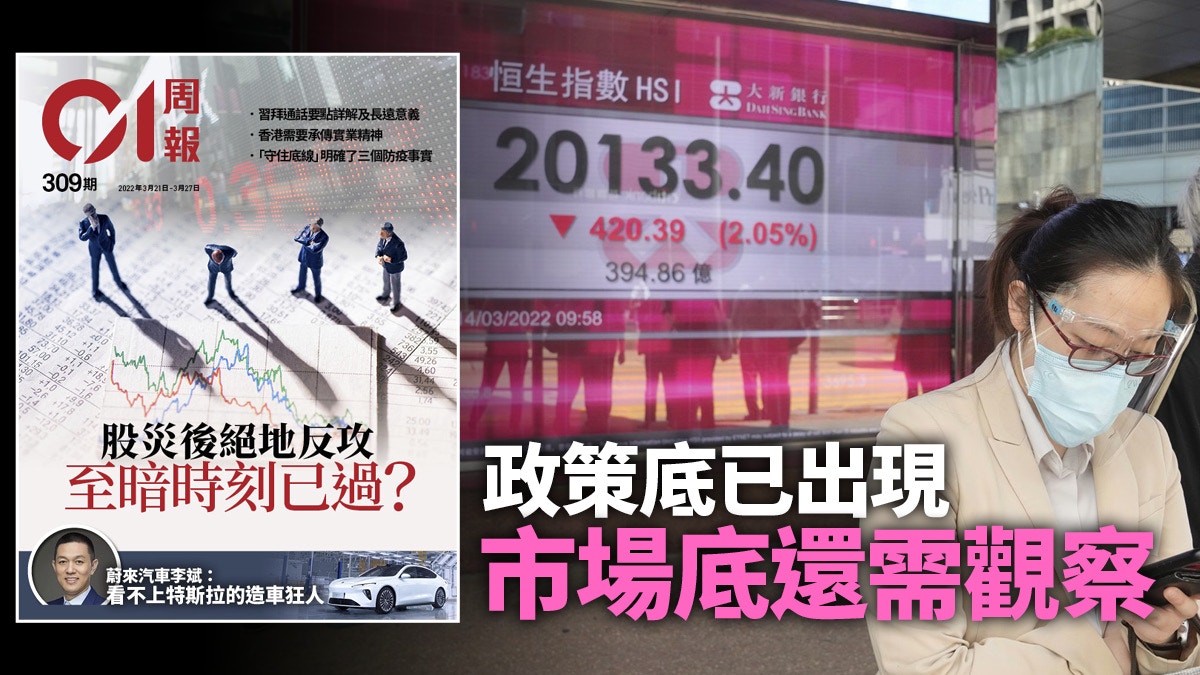

Last Monday (March 14), the Hang Seng Index fell 4.97%, or 1022.13 points.

Last Tuesday (March 15), the Hang Seng Index once fell by nearly 5% at the opening, and then staged a V-shaped rebound, but fell again in the afternoon, and finally fell 5.72%, or 1116.58 points.

It has dropped 2138.71 points in two days, which can be called a "stock crash".

Hong Kong stocks ushered in a retaliatory rebound after plunging thousands of points for two consecutive days.

The Financial Stability and Development Committee of the State Council held a special meeting last Wednesday (March 16) to study the current economic situation and capital market issues and greatly stabilize market confidence.

Then for two consecutive days, the Hang Seng Index rose by 3086.15 points, and the Hang Seng Technology Index rose by more than 20% on the 16th.

Although the market made a technical correction last Friday (March 18), the Hang Seng Index stood above 21,000 points, riding a roller coaster throughout the week, up 858.61 points.

In contrast, the Asian financial crisis in 1997 and the subprime mortgage crisis in 2008 both caused Hong Kong stocks to plummet, and the next day after the plunge, the market retaliated.

Series reports:

After the stock market crash, the dark moment of the Jedi counterattack has passed?

Foreign media listen to the wind and rain, foreign capital maliciously shorts

Listen to what they say and watch what they do to maintain the market. Actions speak louder than words

On March 16, the Hang Seng Index soared 1,672.42 points, or 9.08%, to close at 20,087.5 points.

(China News Agency)

Cancellation of provident fund hedging is not appropriate to make up for the loss of conversion

Last Friday (March 18), the Legislative Council's Bills Committee on the Employment and Retirement Schemes Legislation (Offset Arrangements) (Amendment) Bill 2022 held its first meeting via video to discuss the imminent implementation of the abolition of the Mandatory Provident Fund. Act on "hedging" arrangements.

