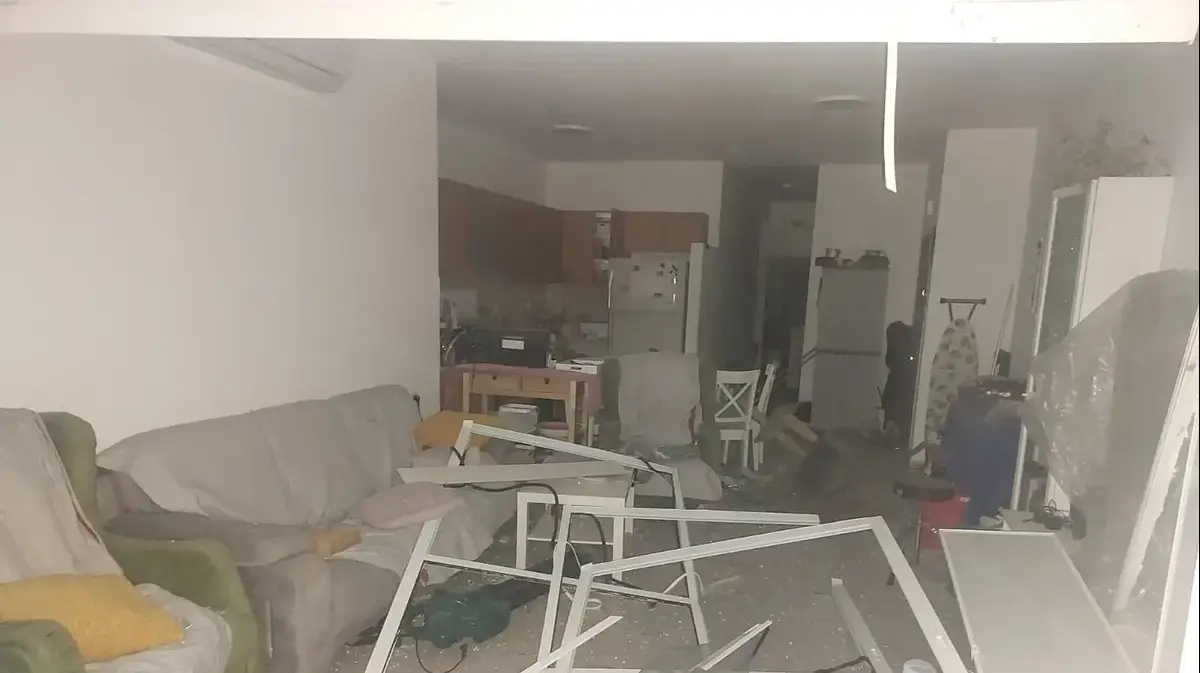

Rocket hits a building in Ashkelon, Operation Shield and Arrow. May 10, 2023 (Photo: official website, Ashkelon Municipality Spokesperson's Office)

Unfortunately, topical: In recent days, following the beginning of Operation Shield and Arrow, the Israel Tax Authority has updated the guide for receiving financial compensation from the state for Israeli citizens whose property was damaged as a result of acts of war or hostilities.

The information presented in the guide is intended to assist Israeli civilians whose property was damaged in acts of war or hostilities. The Tax Authority writes that the state has taken upon itself, by law, to compensate citizens for any damage caused to you as a result of such an action, in order to restore the situation to its previous state as quickly as possible.

The guide is divided into several categories, which talk about receiving compensation during wartime or as a result of hostilities in routine times, as well as how to act in cases of damage to the vehicle, furniture, structure, etc.

Here is the full guide, as published on the Tax Authority website:

Making a Claim for Wartime Damage

Near the time of the incident, as soon as possible by the security forces, members of the Tax Authority's Property Tax Compensation Fund arrive at the affected area together with appraisers and engineers. The teams move between the affected apartments, businesses or offices, explaining their rights to those affected and instructing them how to file a claim.

Important - Do not remove equipment, inventory, waste or any foreign object found in the residence or business, without prior coordination with an appraiser on behalf of the compensation fund. It is forbidden to repair without an appraiser's inspection.

Filing a claim for damage caused during hostilities or terrorist attacks

When damage is caused in a hostile act or attack, for example: damage from stone throwing, small arms fire, Molotov cocktails and others If members of the Compensation Fund (Property Tax) do not arrive at the area, the victims must go to one of the real estate taxation and income tax offices, with a police certificate confirming that the damage caused to property is due to hostilities or an attack.

The documents listed below must be attached, depending on the nature of the damage (vehicle, structure or other). A real estate tax or income tax officer will open a claim for the damage and refer you to the appropriate entity for further treatment.

