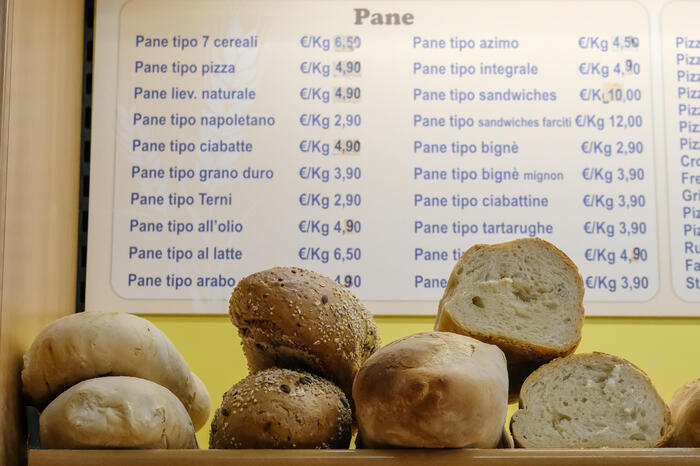

Reduction or elimination of VAT on bread, milk, pasta and baby products. But also tightening on basic income and cutting the wedge by three points, instead of two, and 103 for pensions. These are the new measures that could enter the maneuver

according to what emerged during the government meeting.

The hypothesis of a tax shield for the return of capital from abroad is no longer in sight, while an intervention on tax credits up to 2015 is confirmed

: the package has yet to be defined but the possibility remains that for amounts under one thousand euros there will be an excerpt;

alternatively there may be a reduced payment.

For higher amounts, however, there is a reduction of penalties and interest to 5%.

Energy remains the chapter that drains the bulk of resources, committing over 21 billion out of a total that should be around 30. With a mantra that proves decisive in choosing what to add and what to remove: "prudence" in view of a budget law which, however, Prime Minister Giorgia Meloni also wants to support families, with measures for one billion, and to give relief to the weakest groups.

The approach of the maneuver is "prudent" also reiterated the Minister of Economy Giancarlo Giorgetti,

who appeals to the political forces: "I am confident that they will responsibly support this approach".

The priority is to support the weakest groups and businesses, the minister assures, also announcing a larger cut in the wedge than expected so far (three percentage points) and the increase in the tax credit thresholds from 30 to 35%.

The government wants to hurry and has undertaken to bring the maneuver to the cabinet on Monday (but it is not excluded that it will go on Tuesday).

To pull the strings, the premier brought together the majority group leaders, the deputy premiers and the economy minister Giancarlo Giorgetti in the evening (who had already discussed the dossier with Salvini in the morning).

A summit that came at the end of a whirlwind of meetings for the premier,

who spent the day in the Chamber engaged on equally hot topics, from migrants to autonomy.

Meanwhile, in the evening, the head of state signed the aid decree quater, which can then be published in the Gazette more than a week after its launch in CDM.

The discussion on the maneuver would have brought out the crux of the tax shield for the return of capital abroad: a measure that is heading towards a stop and on which the intention to start a reflection on the tools to bring out the undeclared capital.

Another stumbling block concerns pensions, with Forza Italia pressing for the minimums: the money (it would be 2 billion), "is found", assures the parent company to Montecitorio Cattaneo.

The package of measures intended for families is also rich.

Starting from the reduction or elimination of VAT on bread, pasta and milk (currently only for one year);

the tax will instead drop to 5% on baby products and sanitary towels.

More substantial family allowances are also envisaged for those with more than 4 children or twins.

On the pension front, for overcoming the Fornero, the goal is 'quota 103' (41 years of contributions and 62 of age), in addition to the extension of the Ape sociale and the Women's Option.

The flat tax will be extended (the threshold rises from 65 to 85 thousand euros and the 'incremental' tax on income from the previous three years arrives), but only for the self-employed, while for employees there is a move towards a reduction in taxation on productivity bonuses.

There is also the hypothesis of a tax on home deliveries to encourage local trade.

