The Association of Industrialists joins the calls of the ultra-Orthodox, and demands that the new government that be formed abolish the tax on sugary drinks - which will probably be one of the first steps that the emerging coalition will take.

The association explains that not only has the tax not proven itself, and the public has not reduced the consumption of sugary drinks - but also that the tax rate in Israel is high compared internationally.

Among the countries examined by the Food Association in the Federation, the tax in Israel is the highest, and only Ireland is above Israel - with a $0.34 tax on every 100 ml of a drink that contains more than eight grams of sugar.

The involvement of the manufacturers' association is quite understandable - the bodies it represents also include beverage manufacturers, such as the Central Beverage Company (Coca-Cola), Primor and more.

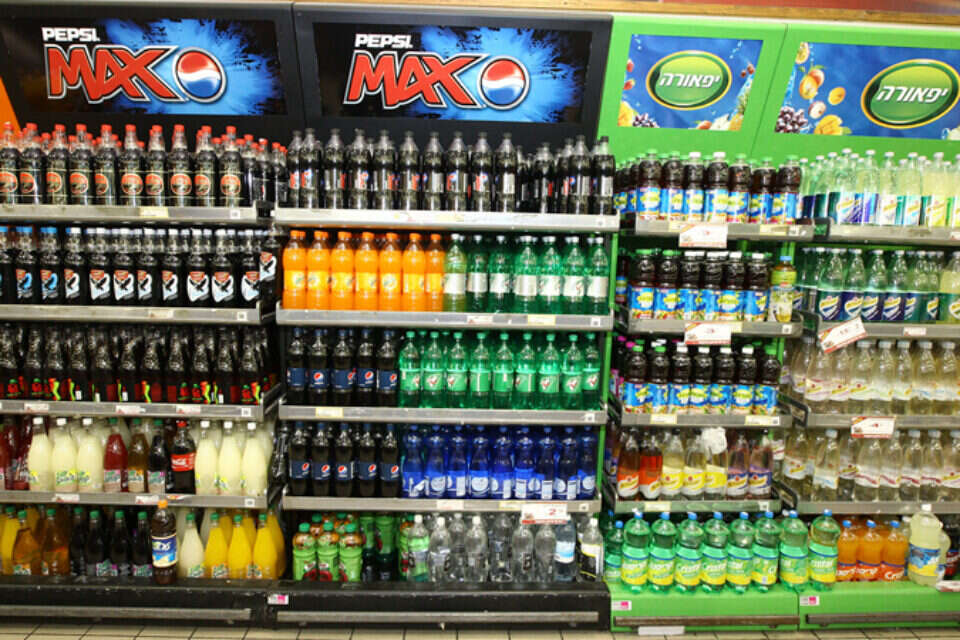

Coca Cola bottles // Photo: Reuters // Coca Cola bottles // Photo: Reuters

The public was harmed

However, the president of the association, Dr. Ron Tomer, explains that these companies were not really harmed as a result of the imposition of the tax, but that the public was harmed. According to him, it is not certain that the beverage companies in general suffered real damage, because this tax is passed on to the consumer, and consumption probably did not decrease That is, damage was caused to the public.

Tomer continues: "The experiment of the tax on sweet drinks in Israel was not successful. We do not really see a real decrease in sugar consumption. The only decrease was in the Arab sector, but this was not due to the fact that this population began to consume less sugary drinks, but because there was more smuggling from Ramallah, and there is We have proof of that."

Tomer explains his commitment to the abolition of the tax by his support for the free economy, and not "unnecessary" taxes, as he put it: "It is an unnecessary tax, which brought into the state coffers three times more than the Treasury predicted. That is, we will not do anything here except collect excess from the public. Tomorrow you will be taxed if you do not exercise three times twice a week, or if you sleep fewer hours at night. This is neither my way nor my economic means," Tomer continues, suggesting: "The state does need to invest money in educating the public for proper health, but not through a tax. This tax is an unnecessary burden, and the government that will be formed should bring Here comes a liberal economy and a free market. Such unnecessary taxes should be avoided."

Dr. Ron Tomer, President of the Federation of Manufacturers: "Abolish the sabbath in the elections", photo: Yossi Aloni

As mentioned, Tomer calls on the new government to abolish the tax on sugary drinks.

However, it is important to mention that the prevalence of overweight and obesity in children according to OECD data for 2019 was about 38% in the ages 5-9, 8th place out of 35 OECD countries and that about 60% of men and 55% of women from the adult population suffer from overweight and obesity remainder.

We will also note that obesity is the most significant risk factor for diabetes, it increases the chance of getting this disease 8.7 times.

This means that the abolition of the tax on sugary drinks without other measures to be taken at the same time with the aim of encouraging the public to consume less sugar, could constitute harm to public health.

were we wrong

We will fix it!

If you found an error in the article, we would appreciate it if you shared it with us