More in Walla!

Shahal's TripleSafe - 3 life-saving devices, and now one as a gift

Presented by Shahal

You can: Make a claim online

You can file an online claim for direct damage through an online application, which is available on computers, cell phones and the Authority's app. The application includes a video tutorial, showing the process of filling out a claim and submitting it.

Filing a claim is relatively easy and convenient. A number of data must be filled in, for example: type of claim (vehicle or agriculture, etc.); type of direct damage (private or business); The details of the damage and the details of the damage must be specified; The claim data may be saved as a draft, until its final approval and submission to the Authority; Upon sending the online claim, a claim number is received, through which it is possible to find out the progress of its processing.

What are the timetables for filing the claim?

Theinitial noticeof damage must be submitted within two weeks of the date the damage occurred; Theclaim for compensation must be filed within three months from the date the damage occurred.

In cases of structural damage

After submitting the claim, employees of the compensation fund (property tax) together with professionals will visit you and conduct an appraisal - calculating the value or value of the building.

The appraisal will assist in determining financial compensation, in order to rehabilitate and repair the damage with the help of professionals, of your choice.

Victims can choose between self-rehabilitation (you will take care of repairing the damages) or rehabilitation by rehabilitative companies, which operate on behalf of the compensation fund.

Damage to household items in residential apartments

Compensation for damaged household items is paid in accordance with the regulations, according to the price list of types of "household items" and family size, up to the ceilings listed in the table below (updated as of January 1, 1).

In any case, there is no entitlement to compensation for cash, checks, jewelry, antiques and art objects damaged in the incident.

The amounts are listed in the attached table:

Details of compensation: damage to household items in residential apartments (screenshot, Israel Tax Authority)

For your information: A resident who wishes to insure his household belongings at a value higher than the value specified in the regulations may do so by paying a premium of 0.3% of the additional value of his belongings, the additional value will not exceed, in total, NIS 944,881;

As appears in the manual "Authority insurance of household objects against war damage" - you can expand the insurance coverage of "household items", by paying a nominal premium by filling out an online declaration form; The value of compensation for damaged household items will be determined according to the value of the repair.

In the event that, in the opinion of the manager of the compensation fund (property tax), the object cannot be repaired - the value of the compensation will be in accordance with the value of a similar and new household object in its place;

Damage caused to vehicles

Owners of vehicles damaged in hostilities should contact employees of the compensation fund at the site to assess the damage. From there, they will be directed immediately to repair the damage, in any garage they choose, provided that the appraiser from the Compensation Fund (Property Tax) approves the repair before it is carried out.

When applying to the compensation fund, the following documents must be attached to the claim form: vehicle license; police authorization (which includes: vehicle number and the signature of an investigator and police officer); power of attorney (if the claimants are not the owner of the vehicle); leasing agreement (if the vehicle is owned by long-term leasing); rental agreement (for taxi owners); approval from an insurance company (repair over NIS 10,000 - the insurance company's confirmation of the absence of a claim must be attached); A photocopy of a check or confirmation from the bank of the management of a bank account in the name of the damaged.

Damage caused to a business

Compensation for damages to damaged business equipment is by law, in accordance with the market value of the equipment (value from a voluntary seller to a voluntary buyer on the free market, in its condition before the damage); In this case, you must prove that the damaged contents belong to you.

For inventory, you are entitled to compensation, according to the value of the cost of the damaged inventory (excluding VAT), after attaching proof that the inventory belonged to you.

When applying to the compensation fund, the following documents must be attached to the claim form: a list of damaged equipment or inventory; financial statements or documents, showing that the equipment or inventory belongs to you (purchase invoices, inventory reports certified by an accountant and others); income tax certificates on withholding tax; Copy of a check or confirmation from the bank of the management of a bank account in the name of the injured person; The appraisers employed by us must be provided with the claim and the required documents and any documents required as needed.

Bystanders who happened to arrive for hostilities and their personal belongings were injured

If you happen to arrive at a hostile act and personal belongings that were with you were damaged: you must apply with a police certificate, confirming that the damage was caused to property as a result of hostilities, to one of the following: members of the Compensation Fund (Property Tax) who are in the field; One of the real estate taxation and income tax offices. Try to present the damaged objects so that the damage caused can be assessed.

Please note: Do not remove equipment, inventory, waste or any other object found in a business or residence, without prior coordination with the Tax Authority's compensation fund appraiser; There is no entitlement to compensation for cash, checks, jewelry, antiques and art objects damaged in the incident.

- Real Estate

Tags

- Real Estate

- Operation Shield and Arrow