VAT on bread, pasta and milk (currently only for one year);

the tax will instead drop to 5% on baby products and sanitary towels.

More substantial family allowances are also envisaged for those with more than 4 children or twins.

On the pension front, for overcoming the Fornero, the goal is 'quota 103' (41 years of contributions and 62 of age), in addition to the extension of the Ape sociale and the Women's Option.

The flat tax will be extended (the threshold rises from 65 to 85 thousand euros and the 'incremental' tax on income from the previous three years arrives), but only for the self-employed, while for employees there is a move towards a reduction in taxation on productivity bonuses.

There is also the hypothesis of a tax on home deliveries to encourage local trade.

VAT on bread, pasta and milk (currently only for one year);

the tax will instead drop to 5% on baby products and sanitary towels.

More substantial family allowances are also envisaged for those with more than 4 children or twins.

On the pension front, for overcoming the Fornero, the goal is 'quota 103' (41 years of contributions and 62 of age), in addition to the extension of the Ape sociale and the Women's Option.

The flat tax will be extended (the threshold rises from 65 to 85 thousand euros and the 'incremental' tax on income from the previous three years arrives), but only for the self-employed, while for employees there is a move towards a reduction in taxation on productivity bonuses.

There is also the hypothesis of a tax on home deliveries to encourage local trade.

the tax will instead drop to 5% on baby products and sanitary towels.

More substantial family allowances are also envisaged for those with more than 4 children or twins.

On the pension front, for overcoming the Fornero, the goal is 'quota 103' (41 years of contributions and 62 of age), in addition to the extension of the Ape sociale and the Women's Option.

The flat tax will be extended (the threshold rises from 65 to 85 thousand euros and the 'incremental' tax on income from the previous three years arrives), but only for the self-employed, while for employees there is a move towards a reduction in taxation on productivity bonuses.

There is also the hypothesis of a tax on home deliveries to encourage local trade.

the tax will instead drop to 5% on baby products and sanitary towels.

More substantial family allowances are also envisaged for those with more than 4 children or twins.

On the pension front, for overcoming the Fornero, the goal is 'quota 103' (41 years of contributions and 62 of age), in addition to the extension of the Ape sociale and the Women's Option.

The flat tax will be extended (the threshold rises from 65 to 85 thousand euros and the 'incremental' tax on income from the previous three years arrives), but only for the self-employed, while for employees there is a move towards a reduction in taxation on productivity bonuses.

There is also the hypothesis of a tax on home deliveries to encourage local trade.

On the pension front, for overcoming the Fornero, the goal is 'quota 103' (41 years of contributions and 62 of age), in addition to the extension of the Ape sociale and the Women's Option.

The flat tax will be extended (the threshold rises from 65 to 85 thousand euros and the 'incremental' tax on income from the previous three years arrives), but only for the self-employed, while for employees there is a move towards a reduction in taxation on productivity bonuses.

There is also the hypothesis of a tax on home deliveries to encourage local trade.

On the pension front, for overcoming the Fornero, the goal is 'quota 103' (41 years of contributions and 62 of age), in addition to the extension of the Ape sociale and the Women's Option.

The flat tax will be extended (the threshold rises from 65 to 85 thousand euros and the 'incremental' tax on income from the previous three years arrives), but only for the self-employed, while for employees there is a move towards a reduction in taxation on productivity bonuses.

There is also the hypothesis of a tax on home deliveries to encourage local trade.

on income for the previous three years), but only for the self-employed, while for employees there is a move towards a reduction in the taxation of productivity bonuses.

There is also the hypothesis of a tax on home deliveries to encourage local trade.

on income for the previous three years), but only for the self-employed, while for employees there is a move towards a reduction in the taxation of productivity bonuses.

There is also the hypothesis of a tax on home deliveries to encourage local trade.

And if the revision of the citizenship income (with a tightening to limit it to residents in Italy) will guarantee coverage on the pension dossier, other resources are expected from the restyling of the extra profits, with a calculation based on profits and a tax raised to at least 33%.