Regarding the commitment to cancel the "hedging" arrangement of MPF, the former Chief Executive Leung Chun-ying proposed in his 2012 election platform to "gradually reduce the employer's accumulated contribution benefits in MPF accounts to offset employees' long service payment and severance payment" ", and in his last "Policy Address" in 2017, he directly suggested that the "hedging" arrangement should be phased out.

However, it was during the ten years when the bill was being prepared that more and more employees in Hong Kong had their MPF funds "hedged" by their original employers...

Please

click here

to read the full text.

Ten years into the preparation of the abolition of the Mandatory Provident Fund "Hedging" Arrangement Act, an increasing number of employees in Hong Kong are "hedging" their MPF funds by their former employers.

(file picture)

Anything that lasts must be moderate and sustainable: what kind of epidemic prevention does China need

In the past few days, epidemics have occurred in many places in mainland China, and the epidemics in Jilin, Shenzhen, Shanghai and other places have received particular attention.

In the early morning of last Monday (March 14), Zhang Wenhong, director of the Department of Infectious Diseases at Huashan Hospital Affiliated to Fudan University, posted "The most difficult period in the two years since the fight against the epidemic is a long winter night or a cold spring." There is an objective analysis of the situation, the current characteristics of the new coronavirus, and the road to epidemic prevention in mainland China in the future.

Regarding the current local epidemic situation in mainland China, Zhang Wenhong wrote: "Due to a large number of cases in a short period of time, it is inevitable that all parts of the country will be a little panicked, and Shanghai is no exception. Shanghai's precise prevention and control is in this Omicron BA. .2 At the time of the spread, due to the sudden occurrence, the late start, and the fast virus, it is still in the stage of running with the virus, and it is very difficult."

Please

click here

to read the full text.

Zhang Wenhong said that if the epidemic prevention policy is released quickly, a large number of people will be infected in a short period of time, and even a low case fatality rate will cause a run on medical resources and a short-term shock in social life.

(file picture)

How does China establish a different style of great power diplomacy?

China has tried many times in recent years to establish a diplomatic demeanor and ideology that vetoes Western oligopoly, but at the same time roughly maintains the existing multilateral order.

Of course, they may not be fully reflected in the facts - there is a gap between political theory and facts in essence, this is not a phenomenon unique to any country, but a fact that is ubiquitous in international relations - but if we start from a more objective but also At the same time, from the perspective of my country as its own, it is a relatively fair starting point and the basic premise for constructing a reasonable and reasonable foreign policy to comment on and examine its choices for different international conflicts and wars based on the diplomatic thinking advocated by our country.

Global public opinion focuses on how to sanction Russia, which will increase Russia's dependence on China in the short and medium term, and will also strengthen Putin's comprehensive attack on Ukraine.

(Associated Press)

Li Bin of Weilai Automobile: A car maker who doesn't like Tesla

NIO, which has been waiting for a long time, is finally officially listed on the Hong Kong Stock Exchange. This is the fourth listed company of 48-year-old Li Bin, and it is probably the most difficult one in the listing process. In order to successfully list in Hong Kong, NIO chose to go public. Listed by the "Introduction to Listing" method without financing at all.

However, the timing of NIO's listing in Hong Kong stocks is extremely unfavorable. Not only is it impossible to obtain financing, but the market environment is also very unfavorable. The entire Chinese concept stocks are at the lowest stage in history.

The stock price of Weilai's US stock has fallen from the highest level of US$67 a year ago to less than US$20, and the market value has evaporated by more than 60%, which means that Li Bin's personal wealth has shrunk significantly.

As a big boss who has been on the road to entrepreneurship, observing Li Bin's life ups and downs has long been connected with the ebb and flow of Chinese business.

(file picture)

Please pay attention to the 309th issue of "Hong Kong 01" e-Weekly Newsletter published on March 21, 2022. You can also

click here

to try out the weekly e-newsletter to read more in-depth reports.

/cloudfront-eu-central-1.images.arcpublishing.com/prisa/3I74UEXLYRBBRPGPSGWNN6WXH4.jpg)

/cloudfront-eu-central-1.images.arcpublishing.com/prisa/PMIQEKJBGXKRGJ5GOOQUIJD4YI.jpg)